Israel vs. Iran: Escalation at the Strait of Hormuz?

Late on Saturday, April 13th, Iran targeted Israel with a series of drone and missile strikes in response to an Israeli assault on the Iranian consulate in Damascus, Syria, on April 1st. On Friday, April 19th Israel retaliated with direct strikes into Iranian territory in the Isfahan region – with no end of the violence spiral in sight.

Moreover, the most recent developments include Iran's Revolutionary Guard navy commander stating that Israel's activities in the United Arab Emirates pose a threat to Tehran, suggesting a possible closure of the Strait of Hormuz, a critical waterway connecting the Persian Gulf to the Gulf of Oman.

Impacts of Supply Shock

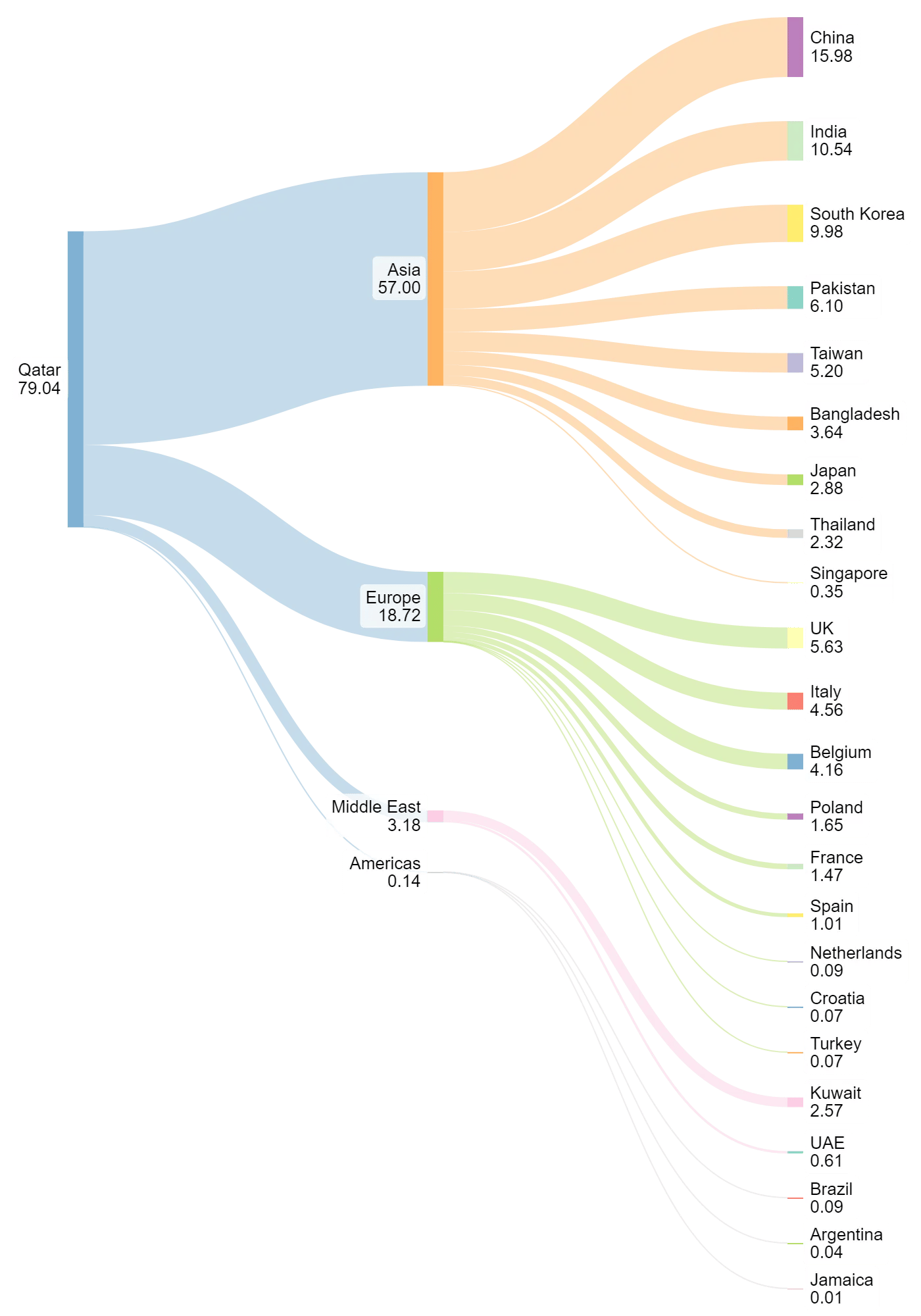

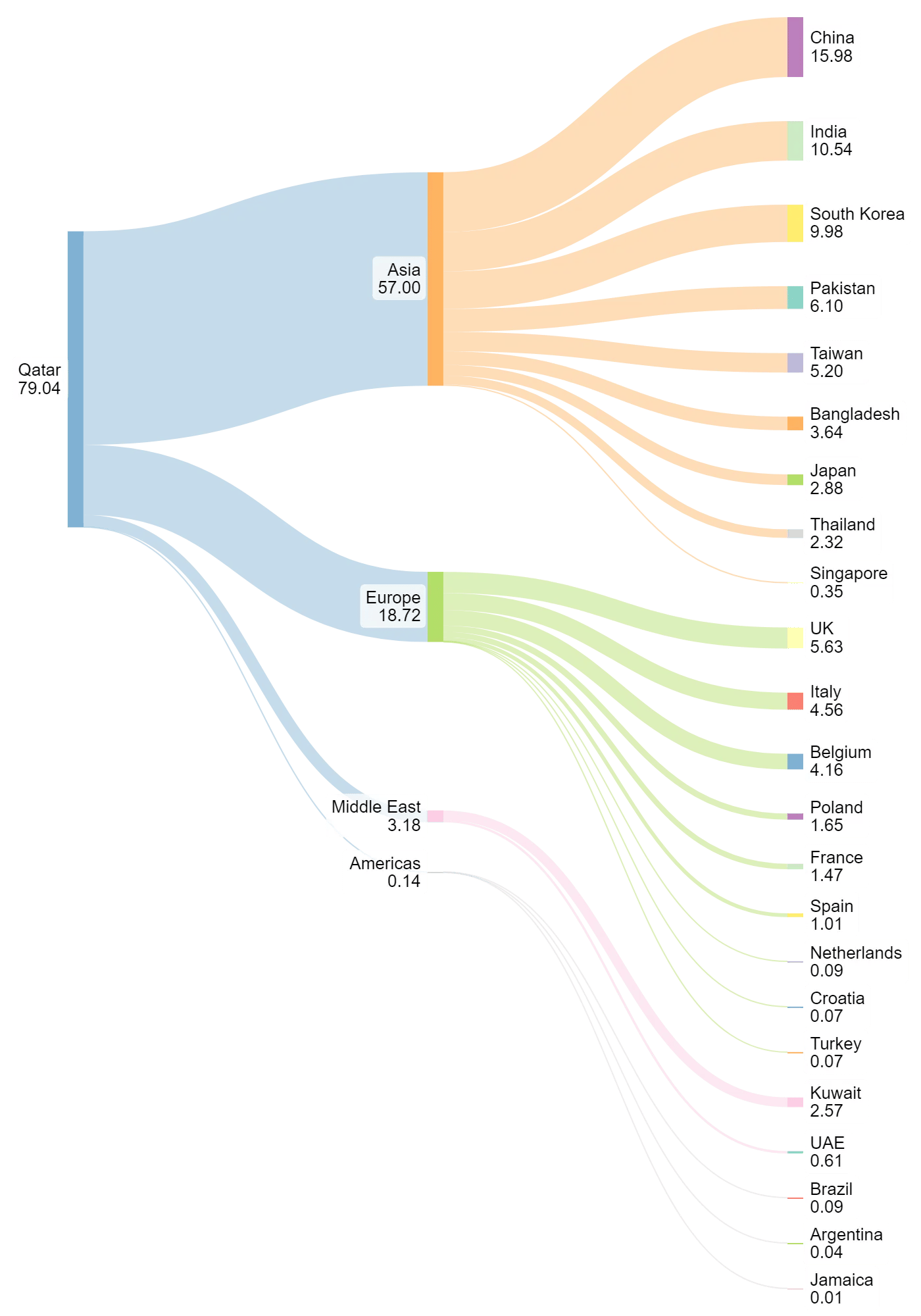

While currently improbable, any disruption in the Strait of Hormuz could critically impact the LNG market, as Qatar, which borders the Persian Gulf and provides about 20% of the world's LNG, might see its exports halted. Calypso analysts have conducted a study about how this scenario impacts the global LNG market. The most exposed region to a stop of the Qatari LNG supply would be Asia, with over 57 MTPA missing (vs. only 19 MTPA in Europe).

Multiple countries would be on the brink of energy shortages, due to a major dependence on Qatari LNG supplies and the lack of alternatives. This negative outlook for Asia would further deteriorate, considering the increasing basinasation of LNG cargos, due to the heavy transit restrictions on both Panama and the Red Sea – as well as the lack of uncommitted molecules from the Gulf of Mexico or Australia. As a consequence, Asian LNG prices – both JKM and crude-based will undergo a significant supply shock, facing a much higher exposure than European markets.

20% of the world’s LNG

is shipped through the Strait of Hormuz making it one of the most crucial chokepoints for the industry. While Qatar’s diplomatic position towards all Middle Eastern neighbours render a full closure unlikely, in an open war scenario between Israel and Iran, the waterway would become increasingly unsafe for passage.

Vulnerable Consumers

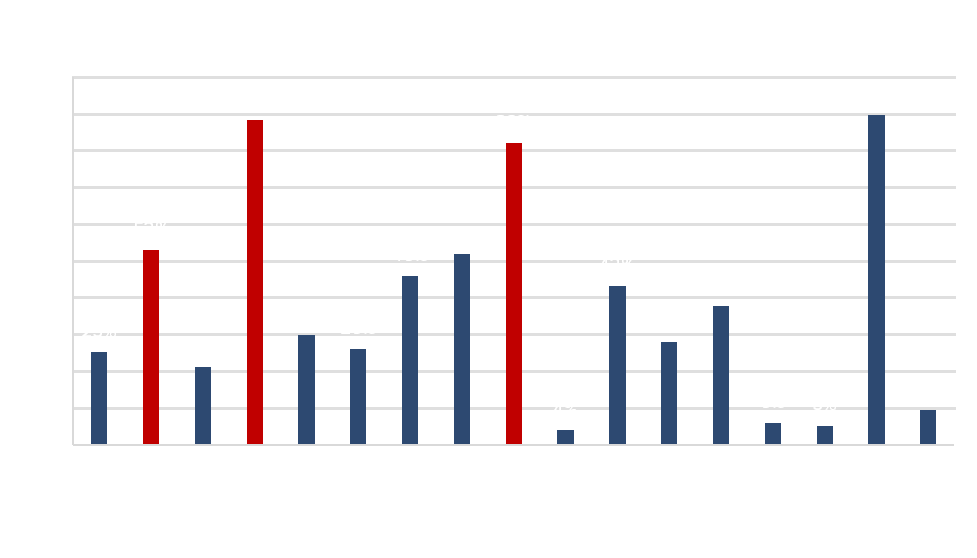

As we can see from the graph, India, Pakistan, and Bangladesh are the most exposed countries to a massive energy shortage in the analyzed scenario. As a majority of Asian flows from Australia and the US are already contracted to Japan and China, which in such a high-risk scenario would not resell volumes to retain their national procurement objectives – there are no imminent supply alternatives to the regions mentioned above to avoid demand destruction and black-outs.

Particularly, for Pakistan and Bangladesh the impacts would be devastating, due to high share of natural gas in its total energy consumption. Pakistan relies on natural gas for 29% of its total energy supply and for 32% of its domestic energy production, while in Bangladesh, natural gas accounts for 55% of its total energy supply and 72% of its domestic energy production.

To discuss the full findings of the case study and the quantitative impacts on the shipping side, please contact our management team.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Israel vs. Iran: Escalation at the Strait of Hormuz?

Late on Saturday, April 13th, Iran targeted Israel with a series of drone and missile strikes in response to an Israeli assault on the Iranian consulate in Damascus, Syria, on April 1st. On Friday, April 19th Israel retaliated with direct strikes into Iranian territory in the Isfahan region – with no end of the violence spiral in sight.

Moreover, the most recent developments include Iran's Revolutionary Guard navy commander stating that Israel's activities in the United Arab Emirates pose a threat to Tehran, suggesting a possible closure of the Strait of Hormuz, a critical waterway connecting the Persian Gulf to the Gulf of Oman.

Impacts of Supply Shock

While currently improbable, any disruption in the Strait of Hormuz could critically impact the LNG market, as Qatar, which borders the Persian Gulf and provides about 20% of the world's LNG, might see its exports halted. Calypso analysts have conducted a study about how this scenario impacts the global LNG market. The most exposed region to a stop of the Qatari LNG supply would be Asia, with over 57 MTPA missing (vs. only 19 MTPA in Europe).

Multiple countries would be on the brink of energy shortages, due to a major dependence on Qatari LNG supplies and the lack of alternatives. This negative outlook for Asia would further deteriorate, considering the increasing basinasation of LNG cargos, due to the heavy transit restrictions on both Panama and the Red Sea – as well as the lack of uncommitted molecules from the Gulf of Mexico or Australia. As a consequence, Asian LNG prices – both JKM and crude-based will undergo a significant supply shock, facing a much higher exposure than European markets.

20% of the world’s LNG

is shipped through the Strait of Hormuz making it one of the most crucial chokepoints for the industry. While Qatar’s diplomatic position towards all Middle Eastern neighbours render a full closure unlikely, in an open war scenario between Israel and Iran, the waterway would become increasingly unsafe for passage.

Vulnerable Consumers

As we can see from the graph, India, Pakistan, and Bangladesh are the most exposed countries to a massive energy shortage in the analyzed scenario. As a majority of Asian flows from Australia and the US are already contracted to Japan and China, which in such a high-risk scenario would not resell volumes to retain their national procurement objectives – there are no imminent supply alternatives to the regions mentioned above to avoid demand destruction and black-outs.

Particularly, for Pakistan and Bangladesh the impacts would be devastating, due to high share of natural gas in its total energy consumption. Pakistan relies on natural gas for 29% of its total energy supply and for 32% of its domestic energy production, while in Bangladesh, natural gas accounts for 55% of its total energy supply and 72% of its domestic energy production.

To discuss the full findings of the case study and the quantitative impacts on the shipping side, please contact our management team.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)