Chartering Case Study: TC for JKTC US-NWE Cargos

Check out the full detailed analysis here

Using a base portfolio of 2 vessels, we show how one might assess if you should charter an additional vessel, when you should charter it for, and how much you should pay for it. The following inputs are used in the base case:

Supply (2025):

• Loading: Sabine Pass, 22 cargos

• Indexation: 115% HH + $ 3.5 tolling fee

Demand (2025):

• Discharge: Gate (spot) or Futtsu (spot)

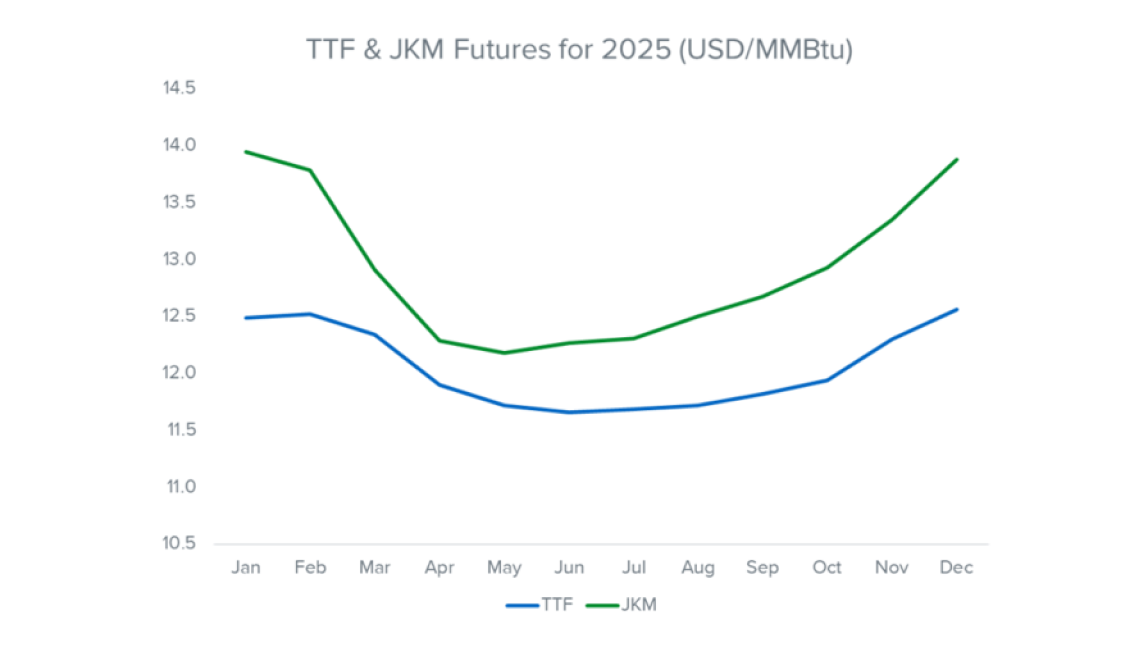

• Indexation: 100% TTF or 100% JKM

Fleet:

• 2 × 174k vessels + 1 TC-In 174k (Charter rate: $48,500/day)

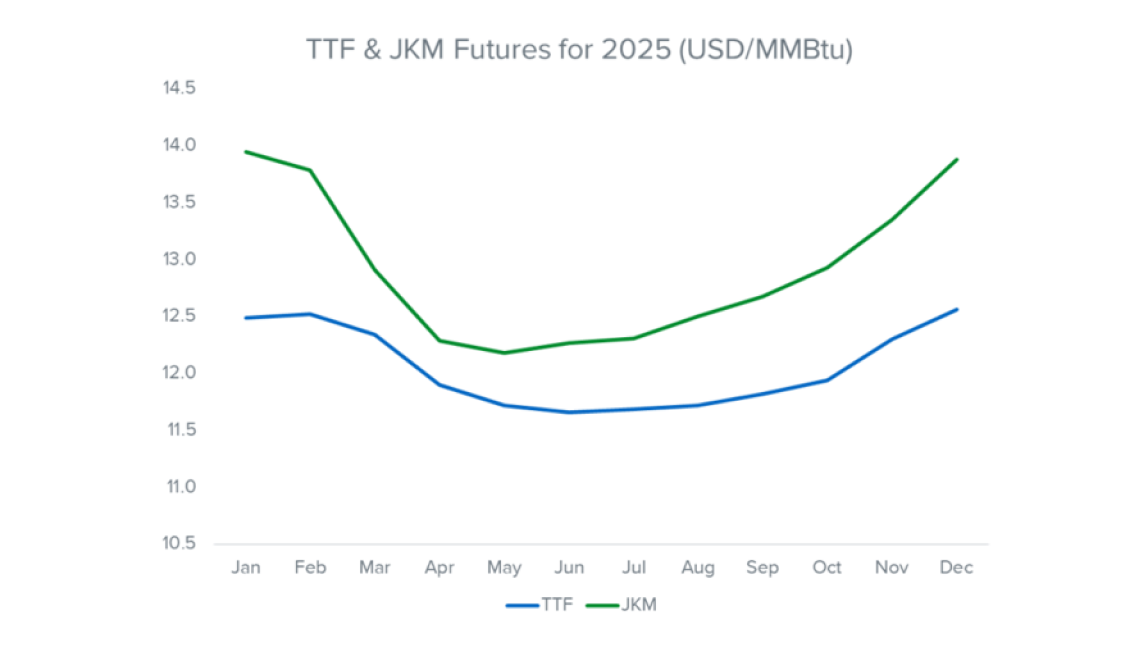

Prices:

• Forward curve based on futures (HH, TTF, JKM)

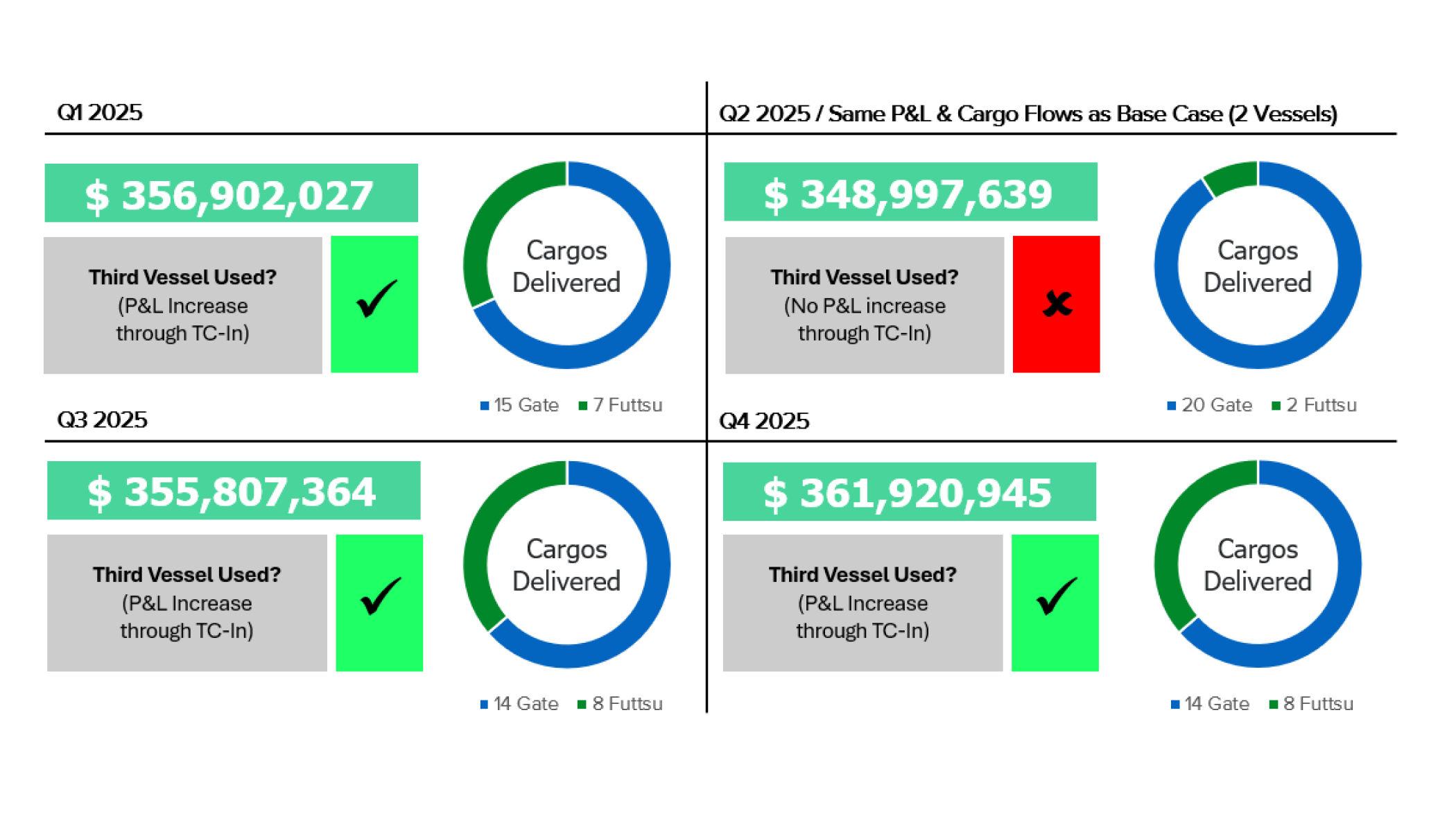

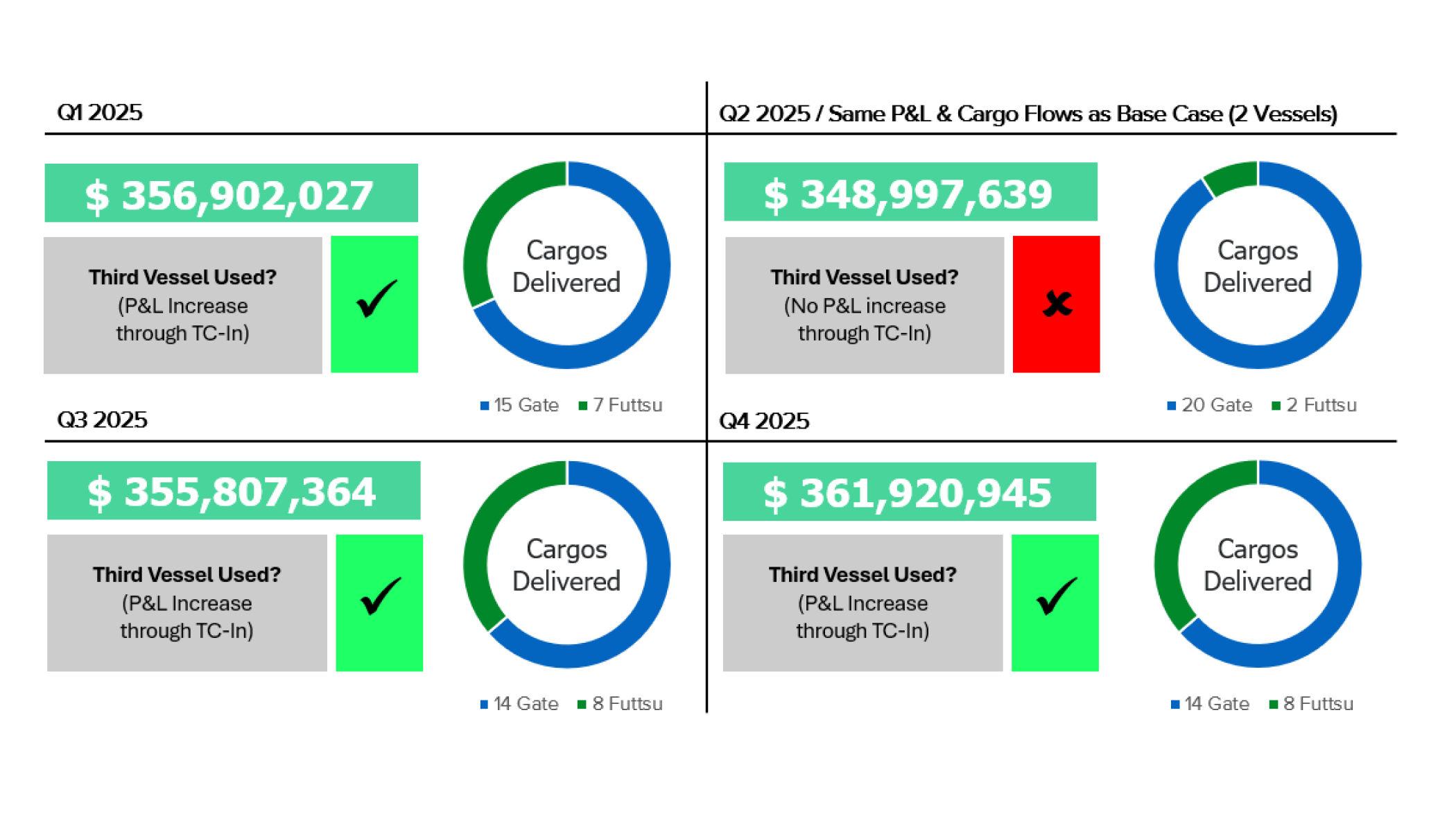

With shipping length of 2 vessels, NWE is a more favourable spot market due to shorter shipping distance. Next, a third vessel with different 90-day charter windows is added – leveraging X-LNG for Chartering Optimisation.

Adding TC-In for Q1, Q3 and Q4 2025

Strategically chartering a third vessel in Q1, Q3 and Q4 improves the P&L of the portfolio as compared to the base case. This is because profitability increases with the JKM-TTF spread. In Q1, Q3 and Q4, the JKM-TTF spread is sufficiently large to justify chartering a third vessel, which can ship more cargos to Asia.

X-LNG also tells the breakeven charter rate for the third vessel. Q4 stands out as the most profitable time to charter, with a break-even rate of $93,750/day.

Adding TC-In for Q2 2025

Chartering the third vessel in Q2 does not change the P&L and cargo flow as compared to the base case because the third vessel is not in use. The JKM-TTF spread is low in Q2, making the chartering of the third vessel not profitable.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Chartering Case Study: TC for JKTC US-NWE Cargos

Check out the full detailed analysis here

Using a base portfolio of 2 vessels, we show how one might assess if you should charter an additional vessel, when you should charter it for, and how much you should pay for it. The following inputs are used in the base case:

Supply (2025):

• Loading: Sabine Pass, 22 cargos

• Indexation: 115% HH + $ 3.5 tolling fee

Demand (2025):

• Discharge: Gate (spot) or Futtsu (spot)

• Indexation: 100% TTF or 100% JKM

Fleet:

• 2 × 174k vessels + 1 TC-In 174k (Charter rate: $48,500/day)

Prices:

• Forward curve based on futures (HH, TTF, JKM)

With shipping length of 2 vessels, NWE is a more favourable spot market due to shorter shipping distance. Next, a third vessel with different 90-day charter windows is added – leveraging X-LNG for Chartering Optimisation.

Adding TC-In for Q1, Q3 and Q4 2025

Strategically chartering a third vessel in Q1, Q3 and Q4 improves the P&L of the portfolio as compared to the base case. This is because profitability increases with the JKM-TTF spread. In Q1, Q3 and Q4, the JKM-TTF spread is sufficiently large to justify chartering a third vessel, which can ship more cargos to Asia.

X-LNG also tells the breakeven charter rate for the third vessel. Q4 stands out as the most profitable time to charter, with a break-even rate of $93,750/day.

Adding TC-In for Q2 2025

Chartering the third vessel in Q2 does not change the P&L and cargo flow as compared to the base case because the third vessel is not in use. The JKM-TTF spread is low in Q2, making the chartering of the third vessel not profitable.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)