Drought Limits at Panama Canal & Impacts on LNG Shipping

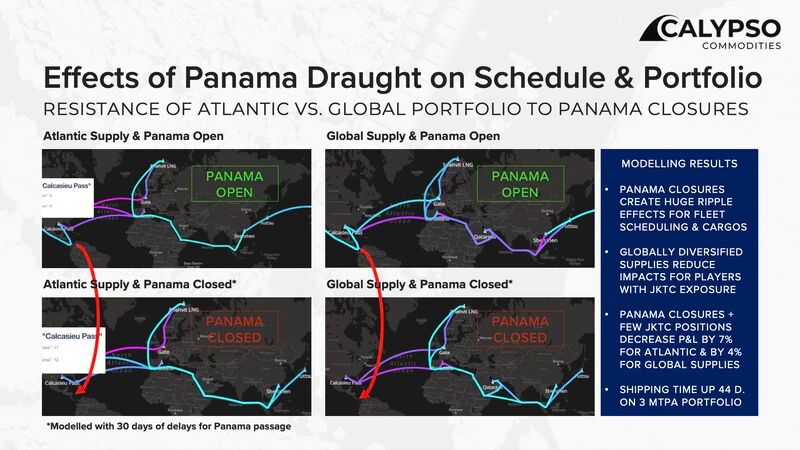

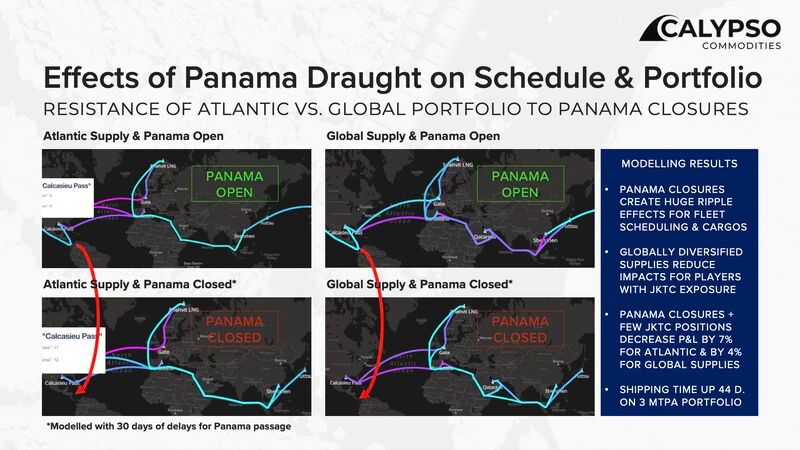

Panama: Robustness of Atlantic vs. Global Portfolio

Key findings from this analysis reveal that LNG players with a diversified supply chain have a substantial advantage, allowing them to maintain operational flexibility amidst disruptions. The case study further identifies that delays and closures at the Panama Canal have far-reaching consequences, significantly disrupting fleet schedules and cargo plans.

Modelled with X-LNG

Numerous LNG tankers globally are scheduled and optimised with X-LNG, reach out for a demo.

AI – navigating ripple effects on rescheduling

The huge ripple effects for fleet schedules and cargos, making AI based optimization for re-scheduling crucial. In addition, a diversified fleet emerges as a pivotal element for resilience. An example highlighted in the study showed a notable increase in shipping time by 44 days for a 3 MTPA LNG portfolio, increasing vessel utilization for that particular player. However, the secondary impacts on the global available shipping length are quite severe, considering the scale of affected vessels for re-routing. If you’d like to model the re-routing impacts on your portfolio and fleet, also testing the robustness of your trading strategy and schedule, contact our management team for a call.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Drought Limits at Panama Canal & Impacts on LNG Shipping

Panama: Robustness of Atlantic vs. Global Portfolio

Key findings from this analysis reveal that LNG players with a diversified supply chain have a substantial advantage, allowing them to maintain operational flexibility amidst disruptions. The case study further identifies that delays and closures at the Panama Canal have far-reaching consequences, significantly disrupting fleet schedules and cargo plans.

Modelled with X-LNG

Numerous LNG tankers globally are scheduled and optimised with X-LNG, reach out for a demo.

AI – navigating ripple effects on rescheduling

The huge ripple effects for fleet schedules and cargos, making AI based optimization for re-scheduling crucial. In addition, a diversified fleet emerges as a pivotal element for resilience. An example highlighted in the study showed a notable increase in shipping time by 44 days for a 3 MTPA LNG portfolio, increasing vessel utilization for that particular player. However, the secondary impacts on the global available shipping length are quite severe, considering the scale of affected vessels for re-routing. If you’d like to model the re-routing impacts on your portfolio and fleet, also testing the robustness of your trading strategy and schedule, contact our management team for a call.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)