Cancellation Profitability Analysis under varying Portfolio Constraints

Check out the full detailed analysis here

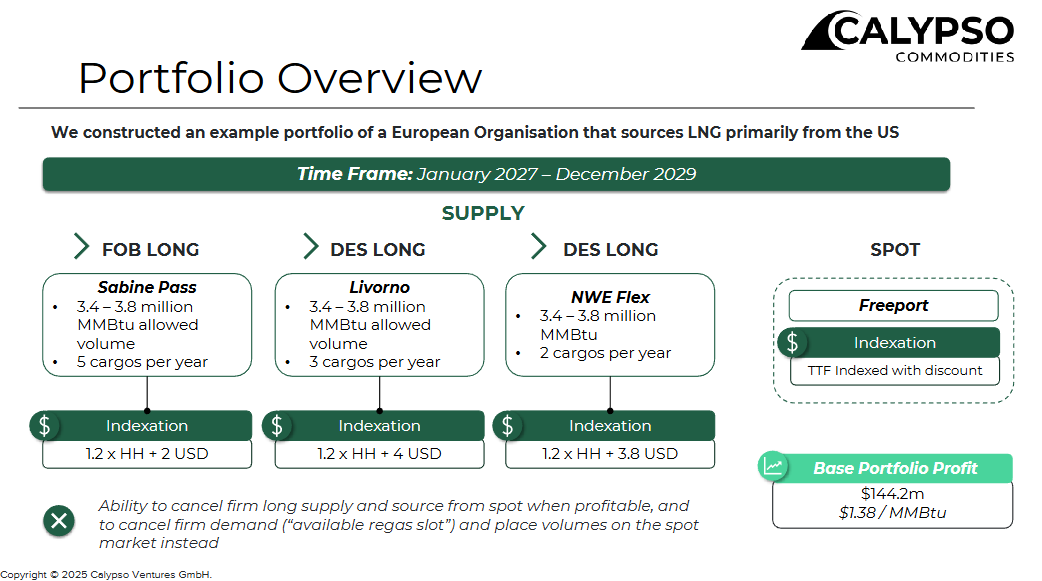

How Market Conditions Impact LNG Portfolio Strategy

Continuing on from our previous Case Study on the Mediterranean LNG portfolio player (located here), we recently analysed cancellation profitability patterns across multiple market scenarios. Here's what we discovered:

The Challenge

Understanding how independent market factors—index prices, charter rates, and spot market dynamics—affect portfolio cancellation decisions and profitability. Economic conditions change constantly, requiring portfolio managers to regularly re-evaluate their strategies under varying scenarios.

Our Approach

We stress-tested a Mediterranean player's portfolio consisting of US FOB supply contracts, European DES contracts, and multiple delivery points across Europe. Our analysis examined three key variables:

・Index price variations (Henry Hub, TTF, PSV)

・Charter rate seasonality (2018-2024 patterns)

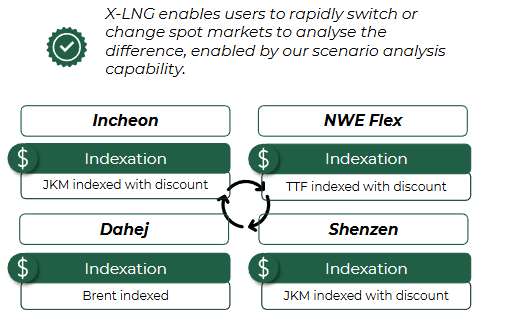

・Alternative spot market configurations (Asia-Pacific or North West Europe destinations)

Key Insights

Price Sensitivity: Henry Hub increases drive the highest cancellation rates (7-8 cargoes), while PSV decreases cause significant cancellation spikes due to concentrated contract exposure. Charter Rate Resilience: Seasonality has minimal impact—only 1% profit variance between flat and seasonal rates, with consistent cancellation patterns. Spot Market Dynamics: Brent-indexed markets proved surprisingly robust versus JKM and TTF alternatives, requiring substantial premiums ($1+ adder) to justify redirection.

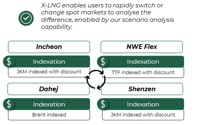

How X-LNG Helps Our portfolio optimization platform enabled rapid scenario analysis through:

・Custom price set modelling for multiple index combinations

・Dynamic charter rate curves capturing historical volatility

・Flexible spot market configurations for comparative analysis

Key Takeaway

Portfolio managers should prioritise hedging against PSV downside risk and HH upside risk - these scenarios demonstrate the most severe impacts on portfolio stability. The analysis reveals that strategic decisions about contract negotiations, pricing formulas, and spot market selection require sophisticated modelling to capture the complex interplay between these variables. This type of analysis transforms portfolio management from reactive to proactive, enabling data-driven negotiations and risk management strategies.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Cancellation Profitability Analysis under varying Portfolio Constraints

Check out the full detailed analysis here

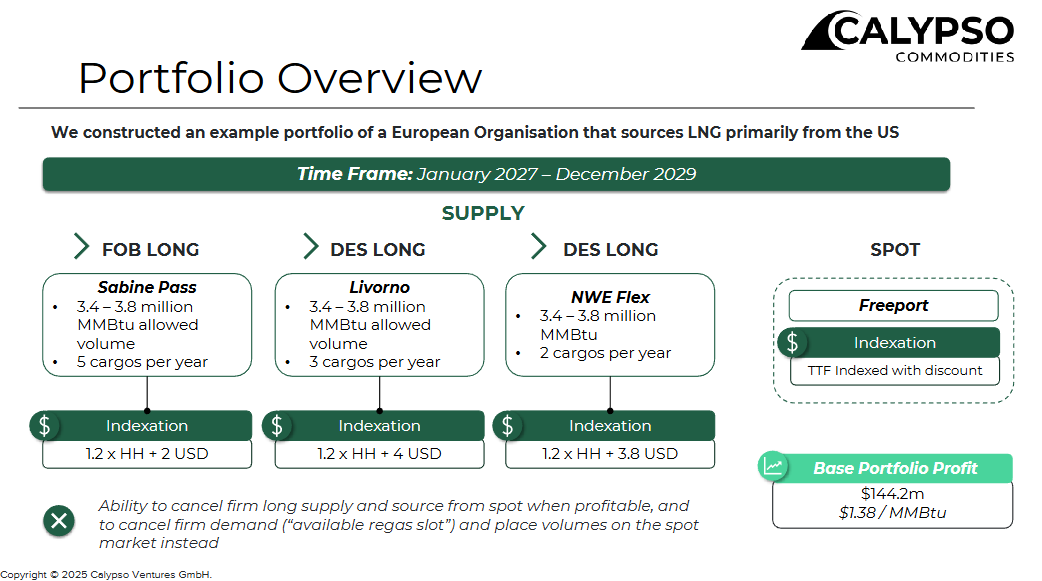

How Market Conditions Impact LNG Portfolio Strategy

Continuing on from our previous Case Study on the Mediterranean LNG portfolio player (located here), we recently analysed cancellation profitability patterns across multiple market scenarios. Here's what we discovered:

The Challenge

Understanding how independent market factors—index prices, charter rates, and spot market dynamics—affect portfolio cancellation decisions and profitability. Economic conditions change constantly, requiring portfolio managers to regularly re-evaluate their strategies under varying scenarios.

Our Approach

We stress-tested a Mediterranean player's portfolio consisting of US FOB supply contracts, European DES contracts, and multiple delivery points across Europe. Our analysis examined three key variables:

・Index price variations (Henry Hub, TTF, PSV)

・Charter rate seasonality (2018-2024 patterns)

・Alternative spot market configurations (Asia-Pacific or North West Europe destinations)

Key Insights

Price Sensitivity: Henry Hub increases drive the highest cancellation rates (7-8 cargoes), while PSV decreases cause significant cancellation spikes due to concentrated contract exposure. Charter Rate Resilience: Seasonality has minimal impact—only 1% profit variance between flat and seasonal rates, with consistent cancellation patterns. Spot Market Dynamics: Brent-indexed markets proved surprisingly robust versus JKM and TTF alternatives, requiring substantial premiums ($1+ adder) to justify redirection.

How X-LNG Helps Our portfolio optimization platform enabled rapid scenario analysis through:

・Custom price set modelling for multiple index combinations

・Dynamic charter rate curves capturing historical volatility

・Flexible spot market configurations for comparative analysis

Key Takeaway

Portfolio managers should prioritise hedging against PSV downside risk and HH upside risk - these scenarios demonstrate the most severe impacts on portfolio stability. The analysis reveals that strategic decisions about contract negotiations, pricing formulas, and spot market selection require sophisticated modelling to capture the complex interplay between these variables. This type of analysis transforms portfolio management from reactive to proactive, enabling data-driven negotiations and risk management strategies.

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)