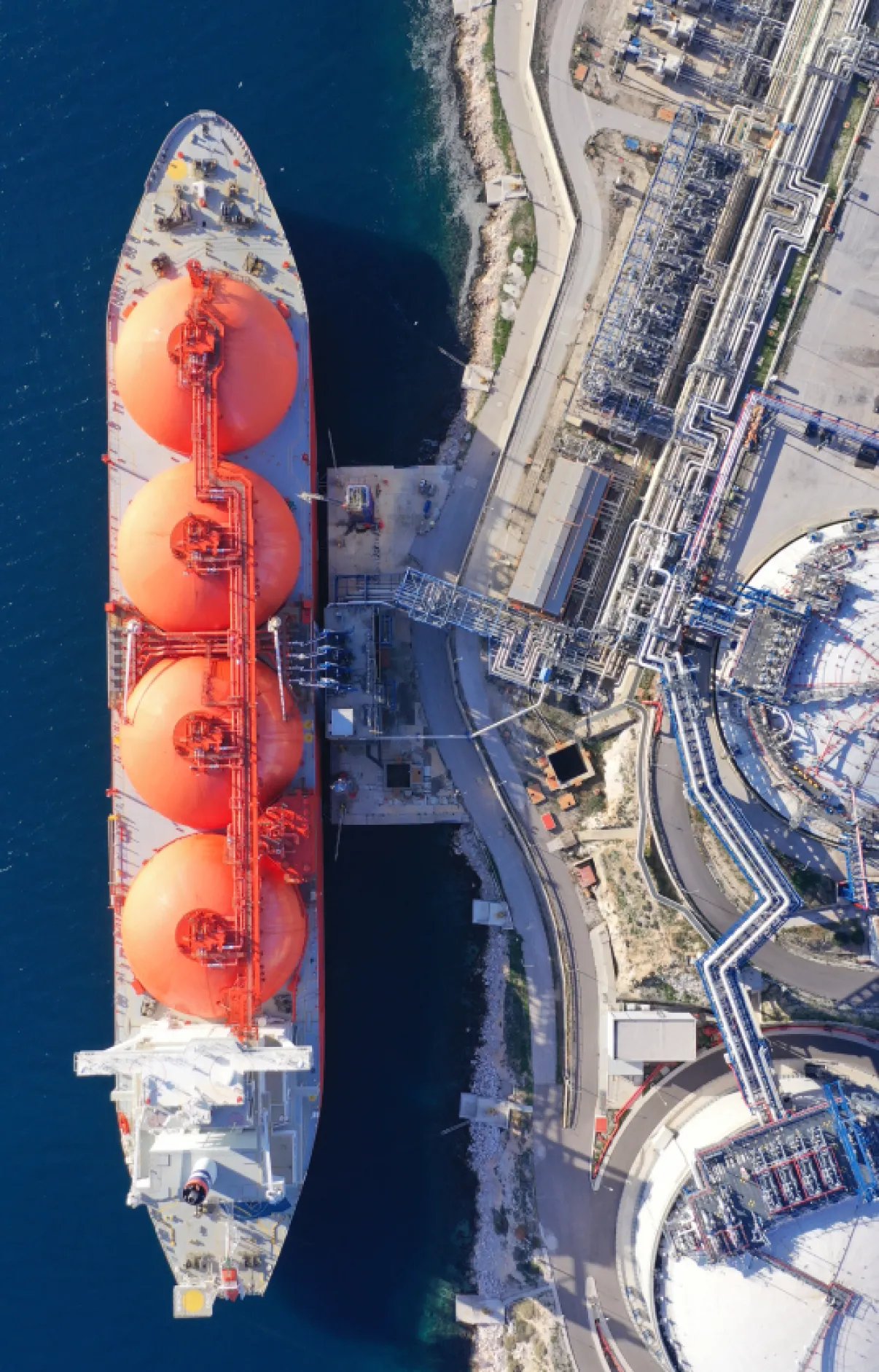

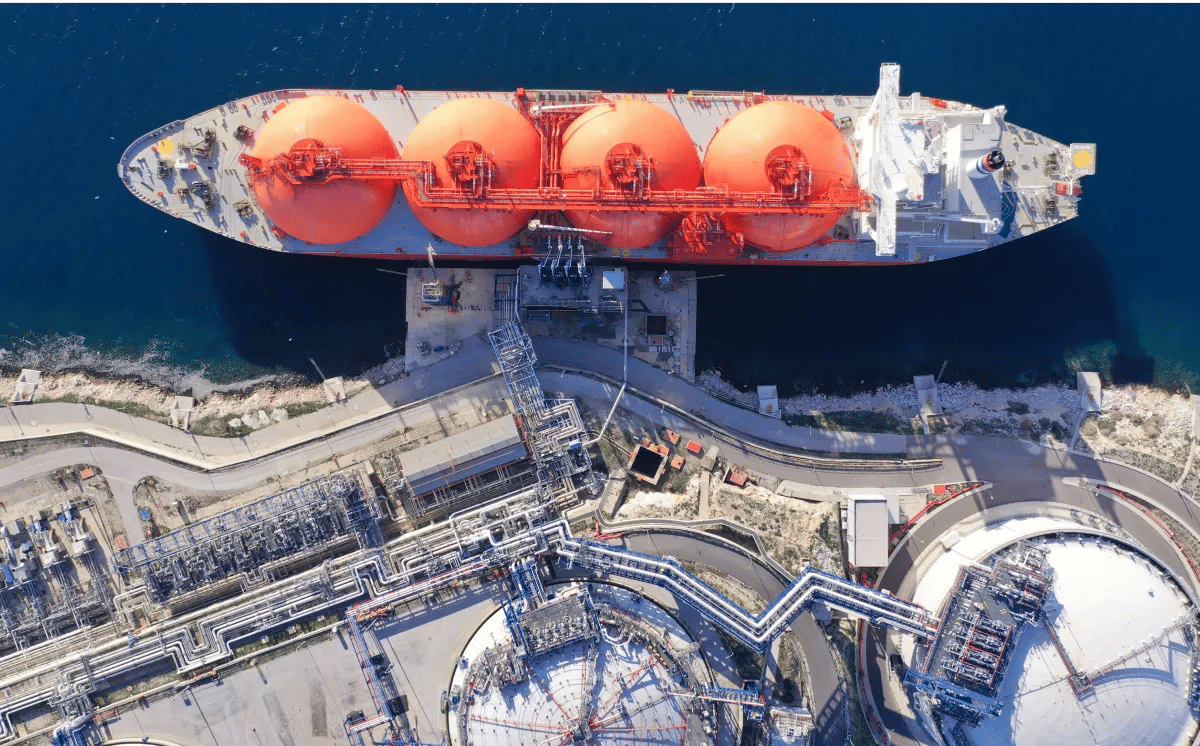

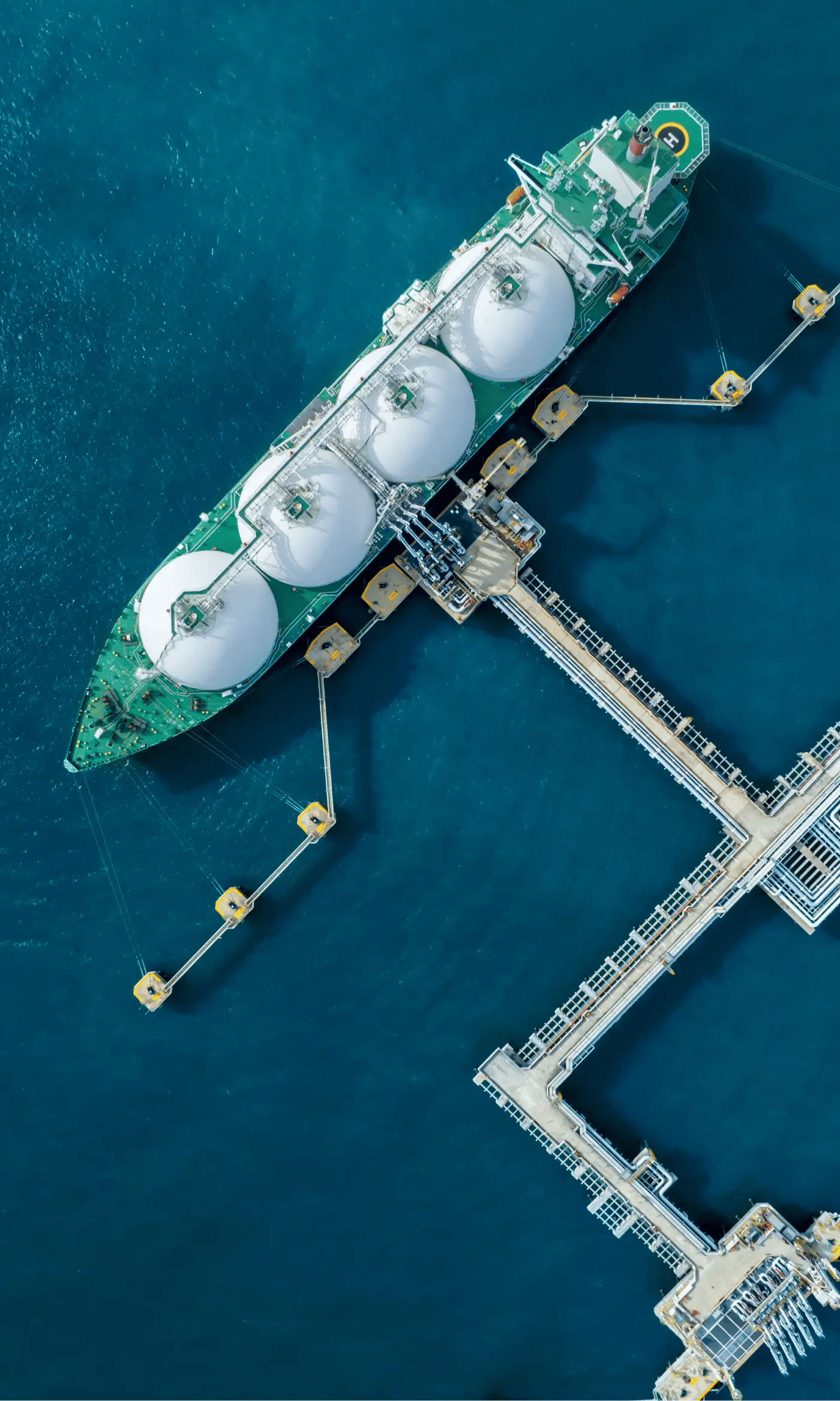

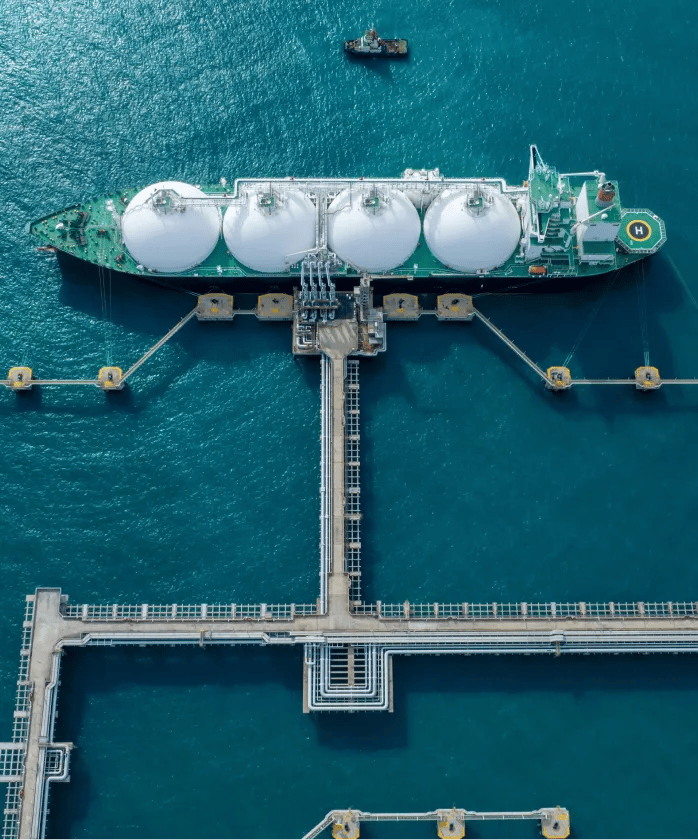

The AI Revolution in LNG

Optimisation in Trading, Shipping & Scheduling

.webp)

About Us

Calypso Commodities is a tech company developing AI-based solutions for LNG scheduling, trading & shipping optimisation, saving millions of USD and GHG emissions. Calypso’s X-LNG is globally used by energy majors, utilities, and hedge funds to optimise LNG tanker schedules & portfolios, value optionalities, and make trading decisions.

With a growing team of over 30 top-tier mathematicians, software engineers, & LNG specialists we’ve built the flagship AI scheduling & optimisation solution for the LNG industry – supported by ideas & feedback from a variety of industry majors.

Calypso has emerged as the leading and fastest growing AI-company in the LNG industry, comprising the largest tech-team with over 150 years of experience. We have two offices in Germany, Berlin and Regensburg, one in London-Mayfair, and are increasing our Asian market presence with a Singapore office in Q4 2026.

.webp)

.svg)

.svg)