US Sanctions and Their Impact on Arctic LNG 2 Shipments

With the imminent initiation of LNG volumes from Arctic LNG 2 and the specter of US sanctions, Calypso Commodities provides an analytical forecast for the project’s 2024 outlook. The study delves into the repercussions for shipping duration and portfolio profitability, based on the constrained shipping options and the particularities of the project’s location along the Northeast Passage.

Shipping from Arctic LNG 2 under constraints

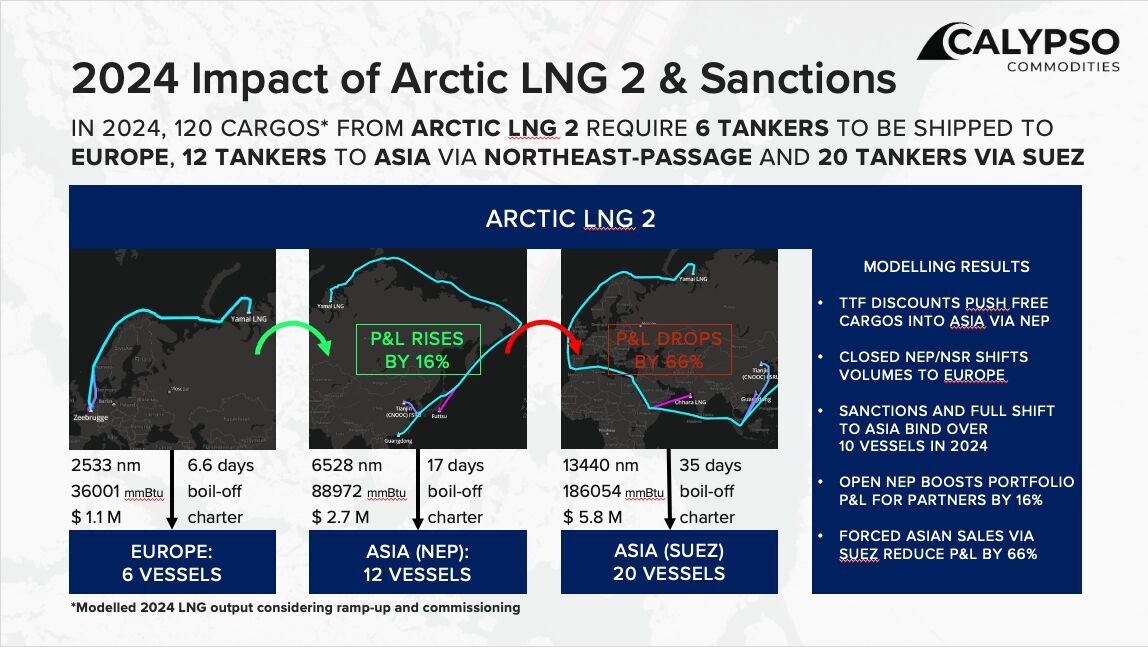

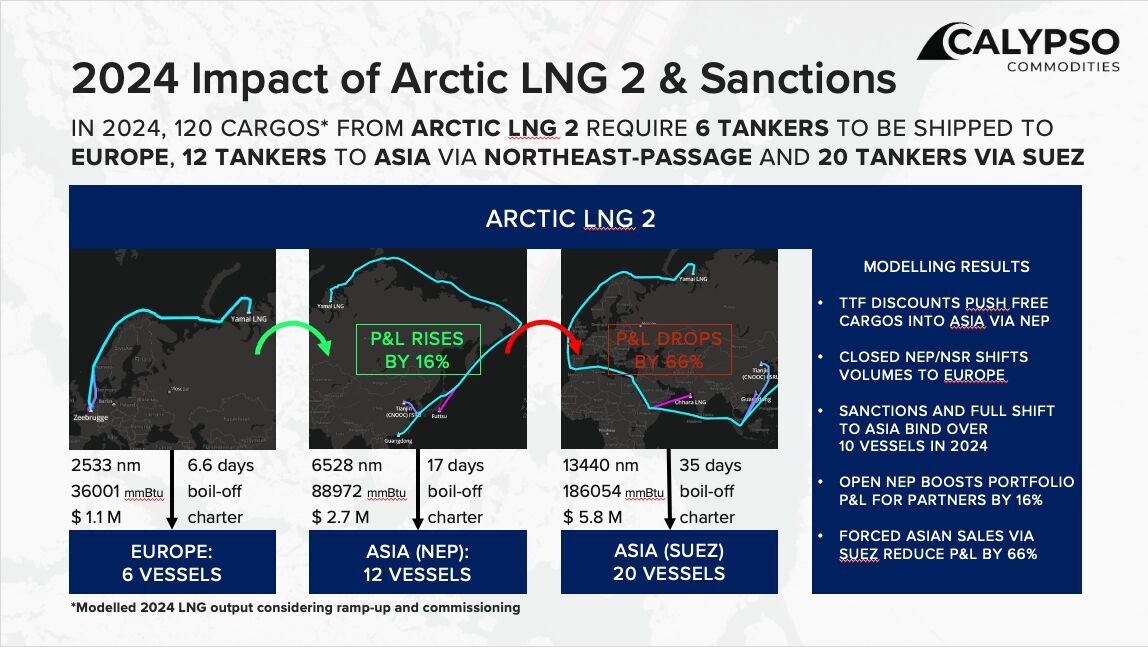

The graphic illustrates projected shifts in LNG shipping for Arctic LNG 2 in 2024 due to potential sanctions and route choices. It compares the effects of various passage options—Northeast Passage and Suez—on shipping distances, times, and costs for cargos headed to Europe and Asia.

Arctic LNG 2 would boost Russian LNG capacities to over 50 MTPA

While the share of Russian pipeline gas in Europe dropped to historic lows, LNG exports to Europe are rising. The most recent US sanctions against the Arctic LNG 2 project, will massively obstruct the project’s ramp-up.

Key Takeaways

This realignment hinges on the operational uncertainty of the Northeast Passage. The modeling, premised on the ramp-up and commissioning of 120 Arctic LNG 2 cargos, projects a substantial engagement of additional shipping vessels due to sanctions and limited vessel availability. The analysis also shows a significant impact on cargos directed to Asia via the Northeast Passage, effecting portfolio P&L by 16%. Conversely, the closure of the passage could reroute volumes back to Europe, whereas forced redirection through the Suez Canal would drastically cut P&L by 66%, highlighting the delicate balance of maritime logistics in the LNG industry.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

US Sanctions and Their Impact on Arctic LNG 2 Shipments

With the imminent initiation of LNG volumes from Arctic LNG 2 and the specter of US sanctions, Calypso Commodities provides an analytical forecast for the project’s 2024 outlook. The study delves into the repercussions for shipping duration and portfolio profitability, based on the constrained shipping options and the particularities of the project’s location along the Northeast Passage.

Shipping from Arctic LNG 2 under constraints

The graphic illustrates projected shifts in LNG shipping for Arctic LNG 2 in 2024 due to potential sanctions and route choices. It compares the effects of various passage options—Northeast Passage and Suez—on shipping distances, times, and costs for cargos headed to Europe and Asia.

Arctic LNG 2 would boost Russian LNG capacities to over 50 MTPA

While the share of Russian pipeline gas in Europe dropped to historic lows, LNG exports to Europe are rising. The most recent US sanctions against the Arctic LNG 2 project, will massively obstruct the project’s ramp-up.

Key Takeaways

This realignment hinges on the operational uncertainty of the Northeast Passage. The modeling, premised on the ramp-up and commissioning of 120 Arctic LNG 2 cargos, projects a substantial engagement of additional shipping vessels due to sanctions and limited vessel availability. The analysis also shows a significant impact on cargos directed to Asia via the Northeast Passage, effecting portfolio P&L by 16%. Conversely, the closure of the passage could reroute volumes back to Europe, whereas forced redirection through the Suez Canal would drastically cut P&L by 66%, highlighting the delicate balance of maritime logistics in the LNG industry.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)