Balancing Risk and Upside in LNG Portfolios

Find the full detailed analysis here

We’ve released a case study comparing three LNG portfolio strategies under shifting market conditions. We combined Monte Carlo simulations across volatility regimes with deterministic price sweeps to quantify risk–return. It also showcases our new FOB Short modelling in X-LNG.

The Challenge

How should managers structure contract mixes and indexation as HH–TTF spreads and volatility shift? We compare dual-index exposure vs. netback strategies, and the value of optional spot outlets.

Our Approach

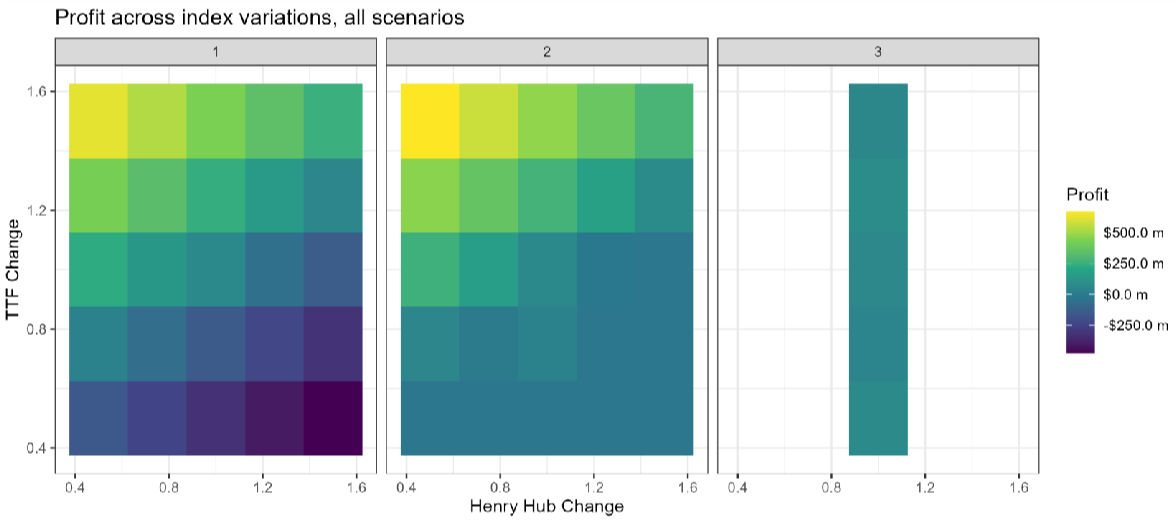

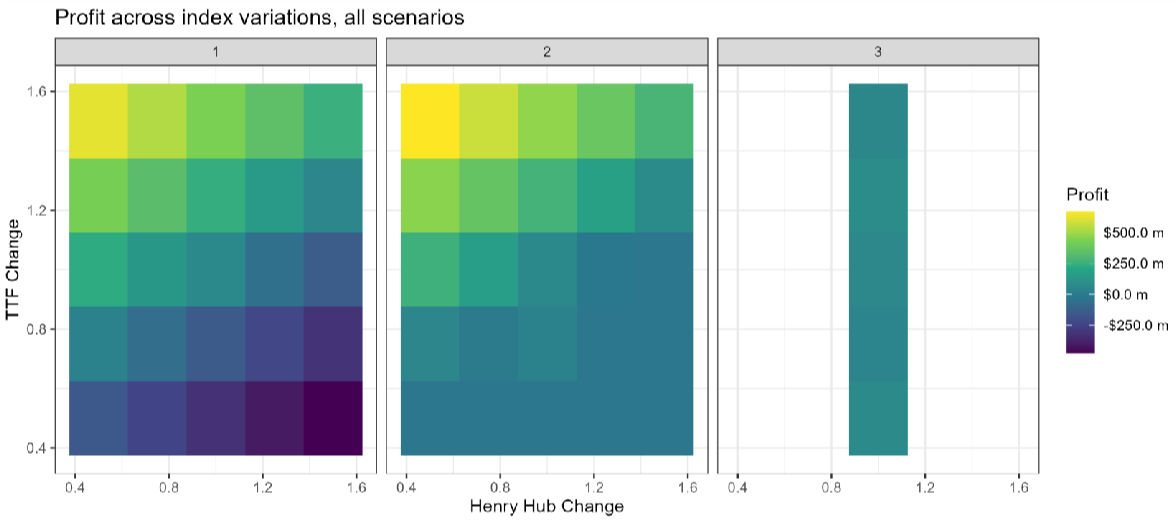

We benchmarked three strategies with similar baseline profits at current forwards to isolate risk/vol effects:

Scenario 1: US FOB-long (HH) to Europe DES-short (TTF), no spot outlets

Scenario 2: S1 plus optional FOB-short and DES-long spot outlets to unwind at small losses

Scenario 3: TTF-only “netback” for US supply (no HH), with a buy-side premium

We ran:

- Monte Carlo at low/base/high volatility

- HH and TTF price sweeps to map spread sensitivity

Key Insights

1) Upside vs. downside

S1 has the highest upside at base vol (~$165m mean) but the fattest left tail; HH↑/TTF↓ can drive severe losses (one sim > $400m).

2) Loss-capping via spot outlets

S2 materially reduces tail risk by enabling FOB–FOB and DES–DES matches at small per-cargo losses. It leads under high volatility (~$139m mean).

3) Defensive netback

S3 (TTF-only) is tightest and largely insensitive to TTF shifts, but with lower expected profit (~$67m at base vol).

4) Volatility matters

Low vol: S2 slightly tops S1 (~$99m vs. ~$98m); S3 ~ $63m.- High vol: S2 dominates; S1 sees frequent losses; S3 is most stable but lowest return.

5) Price sensitivity

HH increase /TTF decrease is most punitive for dual-index portfolios. S2 caps losses there; S3 stays steady via matched indexation.

How X-LNG Helps

- Model firm/optional contracts (FOB Short, DES Long) alongside core positions

- Run Monte Carlo by volatility regime plus deterministic sweeps

- Compare dual-index vs. netback and optional unwind routes

- Quantify tails and expected value to fit risk appetite

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

Balancing Risk and Upside in LNG Portfolios

Find the full detailed analysis here

We’ve released a case study comparing three LNG portfolio strategies under shifting market conditions. We combined Monte Carlo simulations across volatility regimes with deterministic price sweeps to quantify risk–return. It also showcases our new FOB Short modelling in X-LNG.

The Challenge

How should managers structure contract mixes and indexation as HH–TTF spreads and volatility shift? We compare dual-index exposure vs. netback strategies, and the value of optional spot outlets.

Our Approach

We benchmarked three strategies with similar baseline profits at current forwards to isolate risk/vol effects:

Scenario 1: US FOB-long (HH) to Europe DES-short (TTF), no spot outlets

Scenario 2: S1 plus optional FOB-short and DES-long spot outlets to unwind at small losses

Scenario 3: TTF-only “netback” for US supply (no HH), with a buy-side premium

We ran:

- Monte Carlo at low/base/high volatility

- HH and TTF price sweeps to map spread sensitivity

Key Insights

1) Upside vs. downside

S1 has the highest upside at base vol (~$165m mean) but the fattest left tail; HH↑/TTF↓ can drive severe losses (one sim > $400m).

2) Loss-capping via spot outlets

S2 materially reduces tail risk by enabling FOB–FOB and DES–DES matches at small per-cargo losses. It leads under high volatility (~$139m mean).

3) Defensive netback

S3 (TTF-only) is tightest and largely insensitive to TTF shifts, but with lower expected profit (~$67m at base vol).

4) Volatility matters

Low vol: S2 slightly tops S1 (~$99m vs. ~$98m); S3 ~ $63m.- High vol: S2 dominates; S1 sees frequent losses; S3 is most stable but lowest return.

5) Price sensitivity

HH increase /TTF decrease is most punitive for dual-index portfolios. S2 caps losses there; S3 stays steady via matched indexation.

How X-LNG Helps

- Model firm/optional contracts (FOB Short, DES Long) alongside core positions

- Run Monte Carlo by volatility regime plus deterministic sweeps

- Compare dual-index vs. netback and optional unwind routes

- Quantify tails and expected value to fit risk appetite

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)