Market-Driven Changes in DES Long Flexibility Value: Comparative Analysis and Implications for Portfolio Management

Check out the full detailed analysis here

What this update covers

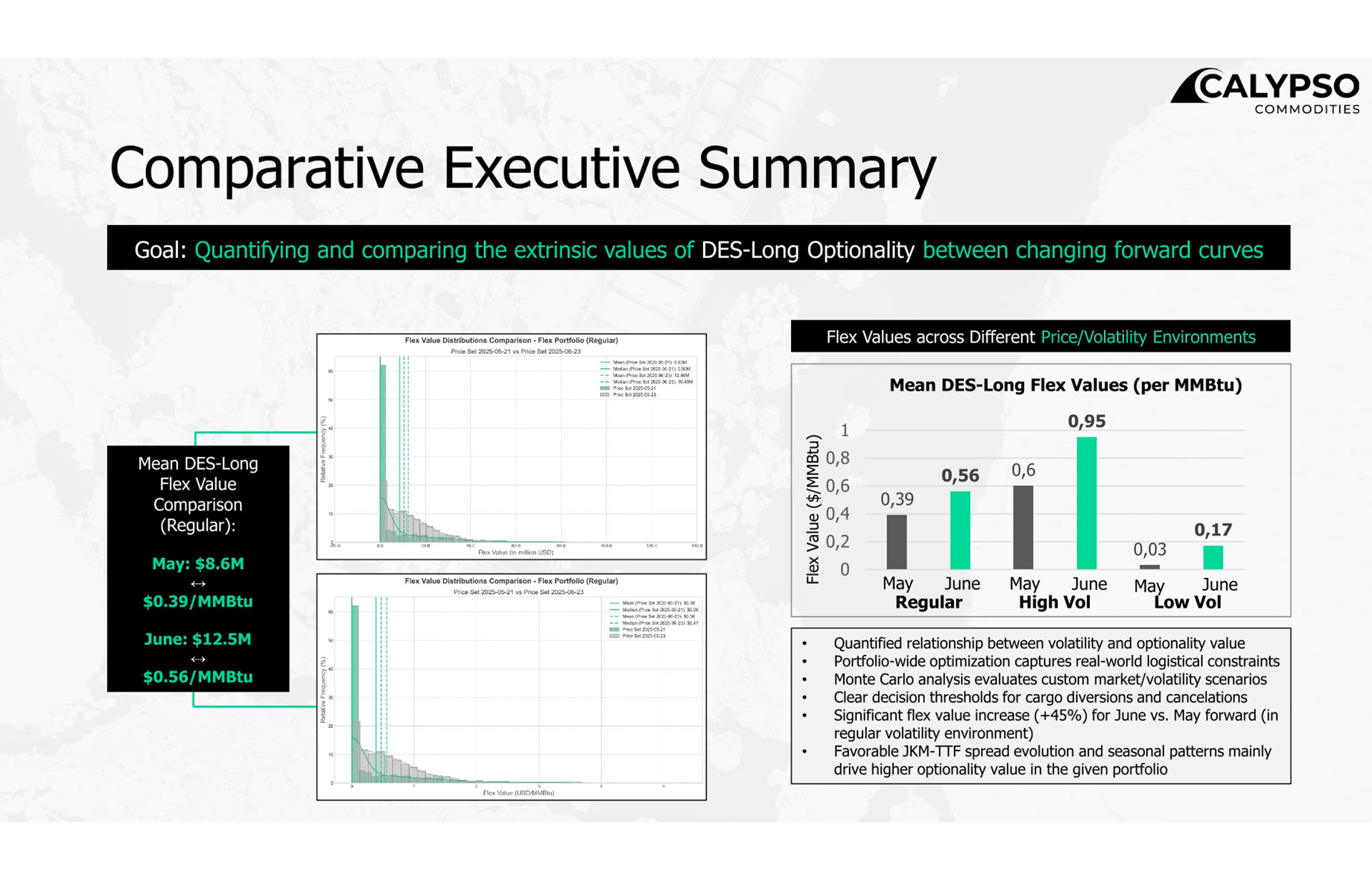

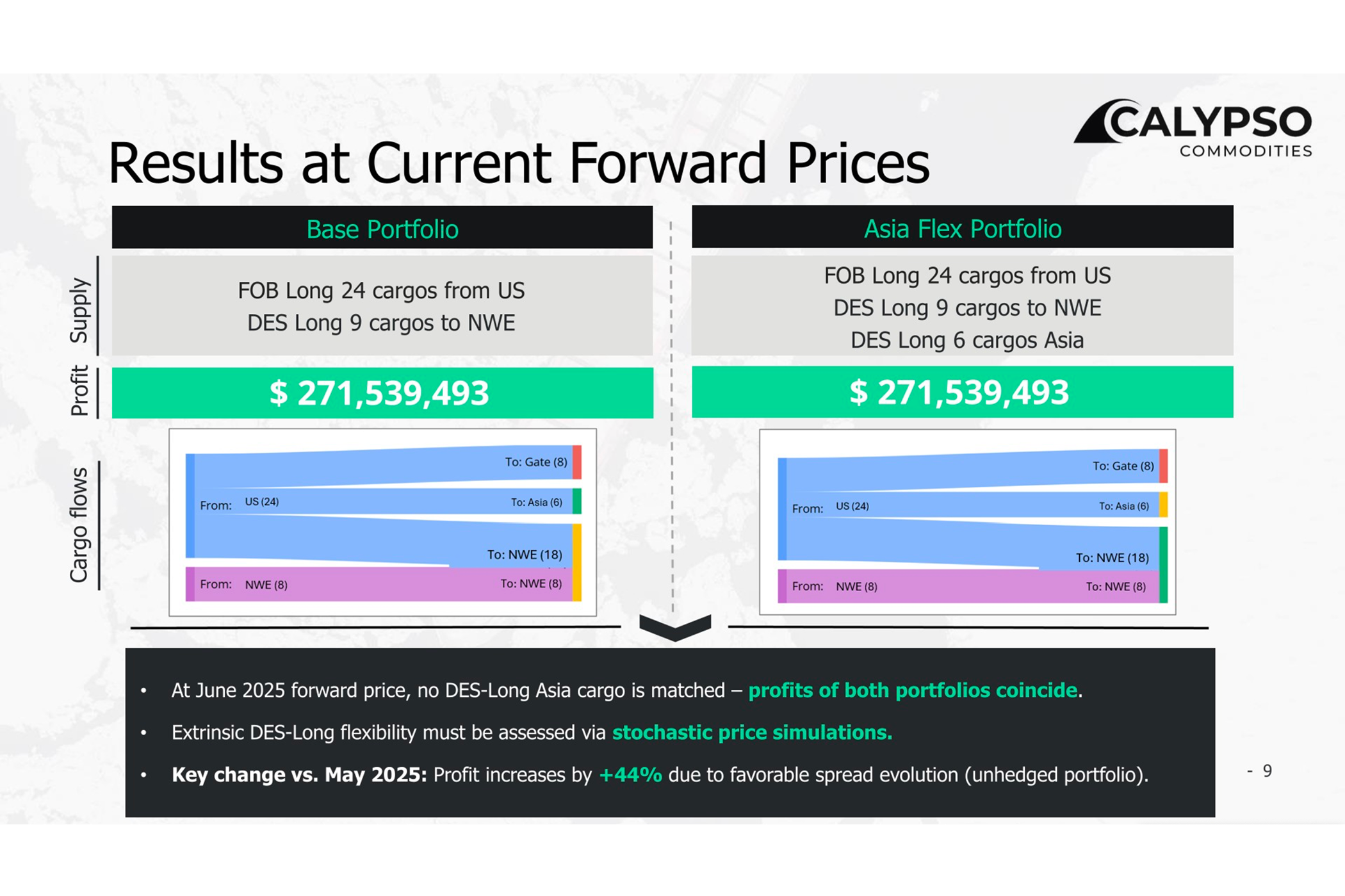

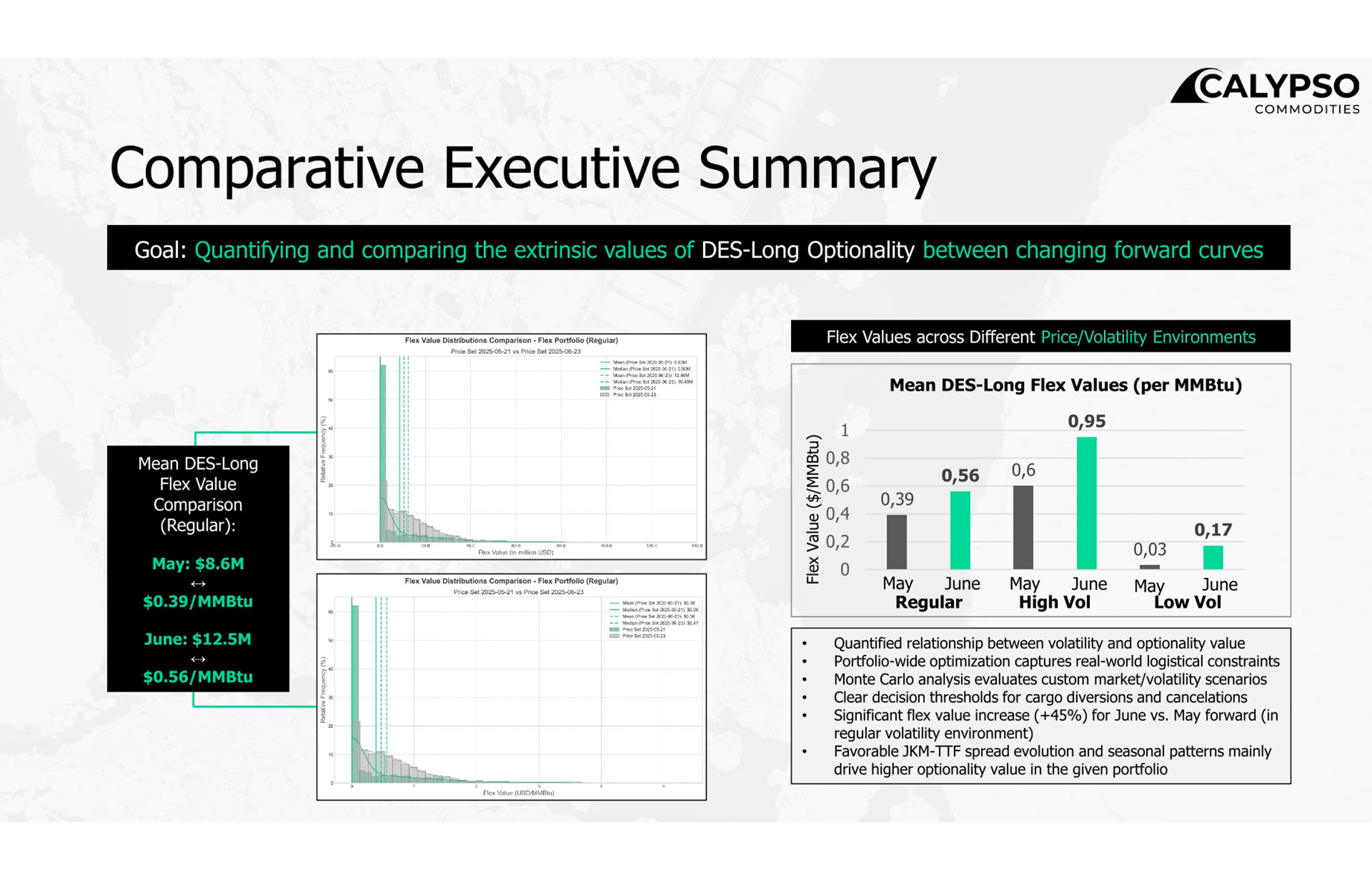

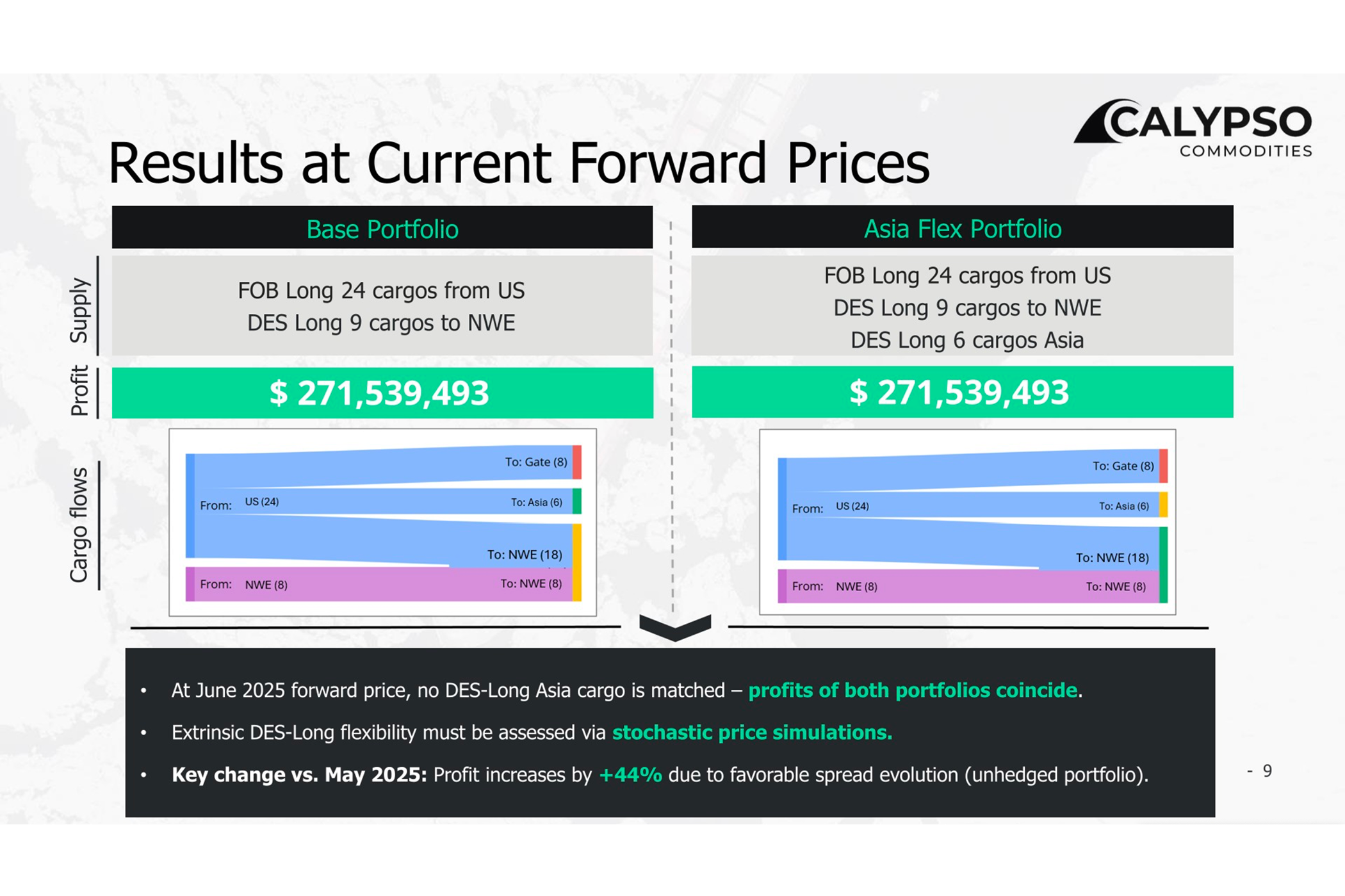

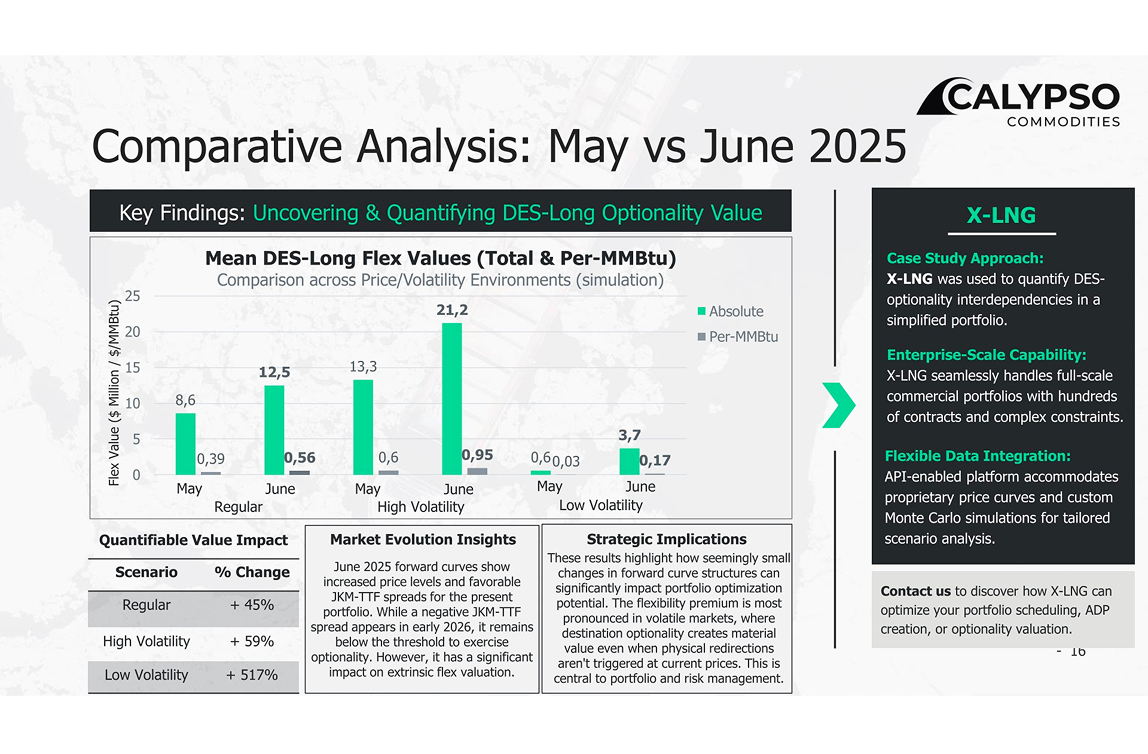

- Objective: Re‑run the May 2025 DES‑Long study with June 2025 market inputs to quantify the month‑over‑month change in optionality value and exercise likelihood.

- Portfolios:

- Base Portfolio: Standard FOB Long‑US to DES Short‑Asia flows (no flex)

- Asia Flex Portfolio: Base + optional DES‑Long Asia capability

- Method: Hundreds of Monte Carlo price paths for HH, JKM, and TTF; full portfolio re‑optimization on each path; results segmented by regular, high‑vol, and low‑vol regimes.

- Comparative layer: Direct delta versus the May environment—updated decision boundary and flex valuation under June forwards and volatility.

What changed since May

- Forward curves and levels: June HH/JKM/TTF levels shift relative netbacks, affecting whether Asian diversion improves economics.

- Asia–Europe spread dynamics: The JKM–TTF relationship moves the “exercise boundary” for DES‑Long; the boundary is recalculated and compared to May.

- Seasonality effects: Different monthly demand/price shapes alter which delivery windows are more likely to exercise the DES‑Long option.

- Volatility profile: Re‑tested under the June vol backdrop to show how extrinsic value expands or compresses with changed uncertainty.

- Portfolio routing: Re‑optimization highlights where vessel allocation and alternative contract matches adapt under June conditions.

Key insights for decision‑makers

- DES‑Long value is sensitive to both spreads and absolute price levels: It increases when JKM’s advantage over TTF (net of logistics) expands, and compresses when that advantage narrows.

- The exercise map moved: The JKM–TTF decision boundary shifts under June curves, updating the thresholds at which Asian DES‑Long becomes favorable.

- Timing matters: Seasonality in June alters which months are more/less likely to exercise; use these windows to refine hedging, nominations, and scheduling.

- Core mechanics are unchanged: Value still comes from portfolio‑wide re‑routing, improved long–short matching, and better vessel utilization rather than isolated deal economics.

Who benefits from the update

- Traders: Align hedge triggers and diversion decisions with the updated JKM–TTF exercise boundary.

- Origination/Structuring: Calibrate pricing and terms for DES‑Long optionality using June‑based deltas versus May.

- Portfolio & Risk teams: Refresh stress tests and value‑at‑risk style views under the new curve and volatility environment.

- Shipping/Scheduling: Adjust fleet plans and route preferences to the revised exercise likelihood by month.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Market-Driven Changes in DES Long Flexibility Value: Comparative Analysis and Implications for Portfolio Management

Check out the full detailed analysis here

What this update covers

- Objective: Re‑run the May 2025 DES‑Long study with June 2025 market inputs to quantify the month‑over‑month change in optionality value and exercise likelihood.

- Portfolios:

- Base Portfolio: Standard FOB Long‑US to DES Short‑Asia flows (no flex)

- Asia Flex Portfolio: Base + optional DES‑Long Asia capability

- Method: Hundreds of Monte Carlo price paths for HH, JKM, and TTF; full portfolio re‑optimization on each path; results segmented by regular, high‑vol, and low‑vol regimes.

- Comparative layer: Direct delta versus the May environment—updated decision boundary and flex valuation under June forwards and volatility.

What changed since May

- Forward curves and levels: June HH/JKM/TTF levels shift relative netbacks, affecting whether Asian diversion improves economics.

- Asia–Europe spread dynamics: The JKM–TTF relationship moves the “exercise boundary” for DES‑Long; the boundary is recalculated and compared to May.

- Seasonality effects: Different monthly demand/price shapes alter which delivery windows are more likely to exercise the DES‑Long option.

- Volatility profile: Re‑tested under the June vol backdrop to show how extrinsic value expands or compresses with changed uncertainty.

- Portfolio routing: Re‑optimization highlights where vessel allocation and alternative contract matches adapt under June conditions.

Key insights for decision‑makers

- DES‑Long value is sensitive to both spreads and absolute price levels: It increases when JKM’s advantage over TTF (net of logistics) expands, and compresses when that advantage narrows.

- The exercise map moved: The JKM–TTF decision boundary shifts under June curves, updating the thresholds at which Asian DES‑Long becomes favorable.

- Timing matters: Seasonality in June alters which months are more/less likely to exercise; use these windows to refine hedging, nominations, and scheduling.

- Core mechanics are unchanged: Value still comes from portfolio‑wide re‑routing, improved long–short matching, and better vessel utilization rather than isolated deal economics.

Who benefits from the update

- Traders: Align hedge triggers and diversion decisions with the updated JKM–TTF exercise boundary.

- Origination/Structuring: Calibrate pricing and terms for DES‑Long optionality using June‑based deltas versus May.

- Portfolio & Risk teams: Refresh stress tests and value‑at‑risk style views under the new curve and volatility environment.

- Shipping/Scheduling: Adjust fleet plans and route preferences to the revised exercise likelihood by month.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

.svg)