Predicting Global LNG Flows: Leveraging X-LNG's Computational Power Through Customised Modelling

Check out the full detailed analysis here

Leveraging X-LNG’s computational power, this case study demonstrates how our platform can simulate, optimise, and forecast future LNG flows by adjusting every technical assumption — from vessel capacity and voyage routing to price indexation and terminal constraints. By integrating verified commercial data and applying advanced filtering logic, X-LNG delivers a dynamic, future-oriented model of global LNG trade under any market scenario.

Portfolio Scale: The X-LNG global model incorporates the entire commercial fleet andall major trade corridors, with non-commercial movements removed (e.g.bunkering, testing, domestic loops). Cargo volumes are standardised (tonnes →MMBtu → cargo units) using IGU conversion factors and allocated to regionalclusters. Every parameter is customisable — enabling simulations that reflectyour operational reality and strategic priorities.

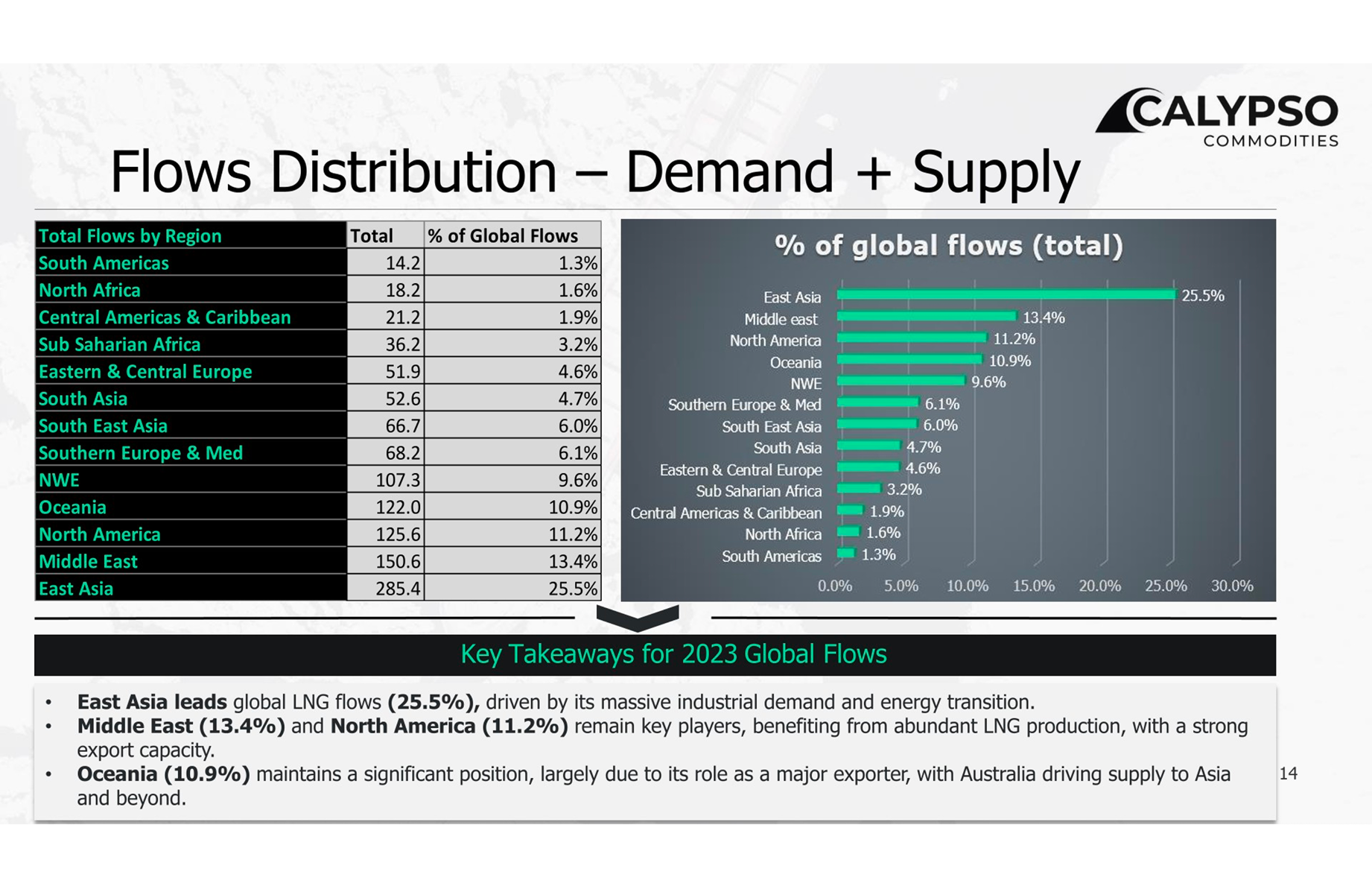

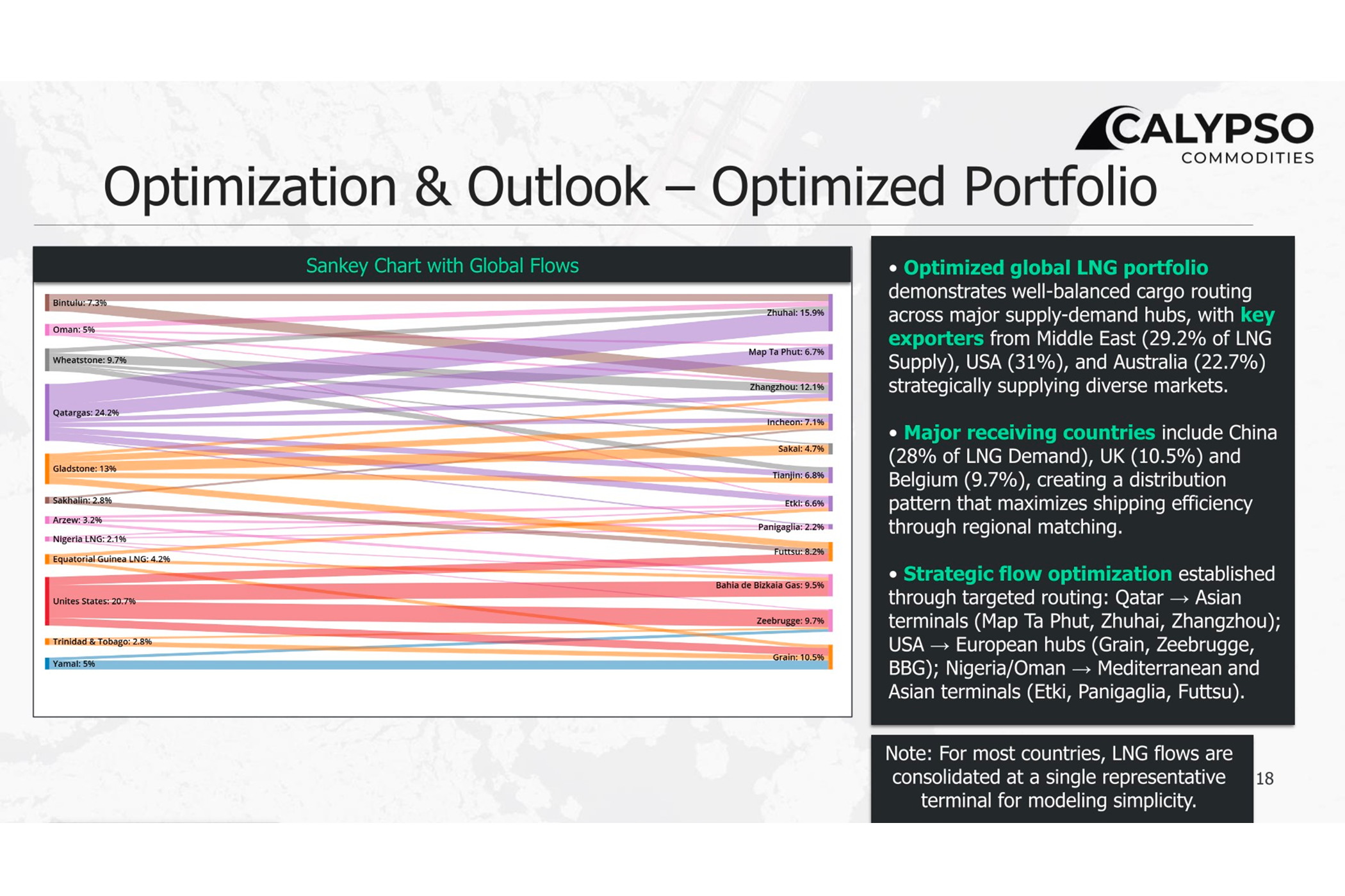

Key Trade Flow 1: Middle East to Asia

Qatar-origin cargoes are modelled to supply high-demand Asian markets (Map TaPhut, Zhuhai, Zhangzhou), with routing and scheduling dynamically adapted toprice spreads, congestion risks, and fleet availability.

Key Trade Flow 2: USA to Europe

US Gulf Coast exports (Sabine Pass, Freeport) are optimised for Europeandelivery to terminals such as Grain, Zeebrugge, and BBG, with routes instantlyrecalculated when market conditions shift.

Key Trade Flow 3: Australia to East Asia

Australian LNG (Wheatstone, Gladstone) is strategically allocated to China, Japan, South Korea, and Taiwan, balancing long-term contract obligations with opportunistic spot deliveries in response to price signals.

Market Insights:

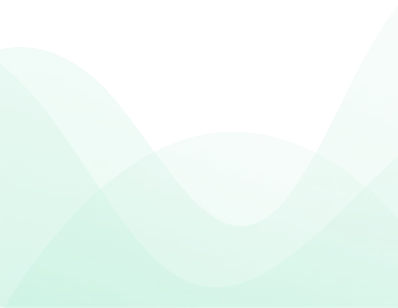

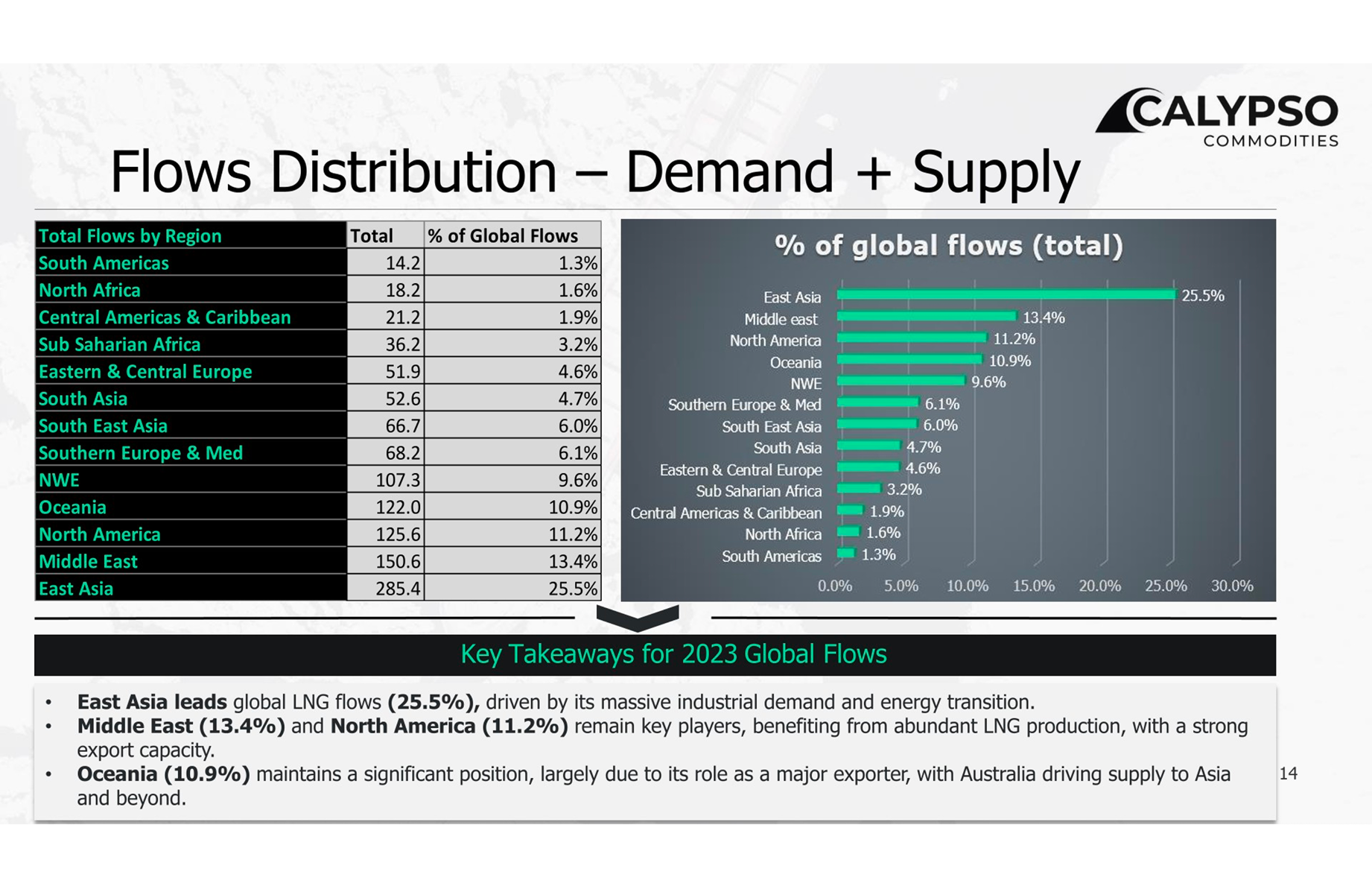

- Exports: X-LNG’s optimisation framework strategically balances Middle East, North America, and Oceania supply to serve multiple markets without over-reliance on a single route.

- Imports: East Asia’s dominant demand share can be stress-tested against different supply mixes and disruption scenarios.

- Top Players: The platform models interplays between the largest exporters and importers, enabling forward-looking flow predictions under changing fundamentals.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Predicting Global LNG Flows: Leveraging X-LNG's Computational Power Through Customised Modelling

Check out the full detailed analysis here

Leveraging X-LNG’s computational power, this case study demonstrates how our platform can simulate, optimise, and forecast future LNG flows by adjusting every technical assumption — from vessel capacity and voyage routing to price indexation and terminal constraints. By integrating verified commercial data and applying advanced filtering logic, X-LNG delivers a dynamic, future-oriented model of global LNG trade under any market scenario.

Portfolio Scale: The X-LNG global model incorporates the entire commercial fleet andall major trade corridors, with non-commercial movements removed (e.g.bunkering, testing, domestic loops). Cargo volumes are standardised (tonnes →MMBtu → cargo units) using IGU conversion factors and allocated to regionalclusters. Every parameter is customisable — enabling simulations that reflectyour operational reality and strategic priorities.

Key Trade Flow 1: Middle East to Asia

Qatar-origin cargoes are modelled to supply high-demand Asian markets (Map TaPhut, Zhuhai, Zhangzhou), with routing and scheduling dynamically adapted toprice spreads, congestion risks, and fleet availability.

Key Trade Flow 2: USA to Europe

US Gulf Coast exports (Sabine Pass, Freeport) are optimised for Europeandelivery to terminals such as Grain, Zeebrugge, and BBG, with routes instantlyrecalculated when market conditions shift.

Key Trade Flow 3: Australia to East Asia

Australian LNG (Wheatstone, Gladstone) is strategically allocated to China, Japan, South Korea, and Taiwan, balancing long-term contract obligations with opportunistic spot deliveries in response to price signals.

Market Insights:

- Exports: X-LNG’s optimisation framework strategically balances Middle East, North America, and Oceania supply to serve multiple markets without over-reliance on a single route.

- Imports: East Asia’s dominant demand share can be stress-tested against different supply mixes and disruption scenarios.

- Top Players: The platform models interplays between the largest exporters and importers, enabling forward-looking flow predictions under changing fundamentals.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)