Chartering Case Study – Q4 2024

Check out the full detailed analysis here

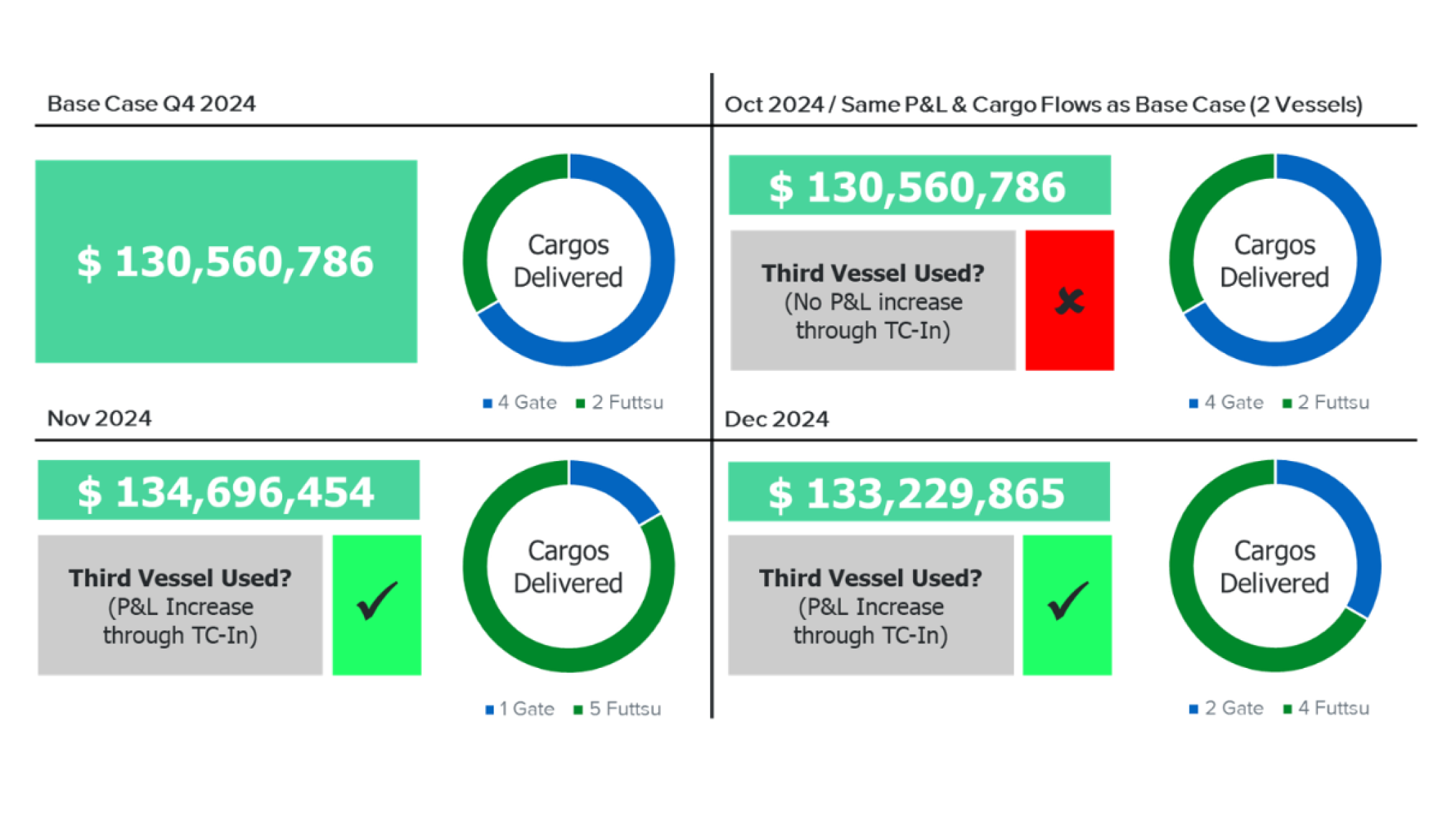

Using a base portfolio of 2 vessels, we show how one might assess if you should charter an additional vessel, when you should charter it for, and how much you should pay for it. The following inputs are used in the base case:

Supply (Q4 2024):

- Loading: Sabine Pass, 6 cargos

- Indexation: 115% HH + $ 3.5 tolling fee

Demand (Q4 2024):

- Spot: Gate (NWE flex) or Futtsu (JKTC flex)

- Indexation: 100% TTF or 100% JKM

Fleet:

- 2 × 174k vessels + 1 TC-In 174k (Spark 30 Rate: $64,000/day)

Prices:

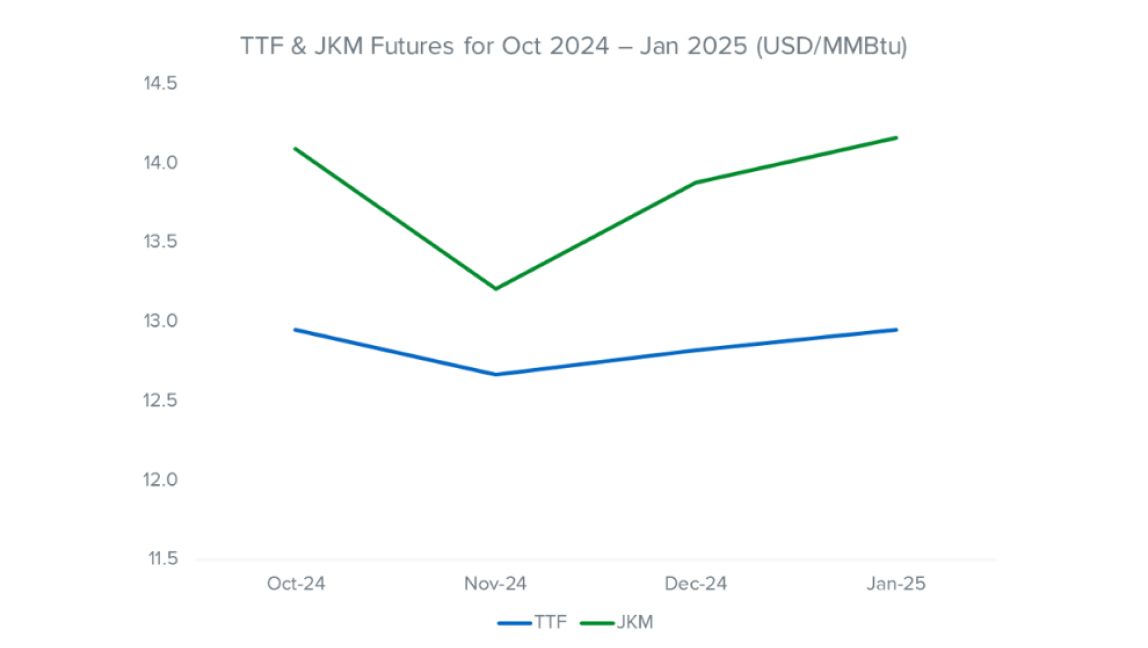

- Forward curve based on futures (HH, TTF, JKM)

With shipping length of 2 vessels, NWE is a more favourable spot market due to shorter shipping distance. Next, a third vessel with different 30-day charter windows is added – leveraging X-LNG for Chartering Optimisation.

Adding TC-In for different time periods

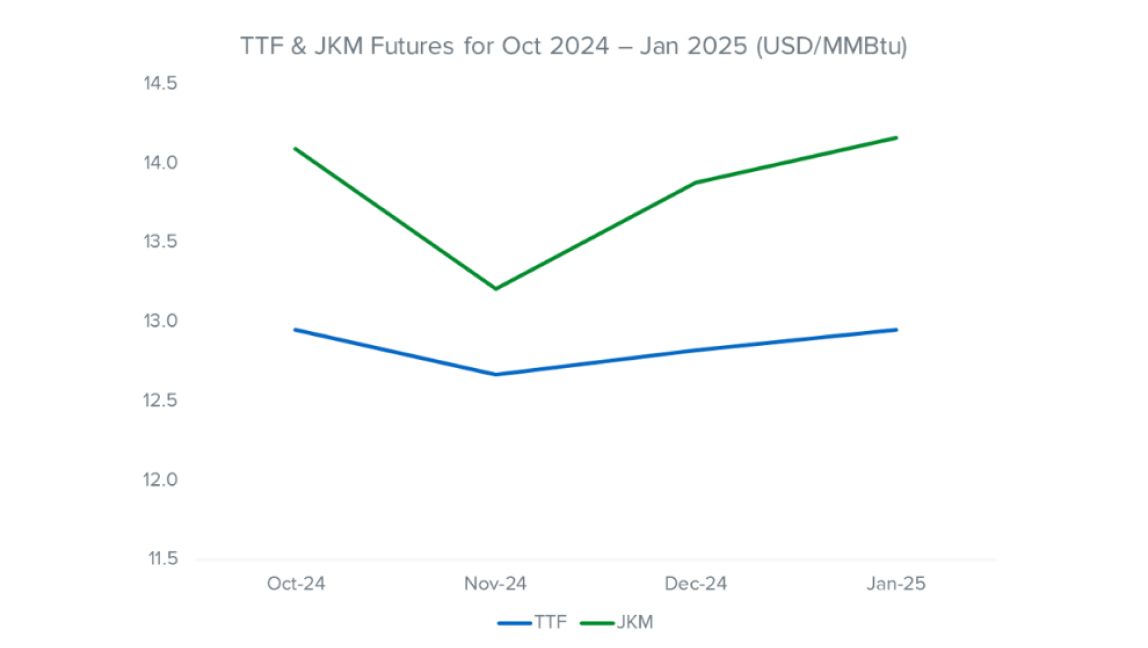

Strategically chartering a third vessel in Nov and Dec 2024 improves the P&L of the portfolio as compared to the base case. This is because profitability increases with the JKM-TTF spread. In Nov and Dec, the JKM-TTF spread is sufficiently large to justify chartering a third vessel, which can ship more cargos to Asia.

Chartering the third vessel in Oct does not change the P&L or cargo flow as compared to the base case because the third vessel is not used at all. The JKM-TTF spread is low, making the chartering of the third vessel not profitable.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Chartering Case Study – Q4 2024

Check out the full detailed analysis here

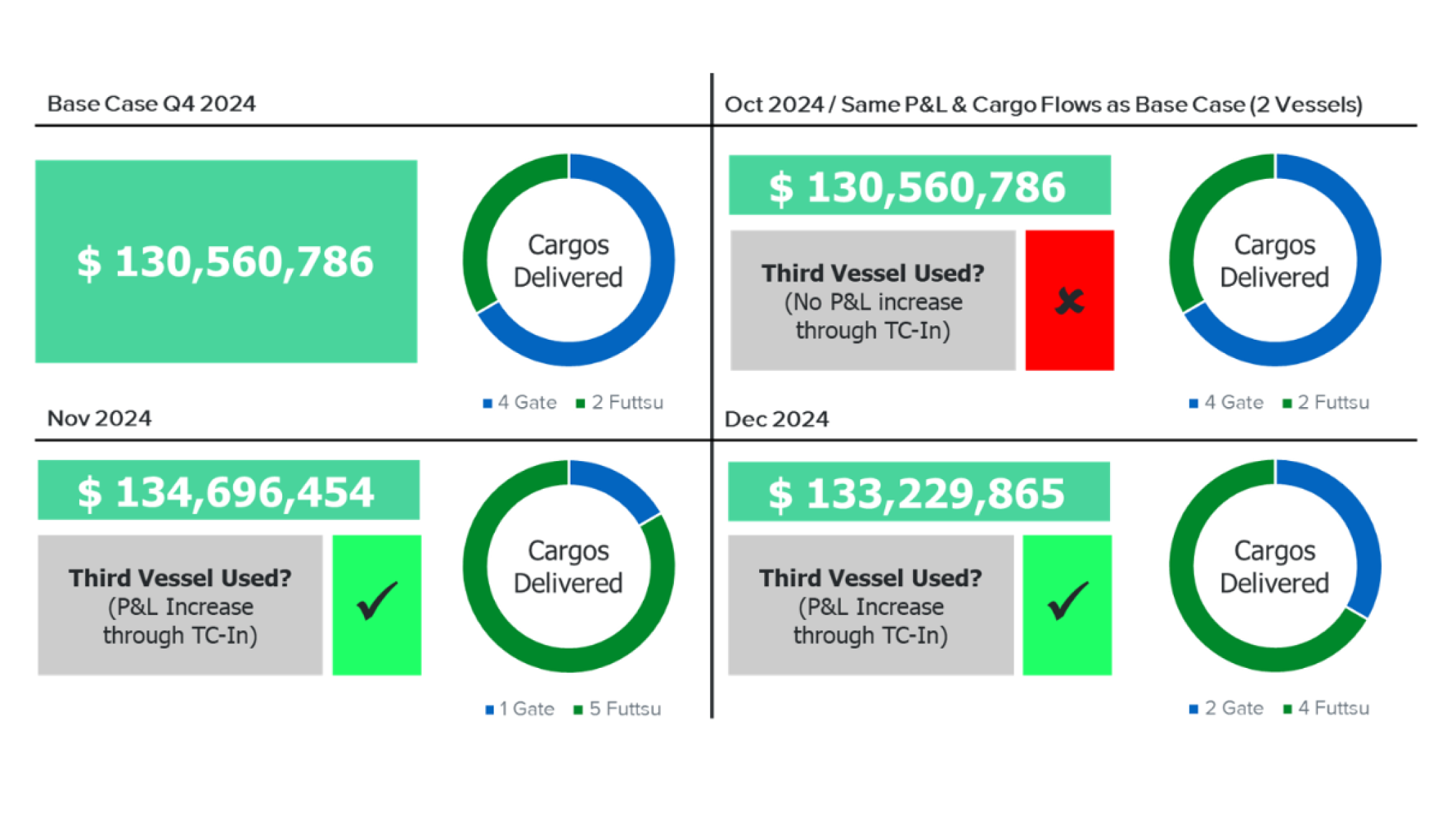

Using a base portfolio of 2 vessels, we show how one might assess if you should charter an additional vessel, when you should charter it for, and how much you should pay for it. The following inputs are used in the base case:

Supply (Q4 2024):

- Loading: Sabine Pass, 6 cargos

- Indexation: 115% HH + $ 3.5 tolling fee

Demand (Q4 2024):

- Spot: Gate (NWE flex) or Futtsu (JKTC flex)

- Indexation: 100% TTF or 100% JKM

Fleet:

- 2 × 174k vessels + 1 TC-In 174k (Spark 30 Rate: $64,000/day)

Prices:

- Forward curve based on futures (HH, TTF, JKM)

With shipping length of 2 vessels, NWE is a more favourable spot market due to shorter shipping distance. Next, a third vessel with different 30-day charter windows is added – leveraging X-LNG for Chartering Optimisation.

Adding TC-In for different time periods

Strategically chartering a third vessel in Nov and Dec 2024 improves the P&L of the portfolio as compared to the base case. This is because profitability increases with the JKM-TTF spread. In Nov and Dec, the JKM-TTF spread is sufficiently large to justify chartering a third vessel, which can ship more cargos to Asia.

Chartering the third vessel in Oct does not change the P&L or cargo flow as compared to the base case because the third vessel is not used at all. The JKM-TTF spread is low, making the chartering of the third vessel not profitable.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)