Optimal pricing of Argentina LNG Positions: Portfolio Impact Assessment for Shell, ADNOC, and ENBW

Check out the full detailed analysis here

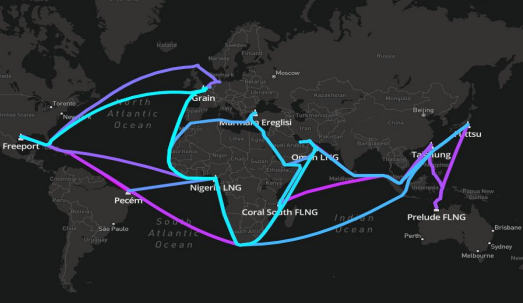

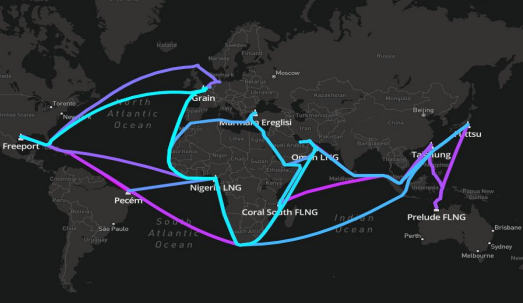

Argentina faces a potentially critical pricing decision: how to optimize FOB-Long contract terms with major LNG players to maximize Bahia Blanca's 𝗿𝗲𝘃𝗲𝗻𝘂𝗲 𝗽𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹 across global markets through strategic counterparty-specific discount targeting.

𝗧𝗵𝗲 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲: How should Argentina choose optimal indexation (TTF/JKM/Brent) and discount levels for maximum loading revenue?

𝗢𝘂𝗿 𝗔𝗽𝗽𝗿𝗼𝗮𝗰𝗵: Comprehensive counterparty modeling via X-LNG across Shell, ADNOC, and EnBW portfolios, testing discount sensitivities from -$0.25 to -$5.00/MMBtu to identify precise revenue optimization points.

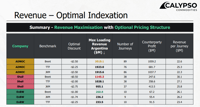

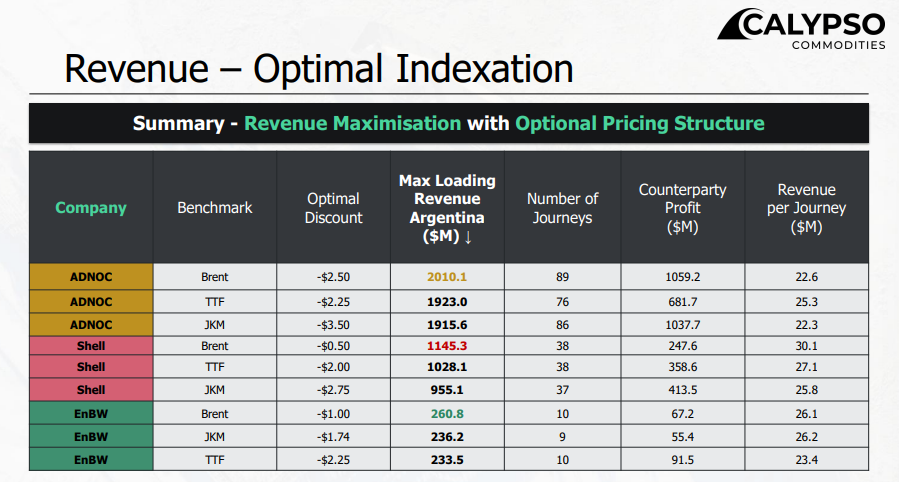

Revenue optimization Breakthroughs:

• ADNOC Group: Scale at $2.01B peak revenue (Brent, -$2.50/MMBtu) generating $25.3M per journey

• Shell: Premium efficiency champion at $30.1M per journey (Brent, -$0.50/MMBtu) - 𝗵𝗶𝗴𝗵𝗲𝘀𝘁 𝗿𝗲𝘃𝗲𝗻𝘂𝗲/𝘃𝗼𝘆𝗮𝗴𝗲 across all scenarios

• EnBW Energie Baden-Württemberg AG: Consistent $234M-$261M with risk-adjusted stability across shallow discounts (-$1.00 to -$2.25/MMBtu)

X-LNG Insights:

Revenue curve "humps" reveal 𝗻𝗼𝗻-𝗹𝗶𝗻𝗲𝗮𝗿 𝗽𝗿𝗶𝗰𝗶𝗻𝗴 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀 where specific discounts unlock superior vessel scheduling and routing strategies. This is why 𝗿𝗲𝗮𝗹-𝘄𝗼𝗿𝗹𝗱 𝗽𝗵𝘆𝘀𝗶𝗰𝗮𝗹 𝗺𝗼𝗱𝗲𝗹𝗶𝗻𝗴 outcompetes theoretical economic curves.

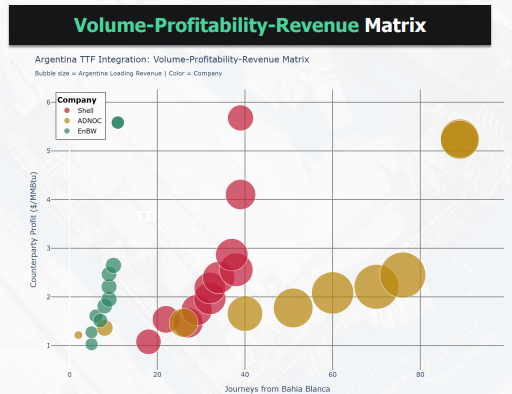

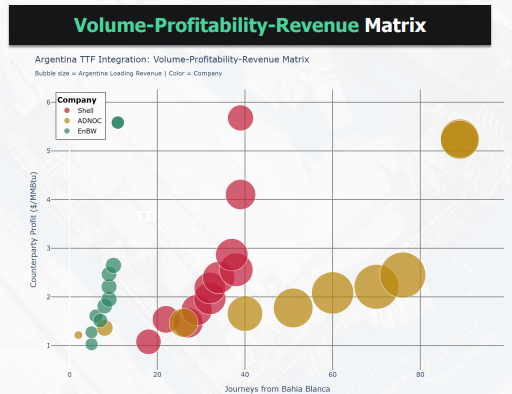

Volume-Profit Synergies:

• ADNOC: 76-89 journeys generating $1.4B-$2.2B combined profits (Argentina captures 40-50%)

• Shell: 37-38 high-value journeys creating $503M-$838M total value (Argentina secures 50-60%)

• EnBW: 9-10 precision journeys with 𝗻𝗶𝗰𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁 𝗳𝗼𝗰𝘂𝘀

The Differentiation Advantage:

・TTF analysis proved ADNOC responds to deeper discounts with massive volume elasticity

・ Shell maximizes efficiency at shallow discounts

・EnBW delivers consistency regardless of discount depth

Key Takeaways: Argentina's FOB-Long Success Demands Counterparty-Specific Discount Strategies:

→Deep discounts (-$2.50-$3.50) for ADNOC's volume dominance

→ Shallow discounts (-$0.50-$1.00) for Shell's premium returns

→ Moderate discounts for EnBW's stable base loadResult: 15-25% portfolio value increases through data-driven precision targeting.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Optimal pricing of Argentina LNG Positions: Portfolio Impact Assessment for Shell, ADNOC, and ENBW

Check out the full detailed analysis here

Argentina faces a potentially critical pricing decision: how to optimize FOB-Long contract terms with major LNG players to maximize Bahia Blanca's 𝗿𝗲𝘃𝗲𝗻𝘂𝗲 𝗽𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹 across global markets through strategic counterparty-specific discount targeting.

𝗧𝗵𝗲 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲: How should Argentina choose optimal indexation (TTF/JKM/Brent) and discount levels for maximum loading revenue?

𝗢𝘂𝗿 𝗔𝗽𝗽𝗿𝗼𝗮𝗰𝗵: Comprehensive counterparty modeling via X-LNG across Shell, ADNOC, and EnBW portfolios, testing discount sensitivities from -$0.25 to -$5.00/MMBtu to identify precise revenue optimization points.

Revenue optimization Breakthroughs:

• ADNOC Group: Scale at $2.01B peak revenue (Brent, -$2.50/MMBtu) generating $25.3M per journey

• Shell: Premium efficiency champion at $30.1M per journey (Brent, -$0.50/MMBtu) - 𝗵𝗶𝗴𝗵𝗲𝘀𝘁 𝗿𝗲𝘃𝗲𝗻𝘂𝗲/𝘃𝗼𝘆𝗮𝗴𝗲 across all scenarios

• EnBW Energie Baden-Württemberg AG: Consistent $234M-$261M with risk-adjusted stability across shallow discounts (-$1.00 to -$2.25/MMBtu)

X-LNG Insights:

Revenue curve "humps" reveal 𝗻𝗼𝗻-𝗹𝗶𝗻𝗲𝗮𝗿 𝗽𝗿𝗶𝗰𝗶𝗻𝗴 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀 where specific discounts unlock superior vessel scheduling and routing strategies. This is why 𝗿𝗲𝗮𝗹-𝘄𝗼𝗿𝗹𝗱 𝗽𝗵𝘆𝘀𝗶𝗰𝗮𝗹 𝗺𝗼𝗱𝗲𝗹𝗶𝗻𝗴 outcompetes theoretical economic curves.

Volume-Profit Synergies:

• ADNOC: 76-89 journeys generating $1.4B-$2.2B combined profits (Argentina captures 40-50%)

• Shell: 37-38 high-value journeys creating $503M-$838M total value (Argentina secures 50-60%)

• EnBW: 9-10 precision journeys with 𝗻𝗶𝗰𝗵𝗲 𝗺𝗮𝗿𝗸𝗲𝘁 𝗳𝗼𝗰𝘂𝘀

The Differentiation Advantage:

・TTF analysis proved ADNOC responds to deeper discounts with massive volume elasticity

・ Shell maximizes efficiency at shallow discounts

・EnBW delivers consistency regardless of discount depth

Key Takeaways: Argentina's FOB-Long Success Demands Counterparty-Specific Discount Strategies:

→Deep discounts (-$2.50-$3.50) for ADNOC's volume dominance

→ Shallow discounts (-$0.50-$1.00) for Shell's premium returns

→ Moderate discounts for EnBW's stable base loadResult: 15-25% portfolio value increases through data-driven precision targeting.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)