Portfolio Valuation Case Study: Assessing Portfolio Resilience Under Varied Price Volatility

Check out the full detailed analysis here

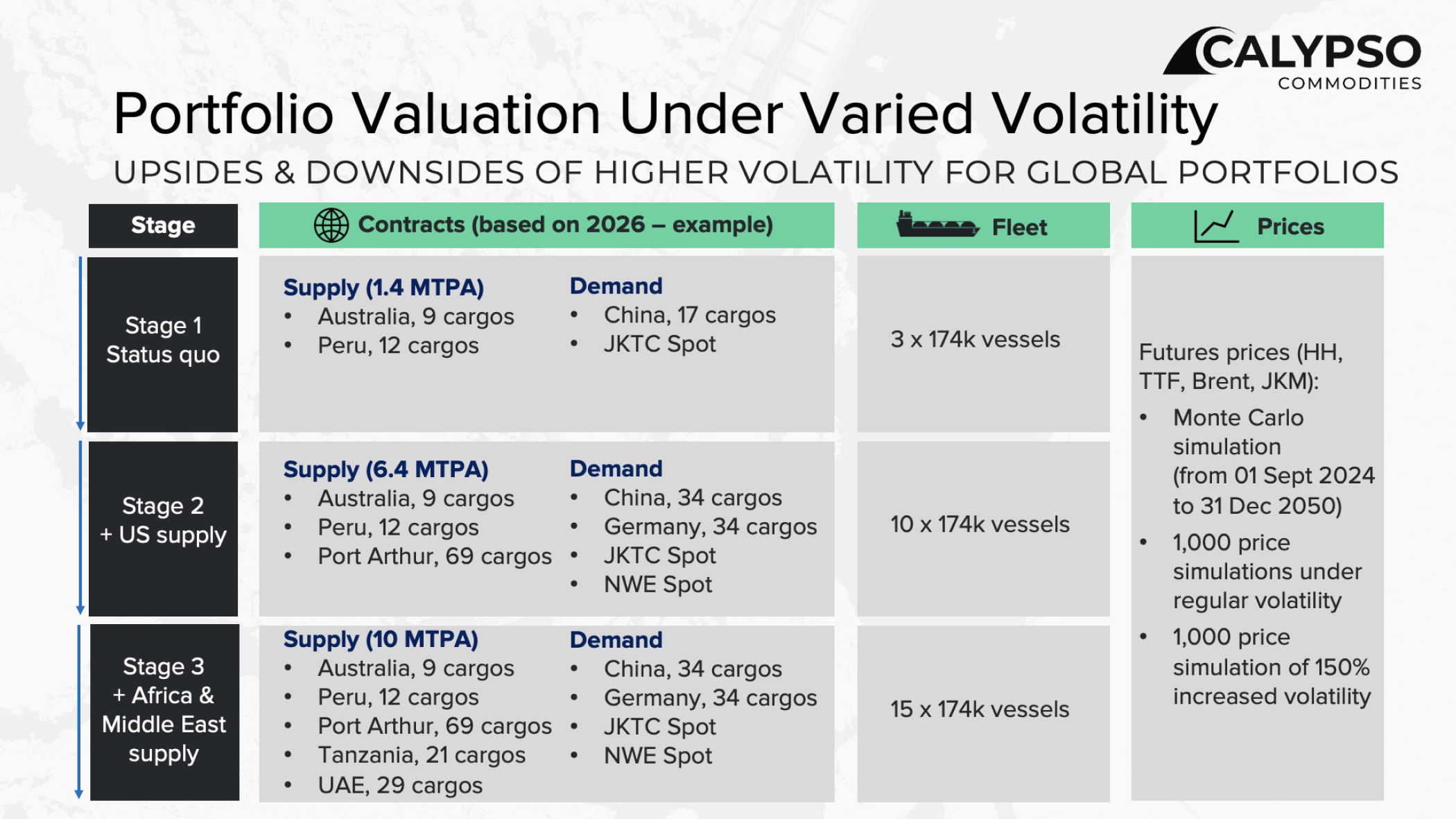

Stage 1: Status quo

Supply (2026):

- Australia (Gorgon), 3 cargos

- Australia (Pluto), 4 cargos

- Australia (Queensland Curtis), 2 cargos

- Peru, 12 cargos

Demand (2026):

- China, 17 cargos

- JKTC spot

Fleet:

- 3 × 174k vessels

Stage 2: Adding US supply

Supply (2026):

- Stage 1 contracts

- + 69 FOB Longs from US (Port Arthur)

Demand (2026):

- Stage 1 contracts

- + China, 17 cargos

- + Germany, 34 cargos

- NWE spot

Fleet:

- 10 × 174k vessels

Stage 3: Adding Africa and Middle East supply

Supply (2026):

- Stage 2 contracts

- + 21 FOB Longs from Tanzania

- + 29 FOB Longs from UAE

Demand (2026):

- Stage 2 contracts

Fleet:

- 15 × 174k vessels

Two Levels of Price Volatility

The same sets of futures price for 2026 with two different levels of price volatility are used for the three stages of portfolios

- Futures prices for HH, TTF, Brent and JKM based on Monte Carlo simulation

- 1,000 price simulations under regular volatility

- 1,000 price simulations of 150% increased volatility

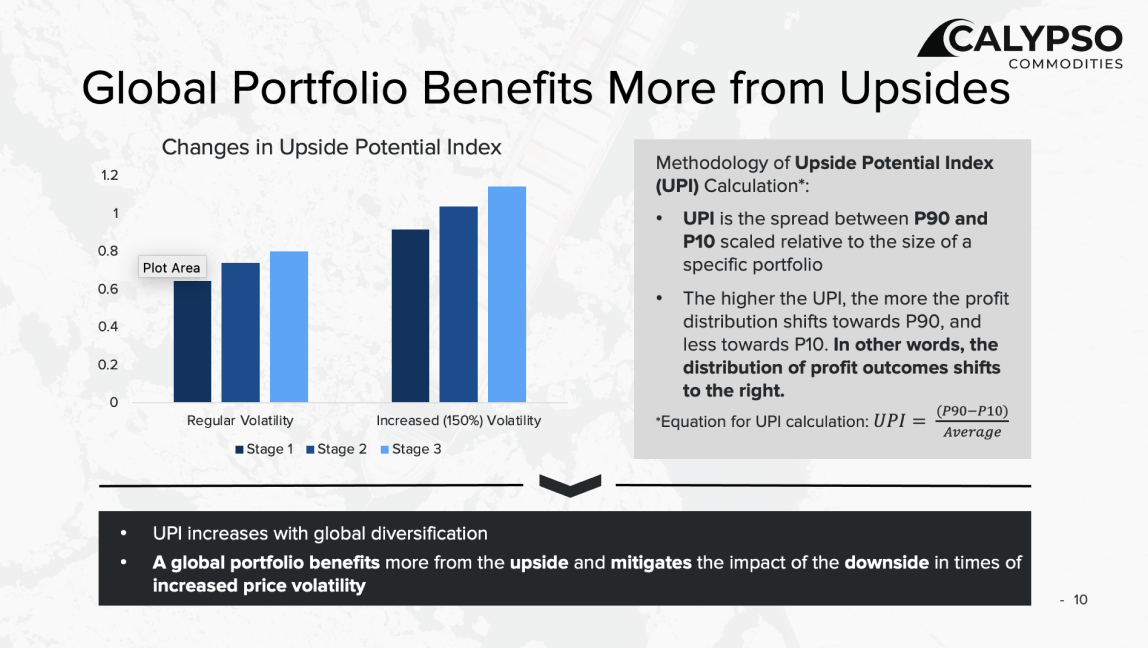

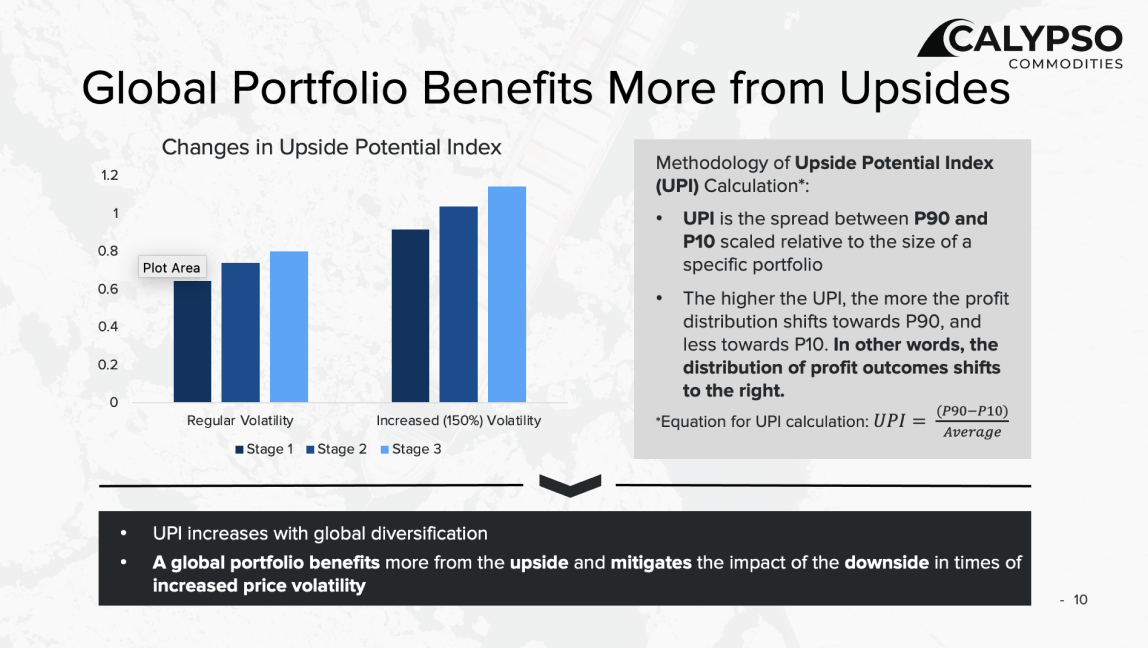

Global Portfolio Benefits More from Upsides

A metric called the Upside Potential Index (UPI), which is the difference between the 90th and 10th percentile profit outcomes adjusted for portfolio size, is introduced and used to assess portfolio resilience. The higher the UPI, the more the profit distribution shifts towards P90 and less towards P10.

By comparing the UPI of portfolios at three different stages, it is observed that UPI increases with global diversification. Adding global supply amplifies portfolio resilience, increasing the upside potential while decreasing the downside risk.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Portfolio Valuation Case Study: Assessing Portfolio Resilience Under Varied Price Volatility

Check out the full detailed analysis here

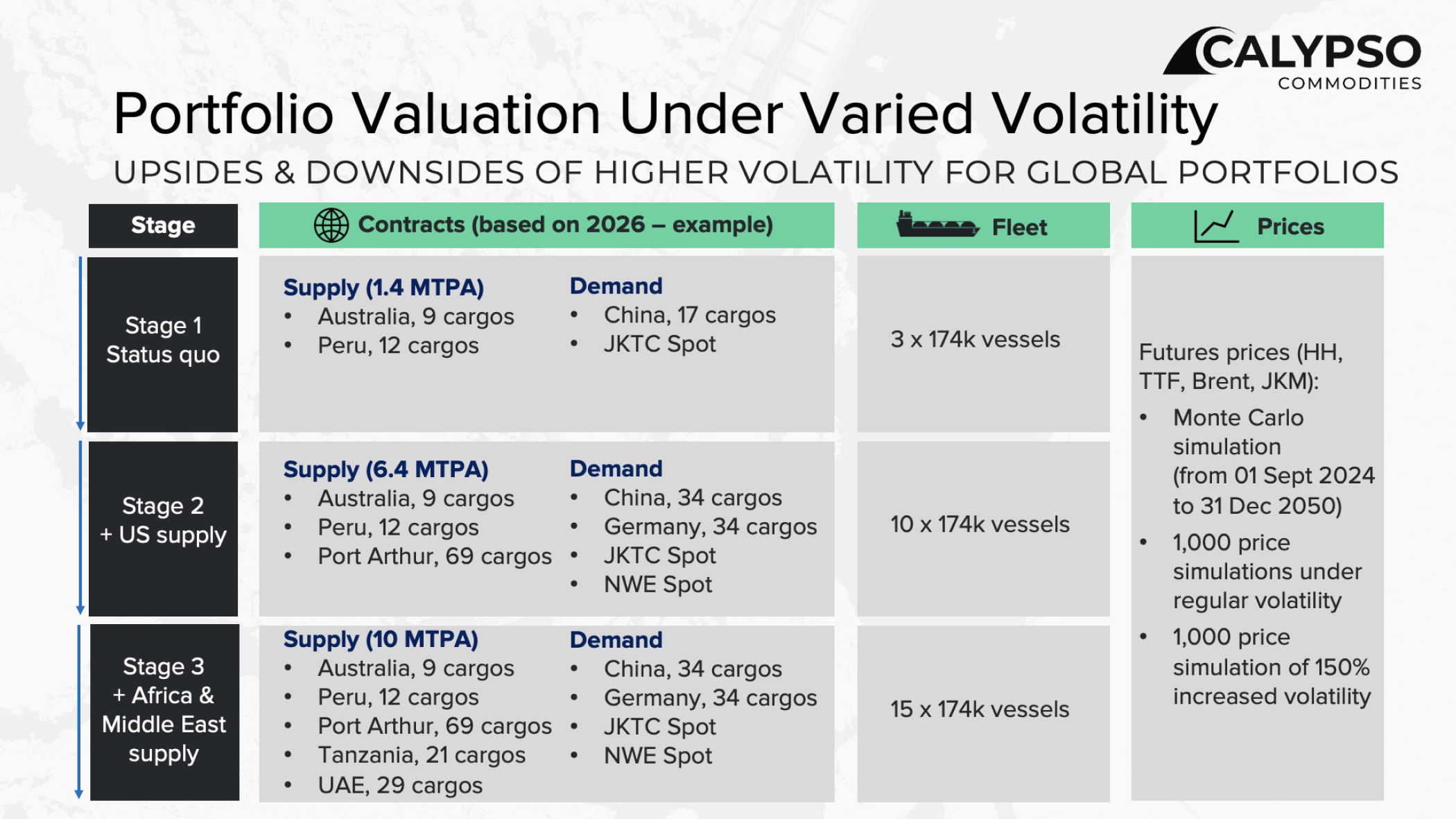

Stage 1: Status quo

Supply (2026):

- Australia (Gorgon), 3 cargos

- Australia (Pluto), 4 cargos

- Australia (Queensland Curtis), 2 cargos

- Peru, 12 cargos

Demand (2026):

- China, 17 cargos

- JKTC spot

Fleet:

- 3 × 174k vessels

Stage 2: Adding US supply

Supply (2026):

- Stage 1 contracts

- + 69 FOB Longs from US (Port Arthur)

Demand (2026):

- Stage 1 contracts

- + China, 17 cargos

- + Germany, 34 cargos

- NWE spot

Fleet:

- 10 × 174k vessels

Stage 3: Adding Africa and Middle East supply

Supply (2026):

- Stage 2 contracts

- + 21 FOB Longs from Tanzania

- + 29 FOB Longs from UAE

Demand (2026):

- Stage 2 contracts

Fleet:

- 15 × 174k vessels

Two Levels of Price Volatility

The same sets of futures price for 2026 with two different levels of price volatility are used for the three stages of portfolios

- Futures prices for HH, TTF, Brent and JKM based on Monte Carlo simulation

- 1,000 price simulations under regular volatility

- 1,000 price simulations of 150% increased volatility

Global Portfolio Benefits More from Upsides

A metric called the Upside Potential Index (UPI), which is the difference between the 90th and 10th percentile profit outcomes adjusted for portfolio size, is introduced and used to assess portfolio resilience. The higher the UPI, the more the profit distribution shifts towards P90 and less towards P10.

By comparing the UPI of portfolios at three different stages, it is observed that UPI increases with global diversification. Adding global supply amplifies portfolio resilience, increasing the upside potential while decreasing the downside risk.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

.svg)