When LNG Cargoes Become Options

Read the full detailed analysis here

Every LNG cargo with a routing choice is an embedded real option. This case study builds a Greeks framework for LNG portfolios — delta, gamma, vega — and shows why flexible scheduling structurally reshapes the P&L distribution.

The Problem

LNG portfolio exposure is non-linear. As prices move, optimal routes change — and sensitivity jumps at the thresholds where cargoes switch destinations. Static hedges degrade exactly where they're needed most. Traditional tools, built for linear instruments, miss these discontinuities.

The Framework

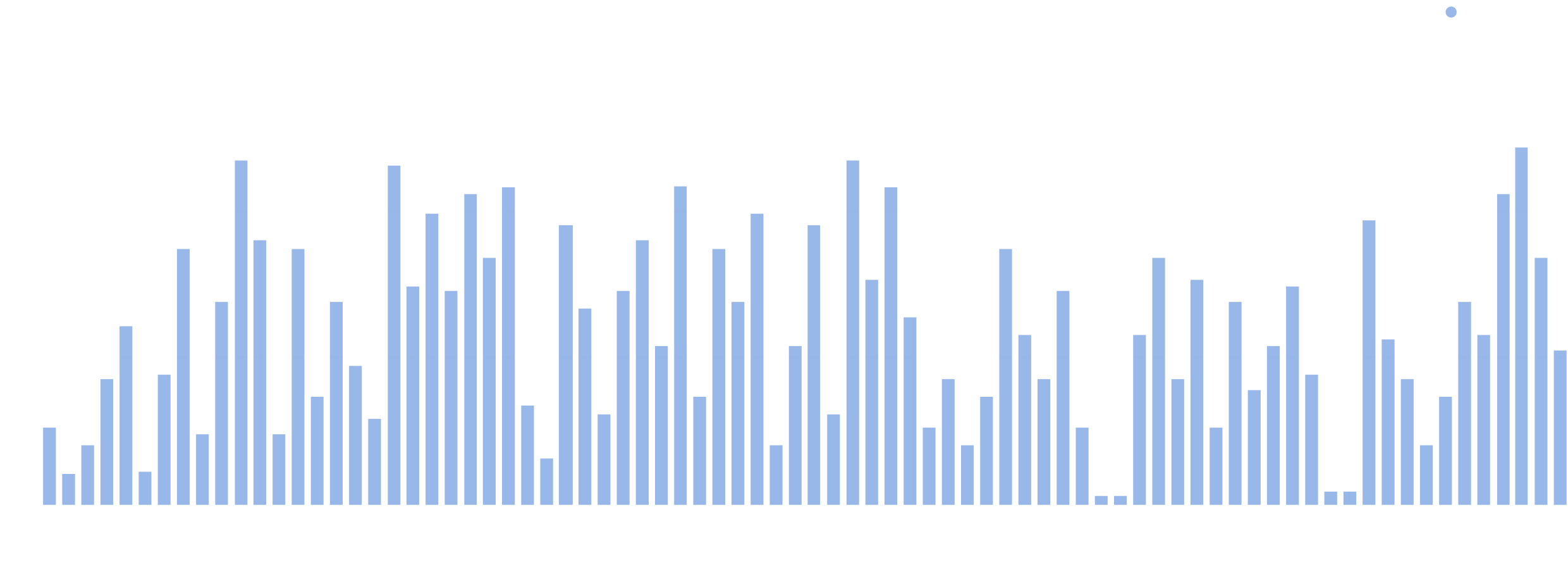

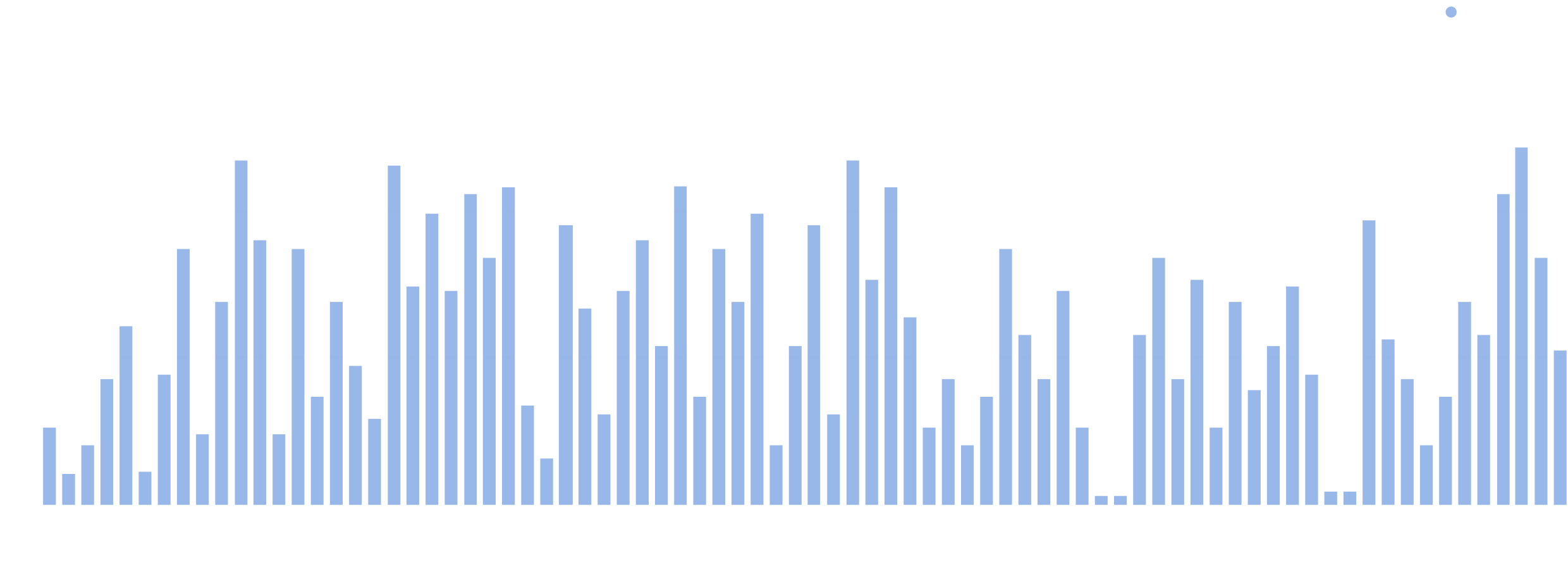

We treat each routing choice as a decision with measurable sensitivity: how much does profit change per $1 price move (Delta)? Where do those changes spike (Gamma)? How does uncertainty affect the value of keeping options open (Vega)? Tested on a 76-cargo diversified book and a transparent 4-contract example where every routing decision is visible.

Key Insights

Each cargo switch is a real option being exercised. When the JKM-TTF spread crosses a threshold, a cargo redirects — creating a kink in the profit curve. The optimized P&L is convex; the fixed schedule is a straight line. The gap is the option premium.

Sensitivity concentrates at boundaries. The 2D gradient map reveals "hot zones" reaching ~$38.9M per $1 move — where direct margin impact compounds with re-routing value.

Flexibility is long volatility. At 120% vol: +$41M average uplift. At 80%: +$19M. The optimized schedule always outperforms or matches fixed one — by construction. But the uplift magnitude varies per path, and maintaining flexibility has real operational costs. Higher volatility creates more re-routing opportunities; the value lies in the ability to react, not in uncertainty itself.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

When LNG Cargoes Become Options

Read the full detailed analysis here

Every LNG cargo with a routing choice is an embedded real option. This case study builds a Greeks framework for LNG portfolios — delta, gamma, vega — and shows why flexible scheduling structurally reshapes the P&L distribution.

The Problem

LNG portfolio exposure is non-linear. As prices move, optimal routes change — and sensitivity jumps at the thresholds where cargoes switch destinations. Static hedges degrade exactly where they're needed most. Traditional tools, built for linear instruments, miss these discontinuities.

The Framework

We treat each routing choice as a decision with measurable sensitivity: how much does profit change per $1 price move (Delta)? Where do those changes spike (Gamma)? How does uncertainty affect the value of keeping options open (Vega)? Tested on a 76-cargo diversified book and a transparent 4-contract example where every routing decision is visible.

Key Insights

Each cargo switch is a real option being exercised. When the JKM-TTF spread crosses a threshold, a cargo redirects — creating a kink in the profit curve. The optimized P&L is convex; the fixed schedule is a straight line. The gap is the option premium.

Sensitivity concentrates at boundaries. The 2D gradient map reveals "hot zones" reaching ~$38.9M per $1 move — where direct margin impact compounds with re-routing value.

Flexibility is long volatility. At 120% vol: +$41M average uplift. At 80%: +$19M. The optimized schedule always outperforms or matches fixed one — by construction. But the uplift magnitude varies per path, and maintaining flexibility has real operational costs. Higher volatility creates more re-routing opportunities; the value lies in the ability to react, not in uncertainty itself.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)