Origination Case Study: Deals under Real-World Uncertainties

Suppose you’re an LNG player that currently supplies European demand position using LNG from the US Gulf. You are now considering diversifying your supply to Australia or the Middle East. You are also thinking of securing additional demand positions in Europe and East Asia but the seasonality and number of cargoes remain uncertain. So which supply hub is better? What if prices vary or there are canal closures? These are challenging, time-consuming and analytically heavy questions for LNG teams to answer. Fortunately, X-LNG can help.

This case study aims to demonstrate the robustness of the deal under real-world uncertainties by modelling the base case and four hypothetical scenarios:

- Additional supplies

- Demand fluctuations

- Seasonal skews

- Price index variations

Check out the full detailed analysis here

Optimized operational schedules are provided in X-LNG for every one of the scenarios

About X-LNG:

Our team at Calypso Commodities utilized our advanced AI system, X-LNG, to model this case study. X-LNG is uniquely designed for comprehensive portfolio-level analyses and calculations. The following powerful features are available in X-LNG:

- Matches Longs and Shorts with Physical Assets: Seamlessly matches long and short positions with physical assets like vessels, ensuring optimal portfolio, operation plan and schedule management.

- Holistic Contract Valuation: Captures and models the value of each contract on a portfolio level taking into account all logistic and market aspects.

- Precise Operation Plans: Provides a precise operation plan for each optimized portfolio that operators can actually use.

- Day-to-Day Usability: Delivers real and actionable day-to-day operation plans for each optimized portfolio in this case study.

- Unmatched Transparency: X-LNG is the most transparent way of valuating and optimizing global LNG portfolios on the market.

- Cloud-Based System: Features a world-class user interface that enhances user experience.

- Scalability: Capable of solving and optimising portfolios of different sizes fast.

- High-Volume Scenario Analysis: Runs hundreds of thousands of scenarios simultaneously, ensuring robust and comprehensive solutions.

Base case:

The following inputs are used in the base case:

Supply (2025):

- Loading: Sabine Pass, 1.6 MTPA, 22 cargos

- Indexation: 115% HH + $ 3.5 tolling fee

Demand (2025):

- Discharge: Gate, 2.25 bcma, 22 cargos

- Indexation: 90% TTF

Fleet:

- 2 × 174k vessels

Prices:

- Forward curve based on futures (HH and TTF)

- Current prices on 21/07/2024 are used for forecast

The base portfolio generates a profit of $ 238,435,281 by using the optimized operational schedule generated by X-LNG. This operational schedule is our proprietary asset due to its robust and comprehensive features. Unlock your own optimized operational plan by launching X-LNG and experience its power firsthand.

Scenario 1: Exercising global flex with additional supplies

Scenario:

- When additional supply from Australia OR the Middle East, and additional demand from Portugal and South Korea are added to the base portfolio, how does the cargo flow change and which supply source is more profitable?

Assumptions/changes:

- Changes in supply:

+ 4 DES Long Positions with NWE flex (90% TTF)

+ 4 FOB Long Leads at Australia (94.5% JKM – $ 3.75) OR

+ 4 FOB Long Leads at UAE (11% Brent)

- Changes in demand:

+ 4 DES Short Positions at Portugal (85% TTF)

+ 4 DES Short Positions at South Korea (100% JKM)

- Changes in fleets:

+ 1 TC-In (174k)

Key takeaways:

- All the South Korea demand cargos are fulfilled by Australia or UAE FOBs.

- Australia and UAE FOBs have similar profitability to South Korea.

- DES Longs free up 4 Sabine Pass Cargos to Portugal.

Scenario 2: Exercising global flex with demand fluctuations

Scenario:

- Do demand fluctuations between Korea and Portugal change the best source of supply?

Assumptions/changes:

- Assume there are additional supplies from Australia OR Middle East as before.

- The balance of demand between Portugal and South Korea changes – instead of both having 4 cargos respectively, one will have 6 and the other 2 cargos.

Key takeaways:

- Under demand fluctuations, Australia is a more profitable supply source as it is better positioned to serve Korea. Portugal is mostly supplied from Sabine Pass in any case.

- When there is higher demand from Portugal, the Red Sea closure reduces the profits.

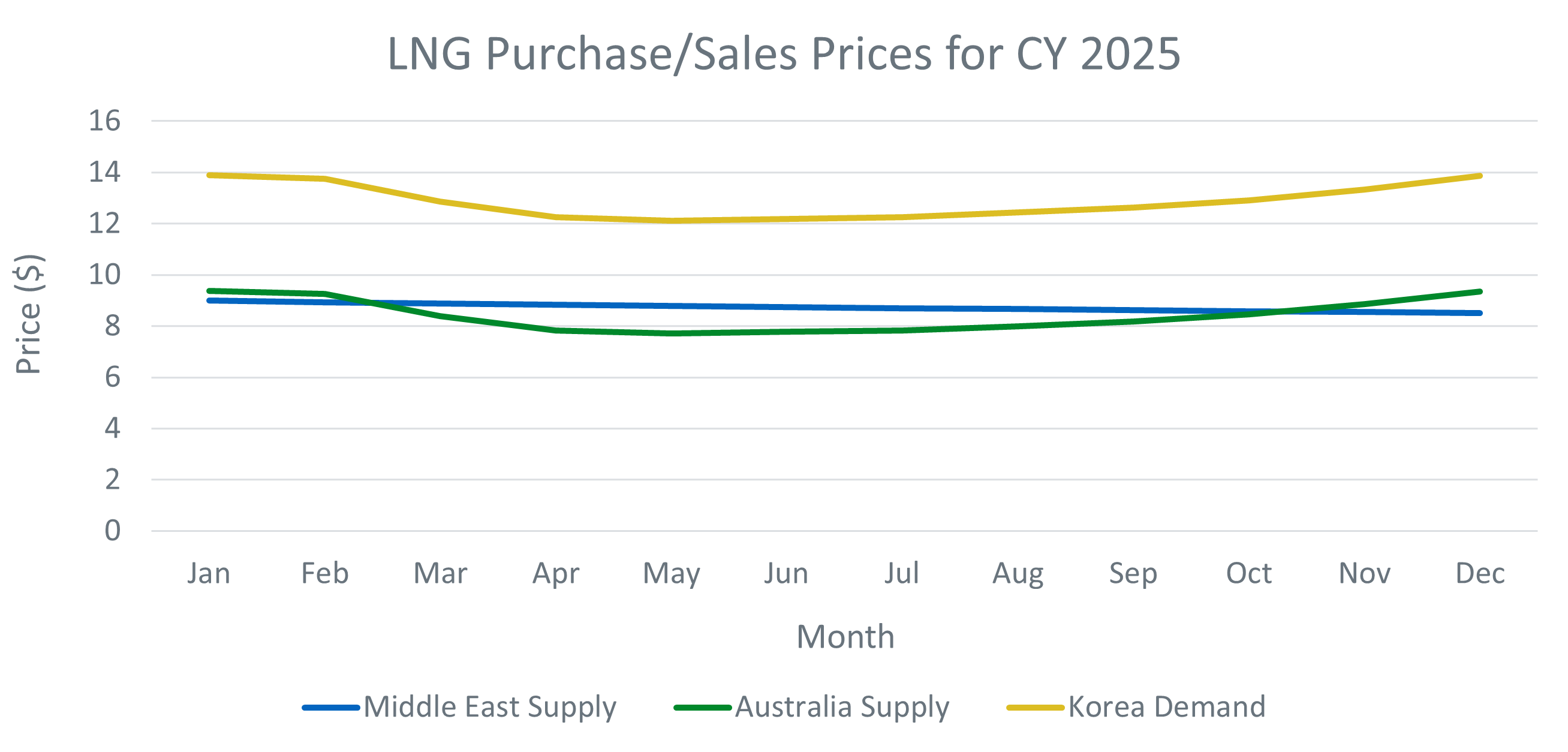

Scenario 3: Seasonal skews in Korean demand

Scenario:

- Does a spike in Korean demand during the summer or winter change the best source of supply?

Assumptions/changes:

- The 4 cargos to Korea are all concentrated in the summer or winter respectively instead of being evenly distributed across the year.

Key takeaways:

- Under a summer skew in Korea, Australia is the most profitable source of supply.

- Under a winter skew in Korea, the Middle East is the most profitable source of supply.

- The differences in profitability are due to the differing indexations both supply sources use. JKM dips in the summer while Brent remains more stable, so the purchase price for Australian LNG is more favorable in the summer while that for the Middle East LNG is more favorable in the winter.

Scenario 4: Price/index volatility exposure

Scenario:

- Which index does the portfolio have the greatest risk exposure to during price variations?

Assumptions/changes:

- Apply one standard deviation on the TTF, JKM and HH index-valuation of the optimized portfolio respectively.

- Assess the portfolio profit range (the difference between one standard deviation above and below the valuation of the optimized portfolio). The wider the profit range, the greater the risk exposure.

Key takeaways:

- The portfolio has the highest risk exposure to TTF, moderate risk exposure to HH and low risk exposure to JKM.

- TTF is highly volatile and is the index of choice for major demand contracts in this case, thus the portfolio is very vulnerable because the supply contracts use different indexations. HH is a more stable index. JKM is generally a volatile index, but risk is limited since a small and similar number of cargos are purchased on JKM terms (Australia) and sold on JKM terms (Korea).

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Origination Case Study: Deals under Real-World Uncertainties

Suppose you’re an LNG player that currently supplies European demand position using LNG from the US Gulf. You are now considering diversifying your supply to Australia or the Middle East. You are also thinking of securing additional demand positions in Europe and East Asia but the seasonality and number of cargoes remain uncertain. So which supply hub is better? What if prices vary or there are canal closures? These are challenging, time-consuming and analytically heavy questions for LNG teams to answer. Fortunately, X-LNG can help.

This case study aims to demonstrate the robustness of the deal under real-world uncertainties by modelling the base case and four hypothetical scenarios:

- Additional supplies

- Demand fluctuations

- Seasonal skews

- Price index variations

Check out the full detailed analysis here

Optimized operational schedules are provided in X-LNG for every one of the scenarios

About X-LNG:

Our team at Calypso Commodities utilized our advanced AI system, X-LNG, to model this case study. X-LNG is uniquely designed for comprehensive portfolio-level analyses and calculations. The following powerful features are available in X-LNG:

- Matches Longs and Shorts with Physical Assets: Seamlessly matches long and short positions with physical assets like vessels, ensuring optimal portfolio, operation plan and schedule management.

- Holistic Contract Valuation: Captures and models the value of each contract on a portfolio level taking into account all logistic and market aspects.

- Precise Operation Plans: Provides a precise operation plan for each optimized portfolio that operators can actually use.

- Day-to-Day Usability: Delivers real and actionable day-to-day operation plans for each optimized portfolio in this case study.

- Unmatched Transparency: X-LNG is the most transparent way of valuating and optimizing global LNG portfolios on the market.

- Cloud-Based System: Features a world-class user interface that enhances user experience.

- Scalability: Capable of solving and optimising portfolios of different sizes fast.

- High-Volume Scenario Analysis: Runs hundreds of thousands of scenarios simultaneously, ensuring robust and comprehensive solutions.

Base case:

The following inputs are used in the base case:

Supply (2025):

- Loading: Sabine Pass, 1.6 MTPA, 22 cargos

- Indexation: 115% HH + $ 3.5 tolling fee

Demand (2025):

- Discharge: Gate, 2.25 bcma, 22 cargos

- Indexation: 90% TTF

Fleet:

- 2 × 174k vessels

Prices:

- Forward curve based on futures (HH and TTF)

- Current prices on 21/07/2024 are used for forecast

The base portfolio generates a profit of $ 238,435,281 by using the optimized operational schedule generated by X-LNG. This operational schedule is our proprietary asset due to its robust and comprehensive features. Unlock your own optimized operational plan by launching X-LNG and experience its power firsthand.

Scenario 1: Exercising global flex with additional supplies

Scenario:

- When additional supply from Australia OR the Middle East, and additional demand from Portugal and South Korea are added to the base portfolio, how does the cargo flow change and which supply source is more profitable?

Assumptions/changes:

- Changes in supply:

+ 4 DES Long Positions with NWE flex (90% TTF)

+ 4 FOB Long Leads at Australia (94.5% JKM – $ 3.75) OR

+ 4 FOB Long Leads at UAE (11% Brent)

- Changes in demand:

+ 4 DES Short Positions at Portugal (85% TTF)

+ 4 DES Short Positions at South Korea (100% JKM)

- Changes in fleets:

+ 1 TC-In (174k)

Key takeaways:

- All the South Korea demand cargos are fulfilled by Australia or UAE FOBs.

- Australia and UAE FOBs have similar profitability to South Korea.

- DES Longs free up 4 Sabine Pass Cargos to Portugal.

Scenario 2: Exercising global flex with demand fluctuations

Scenario:

- Do demand fluctuations between Korea and Portugal change the best source of supply?

Assumptions/changes:

- Assume there are additional supplies from Australia OR Middle East as before.

- The balance of demand between Portugal and South Korea changes – instead of both having 4 cargos respectively, one will have 6 and the other 2 cargos.

Key takeaways:

- Under demand fluctuations, Australia is a more profitable supply source as it is better positioned to serve Korea. Portugal is mostly supplied from Sabine Pass in any case.

- When there is higher demand from Portugal, the Red Sea closure reduces the profits.

Scenario 3: Seasonal skews in Korean demand

Scenario:

- Does a spike in Korean demand during the summer or winter change the best source of supply?

Assumptions/changes:

- The 4 cargos to Korea are all concentrated in the summer or winter respectively instead of being evenly distributed across the year.

Key takeaways:

- Under a summer skew in Korea, Australia is the most profitable source of supply.

- Under a winter skew in Korea, the Middle East is the most profitable source of supply.

- The differences in profitability are due to the differing indexations both supply sources use. JKM dips in the summer while Brent remains more stable, so the purchase price for Australian LNG is more favorable in the summer while that for the Middle East LNG is more favorable in the winter.

Scenario 4: Price/index volatility exposure

Scenario:

- Which index does the portfolio have the greatest risk exposure to during price variations?

Assumptions/changes:

- Apply one standard deviation on the TTF, JKM and HH index-valuation of the optimized portfolio respectively.

- Assess the portfolio profit range (the difference between one standard deviation above and below the valuation of the optimized portfolio). The wider the profit range, the greater the risk exposure.

Key takeaways:

- The portfolio has the highest risk exposure to TTF, moderate risk exposure to HH and low risk exposure to JKM.

- TTF is highly volatile and is the index of choice for major demand contracts in this case, thus the portfolio is very vulnerable because the supply contracts use different indexations. HH is a more stable index. JKM is generally a volatile index, but risk is limited since a small and similar number of cargos are purchased on JKM terms (Australia) and sold on JKM terms (Korea).

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)