LNG Call Options vs. Firm Deliveries: Turning Flexibility into Measurabe Value

Check out the full detailed analysis here

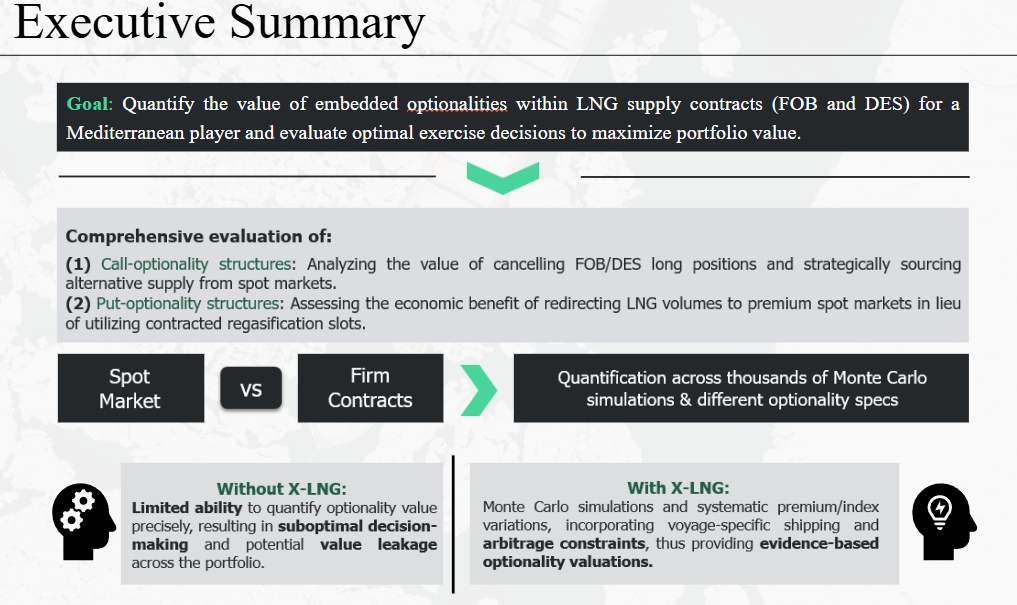

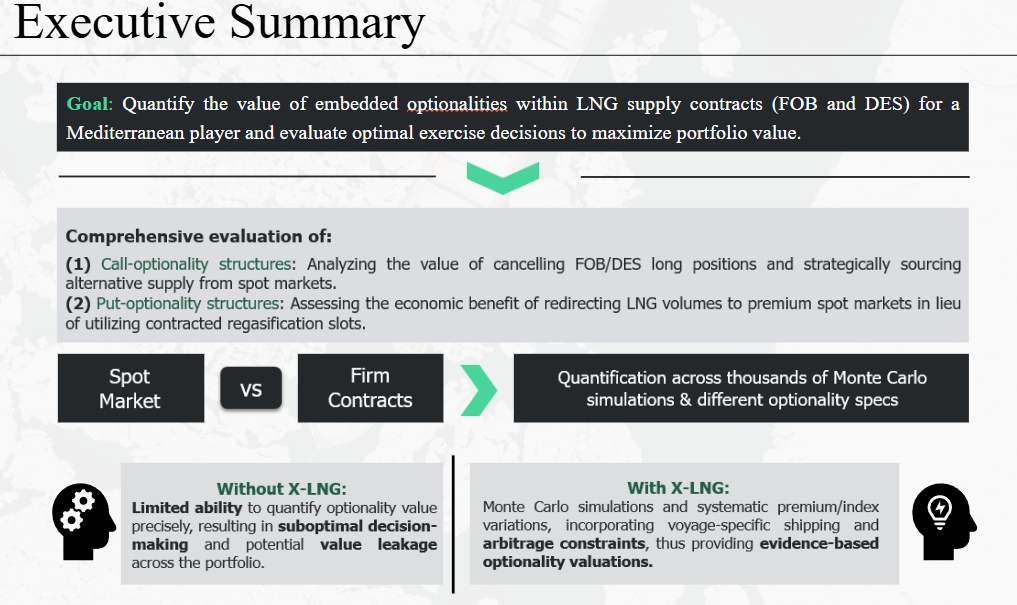

When does contractual flexibility stop being “nice-to-have” and start producing real P&L? We stress-tested a European utility portfolio to answer exactly that: when should you exercise cargo-level call options and cancel regas/demand to redirect volumes into spot markets?

Using 𝗫-𝗟𝗡𝗚, we ran 𝟭,𝟬𝟬𝟬 𝗠𝗼𝗻𝘁𝗲 𝗖𝗮𝗿𝗹𝗼 𝘀𝗶𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻𝘀 with journey-level reoptimization on every path. The model explicitly enforces 𝗳𝗿𝗲𝗶𝗴𝗵𝘁, 𝗕𝗢𝗚, 𝗰𝗮𝗻𝗮𝗹 & 𝗽𝗼𝗿𝘁 𝗹𝗶𝗺𝗶𝘁𝘀, 𝗿𝗲𝗴𝗮𝘀 𝗰𝗮𝗽𝗮𝗰𝗶𝘁𝘆 𝗮𝗻𝗱 𝗰𝗮𝗻𝗰𝗲𝗹𝗹𝗮𝘁𝗶𝗼𝗻 𝗳𝗲𝗲𝘀, so every exercise decision is operationally feasible - not theoretical.

Top Findings

• Value in every regime. Embedded call optionality added

~+$0.14/MMBtu (low vol)

+$0.20/MMBtu (base),

+$0.45/MMBtu (high vol)

→ Optionality is accretive even in calm markets.

• Where value coes from: optionality is monetized mainly on the supply side, replacing higher-cost firm intake with cheaper US spot cargoes. US spot selection rises to ~46–49% with options vs 32–33% in the base. India/China placements fall to ~17–21% vs 23–26%.

• Volatility amplifies upside, preserves downside. Distributions show a right-skewed uplift with minimal negative outcomes — high volatility stretches the right tail (big wins) while keeping left tail near zero.

• Forwards underprice flexibility. Forward-based valuations miss ~$0.20–0.45/MMBtu of extrinsic optionality value.

Strategic Takeaways (What Managers Should Do Tomorrow)

Secure US spot & freight access. US liquidity materially increases exercise value. Don't rely on forwards alone. Use journey-level, Monte Carlo valuation to price optionality and set exercise thresholds.

Operational templates: combine clear cancellation fees, port/regas constraints and exercise decision rules to capture value when markets move.

Bottom Line

Flexibility pays - measurably. By combining operational realism (voyage constraints, regas slots, cancellation fees) with large-scale Monte Carlo optimization, European players can convert contractual optionality into repeatable P&L uplift and downside protection.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

LNG Call Options vs. Firm Deliveries: Turning Flexibility into Measurabe Value

Check out the full detailed analysis here

When does contractual flexibility stop being “nice-to-have” and start producing real P&L? We stress-tested a European utility portfolio to answer exactly that: when should you exercise cargo-level call options and cancel regas/demand to redirect volumes into spot markets?

Using 𝗫-𝗟𝗡𝗚, we ran 𝟭,𝟬𝟬𝟬 𝗠𝗼𝗻𝘁𝗲 𝗖𝗮𝗿𝗹𝗼 𝘀𝗶𝗺𝘂𝗹𝗮𝘁𝗶𝗼𝗻𝘀 with journey-level reoptimization on every path. The model explicitly enforces 𝗳𝗿𝗲𝗶𝗴𝗵𝘁, 𝗕𝗢𝗚, 𝗰𝗮𝗻𝗮𝗹 & 𝗽𝗼𝗿𝘁 𝗹𝗶𝗺𝗶𝘁𝘀, 𝗿𝗲𝗴𝗮𝘀 𝗰𝗮𝗽𝗮𝗰𝗶𝘁𝘆 𝗮𝗻𝗱 𝗰𝗮𝗻𝗰𝗲𝗹𝗹𝗮𝘁𝗶𝗼𝗻 𝗳𝗲𝗲𝘀, so every exercise decision is operationally feasible - not theoretical.

Top Findings

• Value in every regime. Embedded call optionality added

~+$0.14/MMBtu (low vol)

+$0.20/MMBtu (base),

+$0.45/MMBtu (high vol)

→ Optionality is accretive even in calm markets.

• Where value coes from: optionality is monetized mainly on the supply side, replacing higher-cost firm intake with cheaper US spot cargoes. US spot selection rises to ~46–49% with options vs 32–33% in the base. India/China placements fall to ~17–21% vs 23–26%.

• Volatility amplifies upside, preserves downside. Distributions show a right-skewed uplift with minimal negative outcomes — high volatility stretches the right tail (big wins) while keeping left tail near zero.

• Forwards underprice flexibility. Forward-based valuations miss ~$0.20–0.45/MMBtu of extrinsic optionality value.

Strategic Takeaways (What Managers Should Do Tomorrow)

Secure US spot & freight access. US liquidity materially increases exercise value. Don't rely on forwards alone. Use journey-level, Monte Carlo valuation to price optionality and set exercise thresholds.

Operational templates: combine clear cancellation fees, port/regas constraints and exercise decision rules to capture value when markets move.

Bottom Line

Flexibility pays - measurably. By combining operational realism (voyage constraints, regas slots, cancellation fees) with large-scale Monte Carlo optimization, European players can convert contractual optionality into repeatable P&L uplift and downside protection.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)