Global Panama Canal Restrictions – The Ripple Effects of Panama Canal Restrictions Across Major USGC-Asia Trade Flows and Globally

Check out the full detailed analysis here

Quantifying the financial impact of the Panama Canal shutdown reveals a direct erosion of value for US Gulf Coast LNG, fundamentally altering the economics of the trans-Pacific arbitrage and highlighting the tangible cost of supply chain risk.

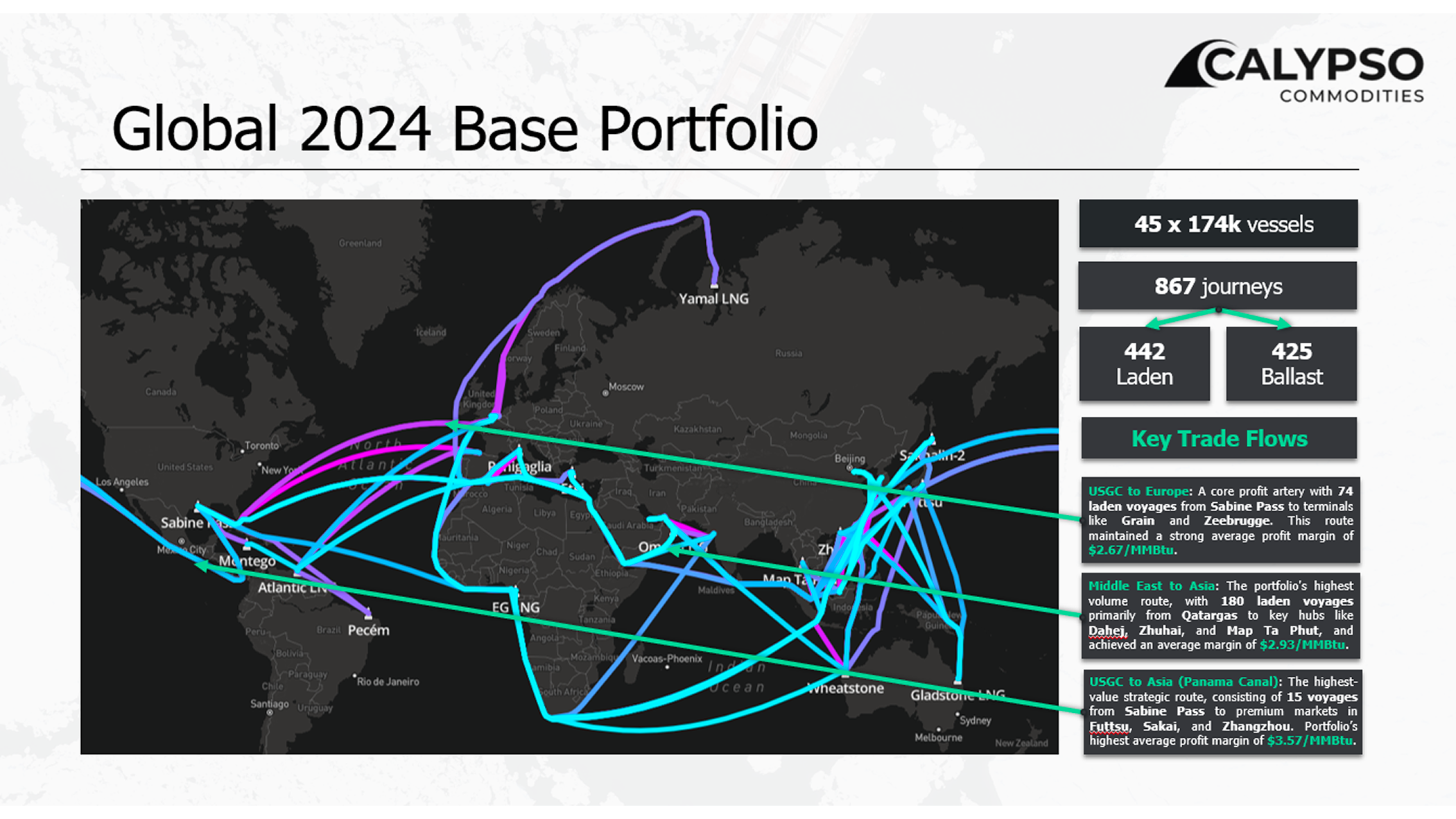

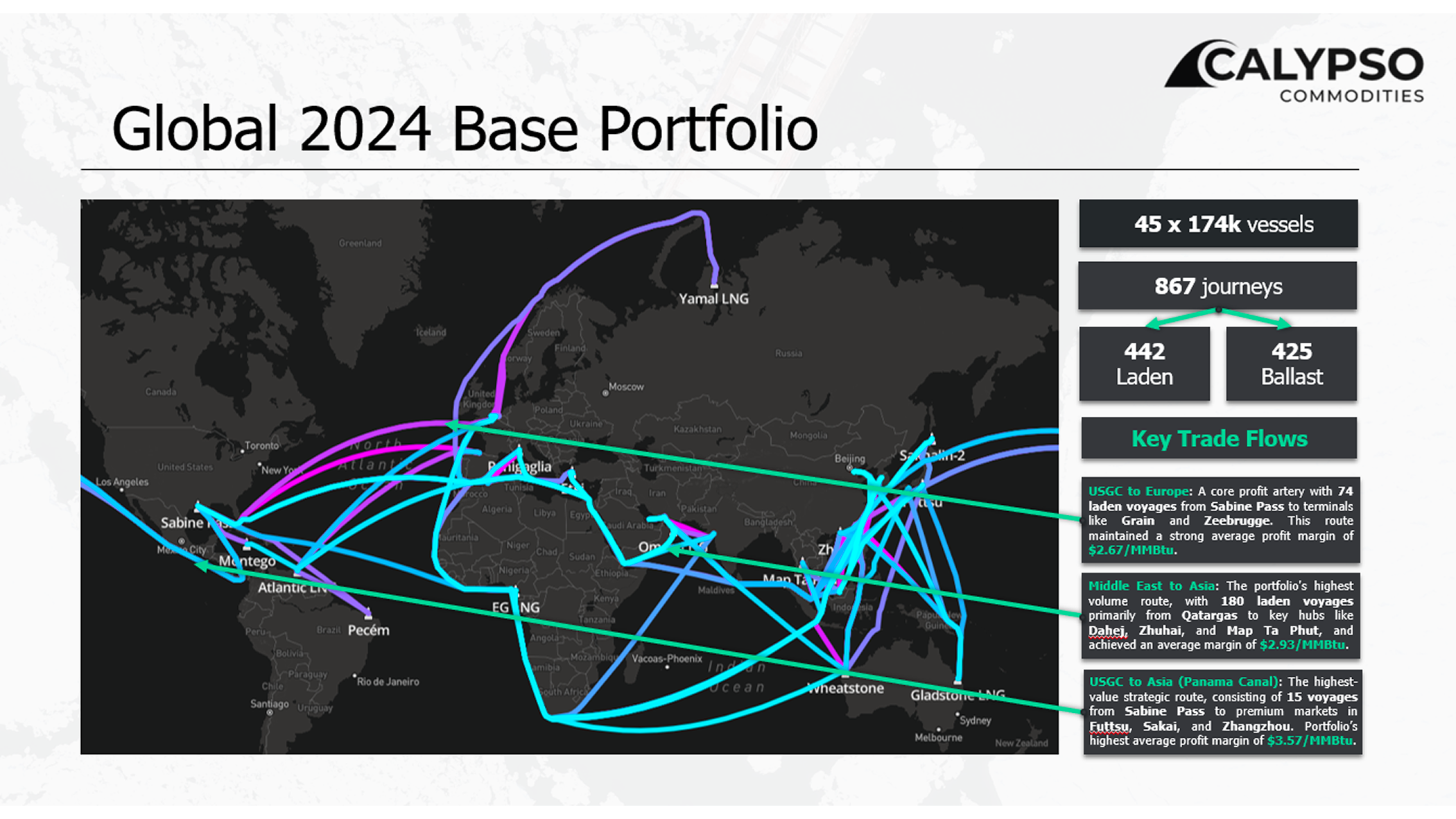

Portfolio Scale: The Global 2024 Portfolio model operates with a fleet of 45 vessels, executing 867 total journeys, which are divided into 442 laden and 425 ballast trips.

Key Trade Flow 1: USGC to Europe

- This is a core, high-frequency trade artery, featuring 74 laden voyages originating from Sabine Pass and delivering to European terminals like Grain and Zeebrugge.

Key Trade Flow 2: Middle East to Asia

- This is the portfolio's highest-volume route, with 180 laden voyages supplying key Asian hubs such as Dahej, Zhuhai, and Map Ta Phut, primarily sourced from Qatargas.

Key Trade Flow 3: USGC to Asia (via Panama Canal)

- A highly strategic route consisting of 15 voyages that move cargo from Sabine Pass through the Panama Canal to premium markets in Asia, including Futtsu, Sakai, and Zhangzhou.

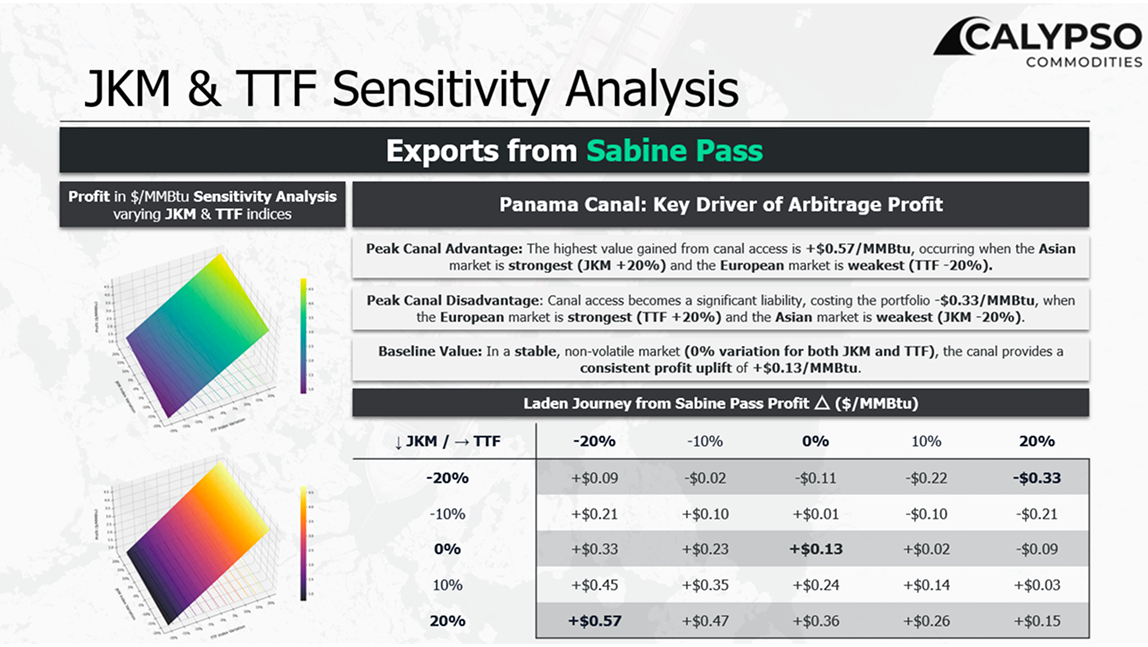

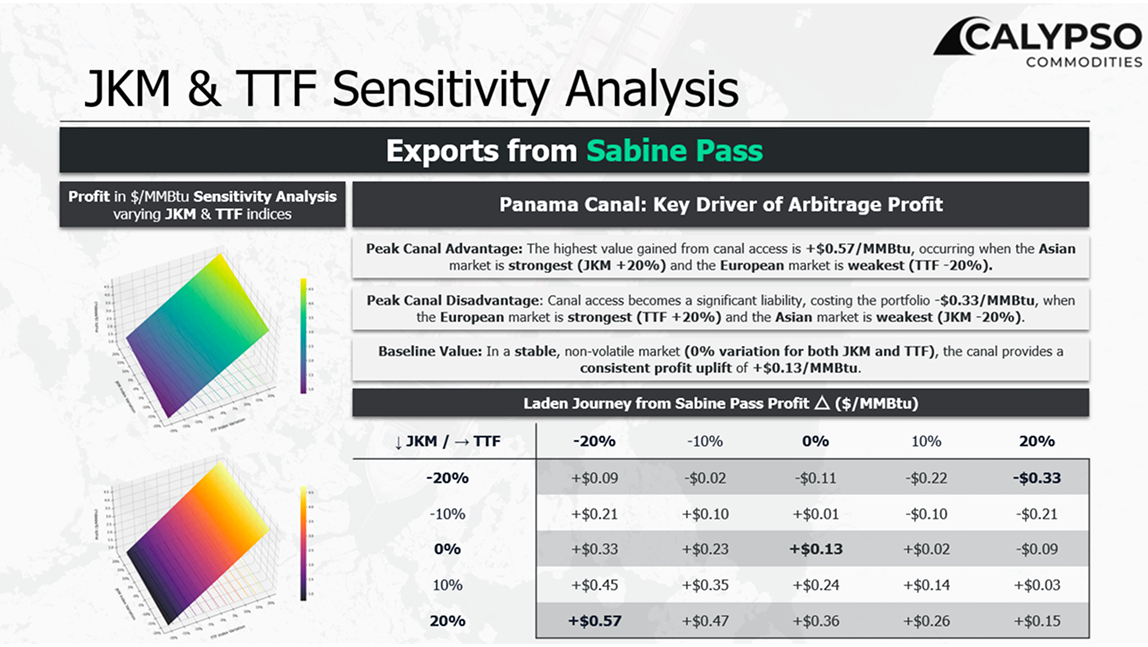

To understand the full arbitrage value chain, our JKM & TTF sensitivity analysis examined both the export economics from Sabine Pass and the corresponding import dynamics into key Asian and European markets.

Panama Canal's Value is Dynamic: The analysis shows that the Panama Canal is a primary driver of arbitrage profit for LNG exports from Sabine Pass. Its value is highly sensitive to the relative strength of Asian (JKM) and European (TTF) gas prices.

- Exports from Sabine Pass: The value of the Panama Canal for US Gulf Coast exports is highly dynamic; it creates a significant profit advantage of up to +$0.57/MMBtu when the Asia-Europe price spread is wide but becomes a financial liability when the European market is exceptionally strong.

- Imports to Asia: From an Asian buyer's perspective, the decision to use the Panama Canal route is purely dependent on the absolute level of the JKM price. The route is only profitable when JKM is high (at least +10% above baseline).

- Imports to Europe: The European arbitrage is almost completely insulated from Panama Canal dynamics. The profitability of importing LNG into Europe is driven entirely by transatlantic freight costs and the TTF price, making the canal's status a non-factor for this trade leg.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Global Panama Canal Restrictions – The Ripple Effects of Panama Canal Restrictions Across Major USGC-Asia Trade Flows and Globally

Check out the full detailed analysis here

Quantifying the financial impact of the Panama Canal shutdown reveals a direct erosion of value for US Gulf Coast LNG, fundamentally altering the economics of the trans-Pacific arbitrage and highlighting the tangible cost of supply chain risk.

Portfolio Scale: The Global 2024 Portfolio model operates with a fleet of 45 vessels, executing 867 total journeys, which are divided into 442 laden and 425 ballast trips.

Key Trade Flow 1: USGC to Europe

- This is a core, high-frequency trade artery, featuring 74 laden voyages originating from Sabine Pass and delivering to European terminals like Grain and Zeebrugge.

Key Trade Flow 2: Middle East to Asia

- This is the portfolio's highest-volume route, with 180 laden voyages supplying key Asian hubs such as Dahej, Zhuhai, and Map Ta Phut, primarily sourced from Qatargas.

Key Trade Flow 3: USGC to Asia (via Panama Canal)

- A highly strategic route consisting of 15 voyages that move cargo from Sabine Pass through the Panama Canal to premium markets in Asia, including Futtsu, Sakai, and Zhangzhou.

To understand the full arbitrage value chain, our JKM & TTF sensitivity analysis examined both the export economics from Sabine Pass and the corresponding import dynamics into key Asian and European markets.

Panama Canal's Value is Dynamic: The analysis shows that the Panama Canal is a primary driver of arbitrage profit for LNG exports from Sabine Pass. Its value is highly sensitive to the relative strength of Asian (JKM) and European (TTF) gas prices.

- Exports from Sabine Pass: The value of the Panama Canal for US Gulf Coast exports is highly dynamic; it creates a significant profit advantage of up to +$0.57/MMBtu when the Asia-Europe price spread is wide but becomes a financial liability when the European market is exceptionally strong.

- Imports to Asia: From an Asian buyer's perspective, the decision to use the Panama Canal route is purely dependent on the absolute level of the JKM price. The route is only profitable when JKM is high (at least +10% above baseline).

- Imports to Europe: The European arbitrage is almost completely insulated from Panama Canal dynamics. The profitability of importing LNG into Europe is driven entirely by transatlantic freight costs and the TTF price, making the canal's status a non-factor for this trade leg.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)