Valuing Indexation Flexibilities in X-LNG

Check out the full detailed analysis here

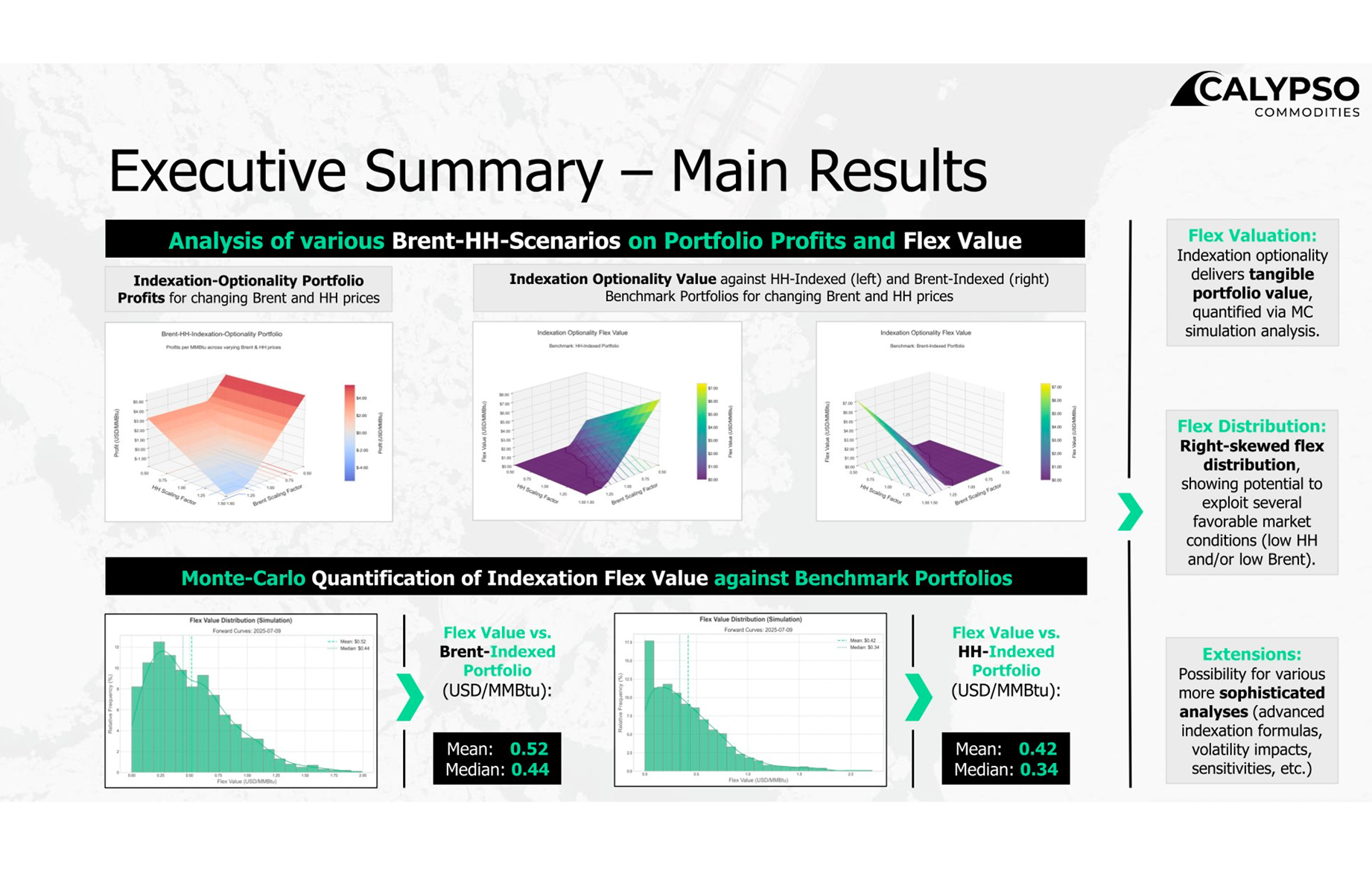

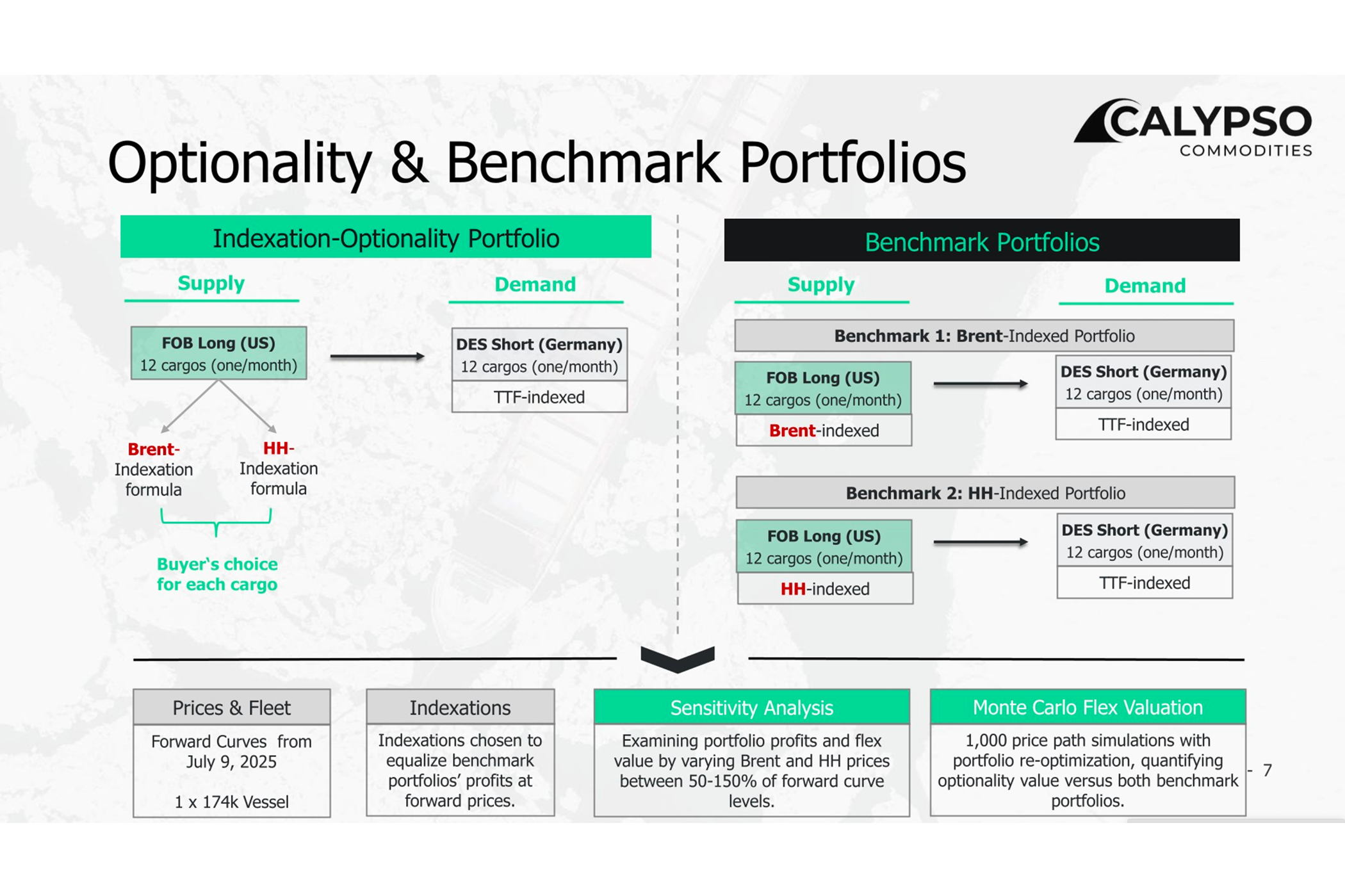

What we analyzed

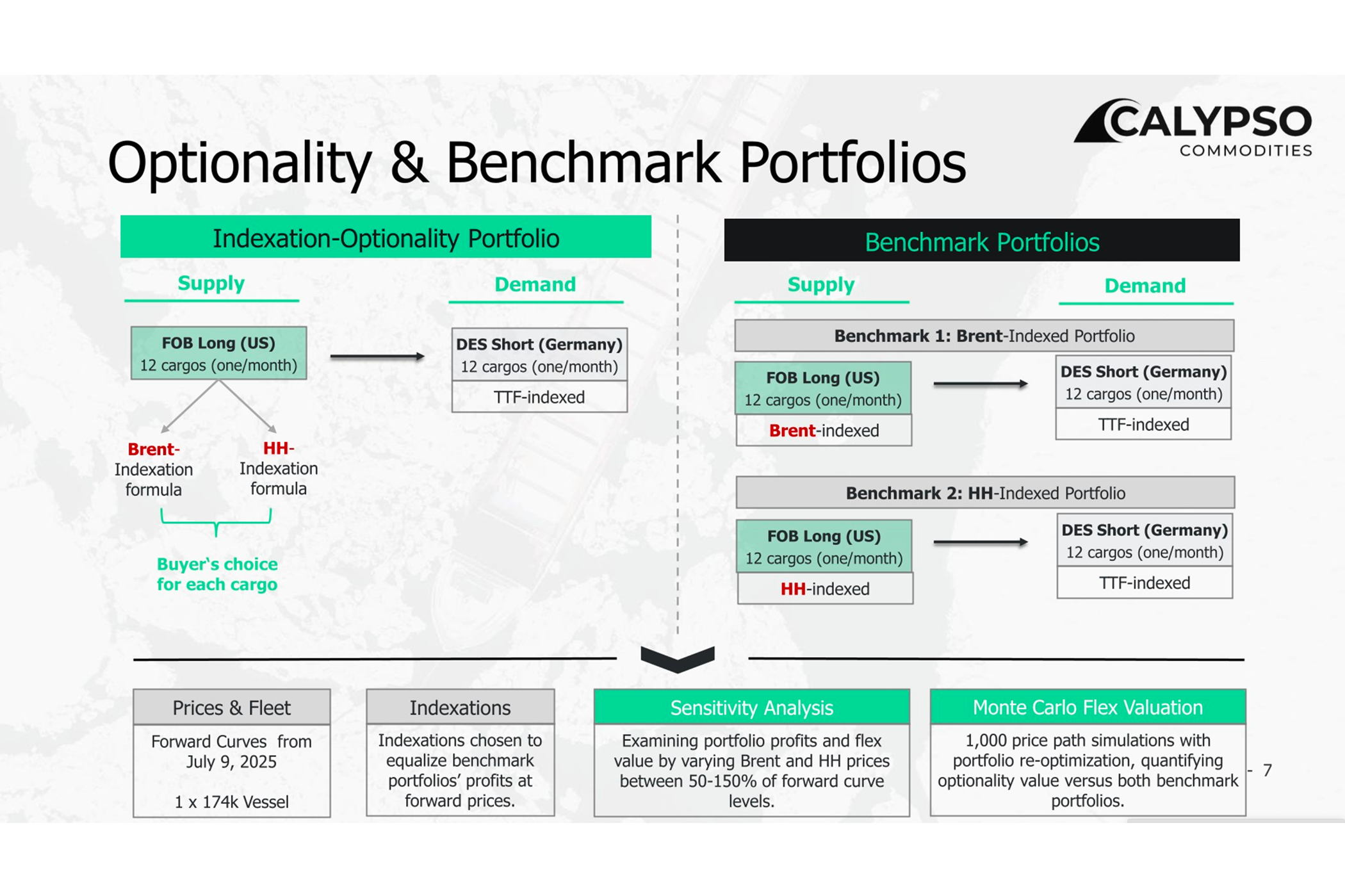

- Three comparable setups:

- Benchmark A: Henry Hub–indexed portfolio (no flex)

- Benchmark B: Brent‑indexed portfolio (no flex)

- Indexation‑Optionality Portfolio: right to settle each cargo on the more economic of the two index formulas

- Apples‑to‑apples calibration: At current forward curves the two benchmark portfolios are set to similar profitability, putting the option “at‑the‑money” so we isolate extrinsic value.

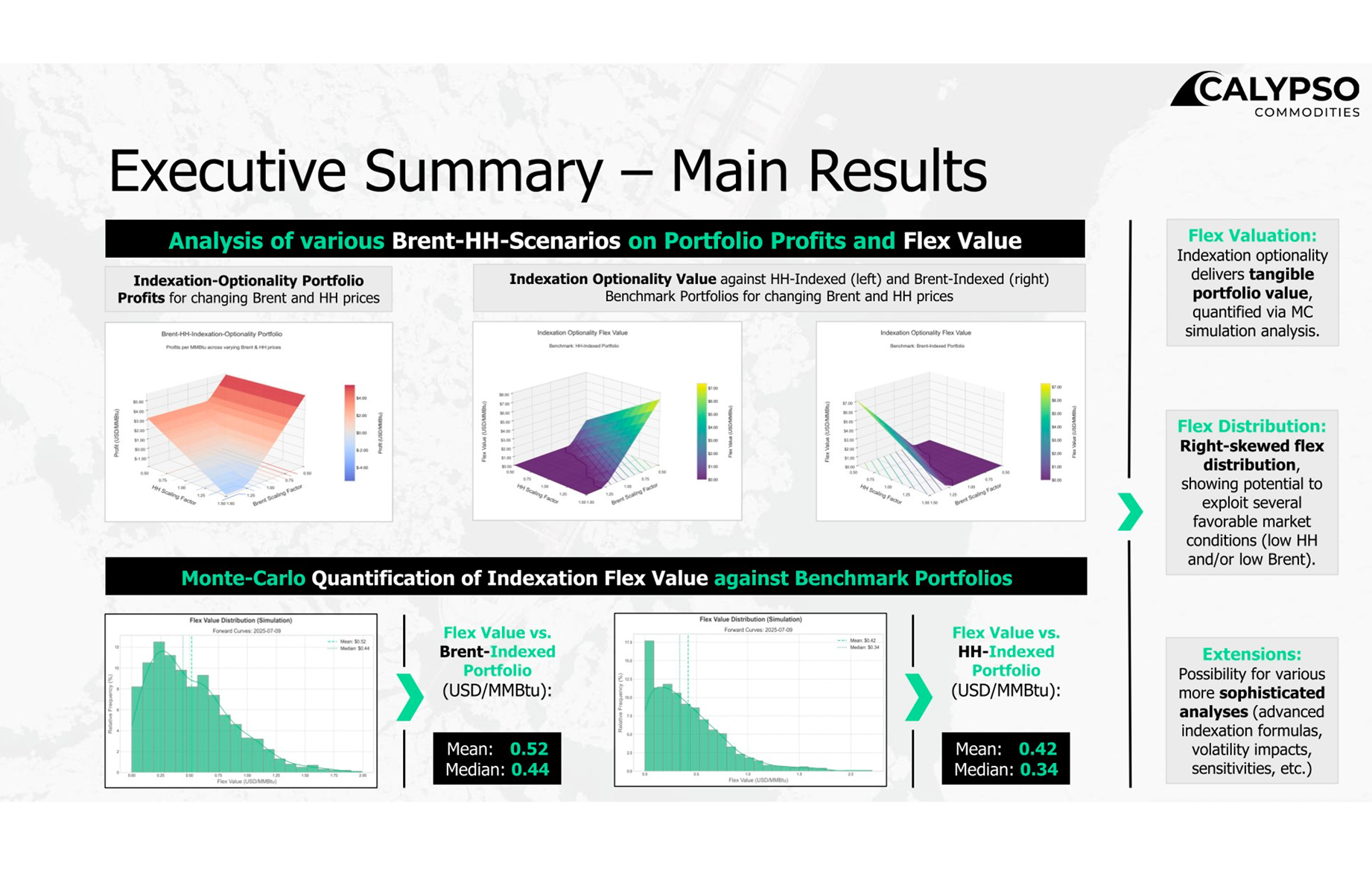

- Method:1,000 realistic simulations for Brent and HH; profit‑sensitivity surfaces map bi‑dimensional exposure and optimization logic.

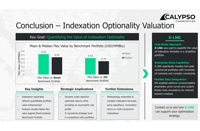

Key takeaways

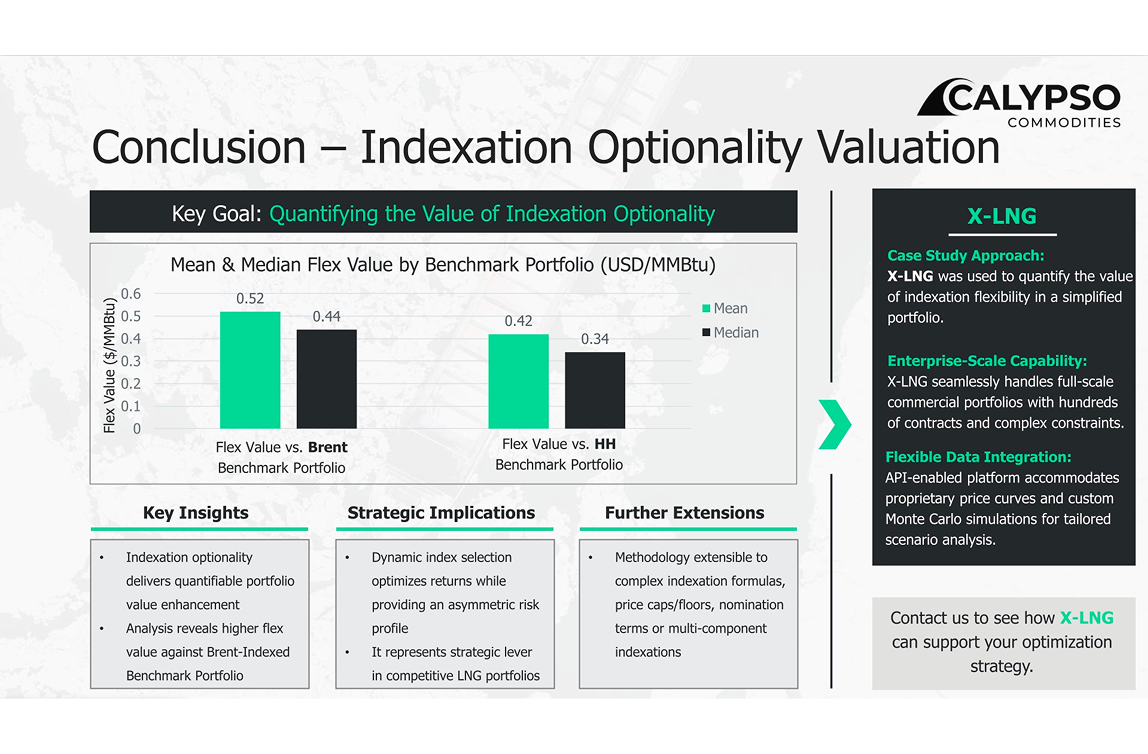

- Consistent structural edge: The flexible portfolio significantly outperforms both benchmarks by “arbitraging” between pricing regimes as markets move.

- Quantified performance: Across simulations, the Indexation‑Optionality Portfolio delivers mean profits of $0.52/MMBtu compared to the Brent-Benchmark Portfolio and $0.44/MMBtu compared to the HH-Benchmark Portfolio.

- Why it works: Optionality captures volatility and the asymmetric effects of different index formulas (e.g., a% HH + b vs. c% Brent), selecting the best settlement state‑by‑state.

- Practical insight: Sensitivity surfaces reveal where Brent vs. HH strength flips the optimal choice, guiding hedging and deal‑design.

Who benefits from this

- Traders: Turn price dispersion into P&L by dynamically settling on the advantaged index; use the surfaces to time hedges.

- Origination/Structuring: Price, design, and negotiate index‑switch rights; evidence‑based justification for premiums and triggers.

- Portfolio & Risk teams: Reduce concentration to a single index, monetize volatility, and stress‑test under alternative curve/volatility scenarios.

- Finance & Strategy: Support fair‑value assessments and capital allocation with simulation‑based distributions rather than point estimates.

Why it matters now

- Forward curves can make single‑index deals look equivalent today, but realized volatility creates material extrinsic value that standard benchmarking misses.

- The same framework extends to alternative formulas and additional indices, allowing tailored negotiation packs and risk overlays.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Valuing Indexation Flexibilities in X-LNG

Check out the full detailed analysis here

What we analyzed

- Three comparable setups:

- Benchmark A: Henry Hub–indexed portfolio (no flex)

- Benchmark B: Brent‑indexed portfolio (no flex)

- Indexation‑Optionality Portfolio: right to settle each cargo on the more economic of the two index formulas

- Apples‑to‑apples calibration: At current forward curves the two benchmark portfolios are set to similar profitability, putting the option “at‑the‑money” so we isolate extrinsic value.

- Method:1,000 realistic simulations for Brent and HH; profit‑sensitivity surfaces map bi‑dimensional exposure and optimization logic.

Key takeaways

- Consistent structural edge: The flexible portfolio significantly outperforms both benchmarks by “arbitraging” between pricing regimes as markets move.

- Quantified performance: Across simulations, the Indexation‑Optionality Portfolio delivers mean profits of $0.52/MMBtu compared to the Brent-Benchmark Portfolio and $0.44/MMBtu compared to the HH-Benchmark Portfolio.

- Why it works: Optionality captures volatility and the asymmetric effects of different index formulas (e.g., a% HH + b vs. c% Brent), selecting the best settlement state‑by‑state.

- Practical insight: Sensitivity surfaces reveal where Brent vs. HH strength flips the optimal choice, guiding hedging and deal‑design.

Who benefits from this

- Traders: Turn price dispersion into P&L by dynamically settling on the advantaged index; use the surfaces to time hedges.

- Origination/Structuring: Price, design, and negotiate index‑switch rights; evidence‑based justification for premiums and triggers.

- Portfolio & Risk teams: Reduce concentration to a single index, monetize volatility, and stress‑test under alternative curve/volatility scenarios.

- Finance & Strategy: Support fair‑value assessments and capital allocation with simulation‑based distributions rather than point estimates.

Why it matters now

- Forward curves can make single‑index deals look equivalent today, but realized volatility creates material extrinsic value that standard benchmarking misses.

- The same framework extends to alternative formulas and additional indices, allowing tailored negotiation packs and risk overlays.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)