ADNOC signs Rio Grande LNG supply: portfolio implications

On May 20th, ADNOC announced:

- The acquisition of an 11.7% equity stake in Trains 1-3 in the Rio Grande LNG (RGLNG) project managed by NextDecade.

- A 20-year LNG offtake agreement from RGLNG Train 4, which will provide 1.9 million tonnes per annum (mtpa).

Calypso analyzes the impact of the newly acquired supply on ADNOC’s 2027 portfolio and shipping capacities, using public information on ADNOC's portfolio and Calypso's own assumptions, which might differ from the real portfolio. This analysis explores the opportunities generated in terms of:

- Cargo flow rerouting

- Spot market positions

- Price volatility scenarios

- Resilience to Force Majeure (FM) events

Details of X-LNG:

Our team at Calypso Commodities utilized our advanced AI system, X-LNG, to model this case study. X-LNG is uniquely designed to handle comprehensive portfolio-level analyses and calculations.

Key Features of X-LNG:

- Matches Longs and Shorts with Physical Assets: Seamlessly matches long and short positions with physical assets like vessels, ensuring optimal portfolio, operation plan and schedule management.

- Holistic Contract Valuation: Captures and models the value of each contract on a portfolio level taking into account all logistic and market aspects.

- Precise Operation Plans: Provides a precise operation plan for each optimized portfolio that operators can actually use.

- Day-to-Day Usability: Delivers real and actionable day-to-day operation plans for each optimized portfolio in this case study.

- Unmatched Transparency: X-LNG is the most transparent way of valuating and optimizing global LNG portfolios on the market.

- Cloud-Based System: Features a world-class user interface that enhances user experience.

- Scalability: Capable of solving and optimising portfolios of different sizes fast.

- High-Volume Scenario Analysis: Runs hundreds of thousands of scenarios simultaneously, ensuring robust and comprehensive solutions.

Scenario 1: Optimizing ADNOC's Portfolio with Rio Grande Supply

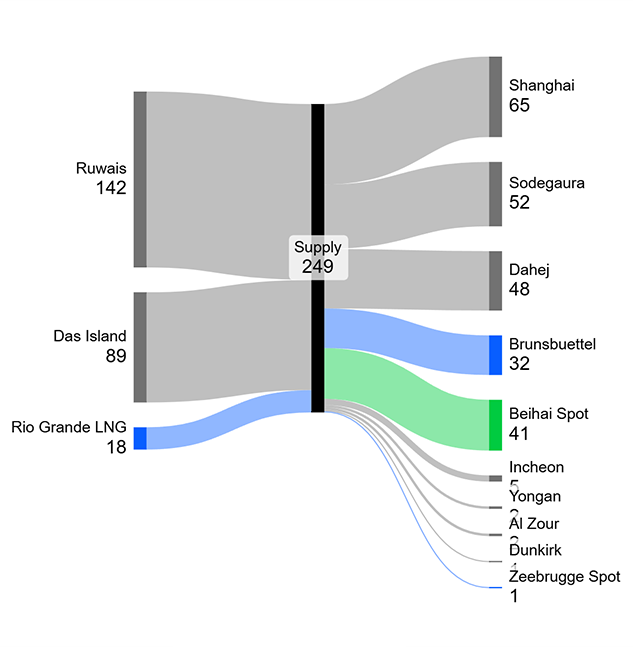

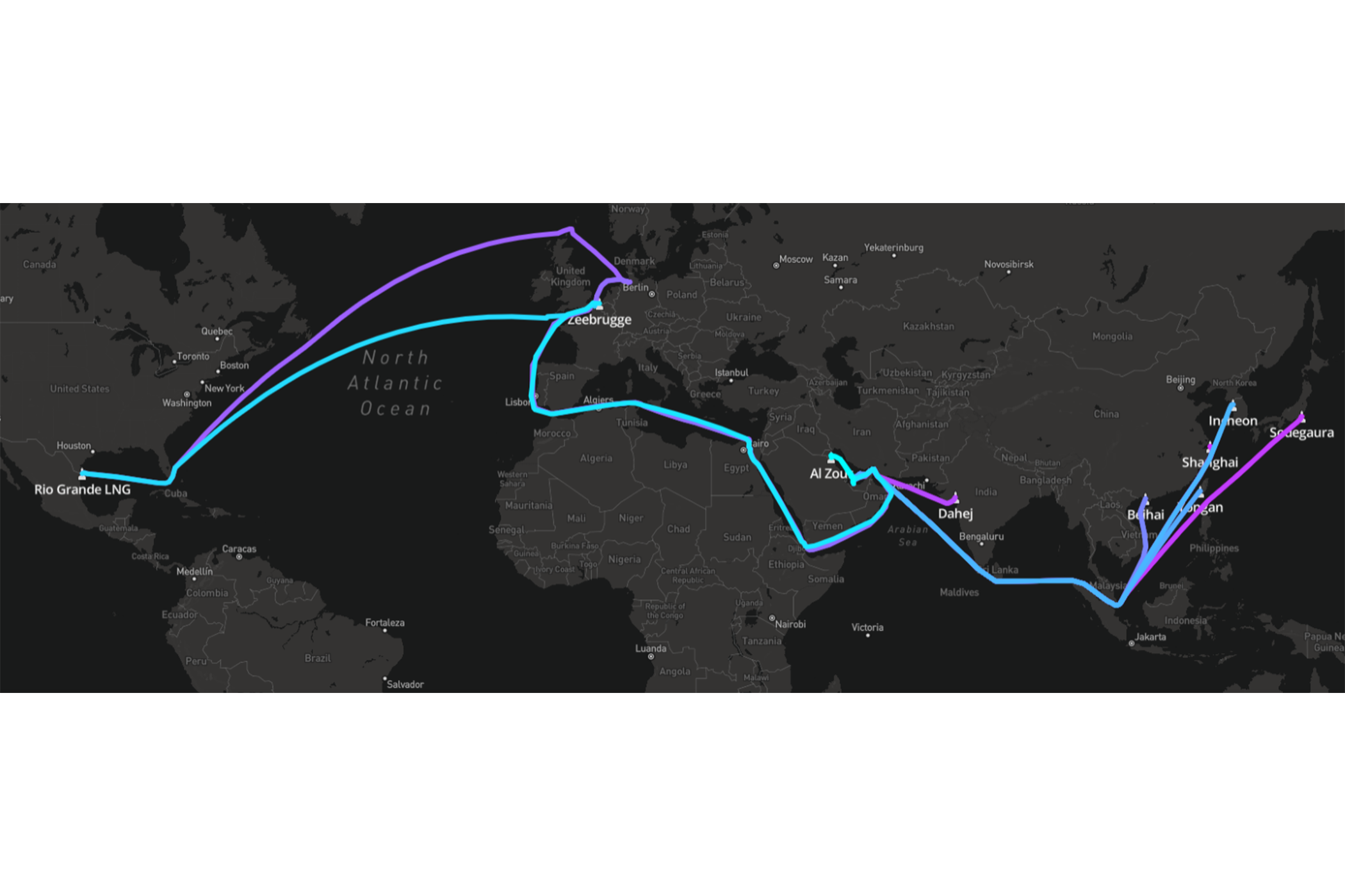

Using our own assumptions and x-lng, we modeled a scenario incorporating ADNOC's 2027 portfolio with the addition of the Rio Grande supply. This supply accounts for 18 out of the total 269 cargos in ADNOC's portfolio. This analysis compares the case with Rio Grande supply against the case without it, after we calculated an optimal sequence of laden and ballast journeys with x-lng for both cases in order to have two real and executable schedules.

Key Findings

The P&L was significantly higher with Rio Grande supply:

- With Rio Grande: $1,105,073,371

- Without Rio Grande: $879,914,321

- Difference: Approximately $120 million higher with Rio Grande supply

Cargo Distribution

In the scenario with Rio Grande supply:

- 17 Rio Grande cargos were delivered to Brunsbuettel.

- 1 cargo was delivered to Spot Zeebrugge.

- The spot market saw an increase to 42 cargos shipped, up from 24 in the base case.

For German demand fulfillment:

- With Rio Grande: 15 cargos (9 from Das Island, 6 from Ruwais)

- Without Rio Grande: 32 cargos (21 from Das Island, 11 from Ruwais)

Utilization of Available Cargos

With the addition of Rio Grande, ADNOC had 12 more cargos from Das Island and 5 more from Ruwais. These additional cargos were used to fulfill spot market positions in China.

Strategic Benefits

1. Demand Hub Service Expansion

Adding Rio Grande LNG allows ADNOC to serve more demand hubs in the Atlantic area. This supply can be used to fulfill firm demand contracts or optional regas slots in Europe, and it opens the potential to start selling to South America, particularly Brazil.

2. Geographical Advantage

Geographically, incorporating Rio Grande supply enables ADNOC to serve the European market more easily with consistent cargo flows. In the base case scenario, all Rio Grande cargos are directed to Europe.

3. Resilience Enhancement

This portfolio configuration enhances ADNOC’s resilience to Force Majeure (FM) events. For instance, in the event of a Suez Canal closure, a significant portion of the supply to Europe would remain unaffected, unlike the current situation where all European demand contracts are fulfilled by cargos flowing through Suez.

4. Price Volatility Exploitation

Adding Rio Grande supply also allows ADNOC to better exploit price volatility scenarios. For example, if TTF prices increase, the Rio Grande supply can be used to fulfill EU spot positions, while the supply from Ruwais and Das Island can fulfill firm demand.

Conclusion

Incorporating Rio Grande supply into ADNOC's portfolio not only increases P&L significantly but also enhances strategic flexibility and resilience. This configuration allows ADNOC to serve a broader market efficiently, mitigate risks associated with geopolitical events, and capitalize on price volatility in the European market.

Scenario 2: Panama Canal closure

In the second case, we modeled a Force Majeure scenario where the Panama Canal was closed. We used our own assumptions and the x-lng software to provide an optimal schedule, comparing the effect of this situation on the portfolio with and without Rio Grande supply.

Key Findings

The P&L and cargo flows remained unaltered by the closure of the Panama Canal. There was no change in the cargo flows due to this restriction of the shipping routes.

Cargo Distribution

- Spot Contracts:

- 41 cargos to Spot China, leaving from UAE.

- 1 cargo to Zeebrugge, leaving from Rio Grande.

Given that the changes are limited to the spot contracts (with all firm demand and supply set to non-cancelable), the flow of spot cargos remained the same as before.

Impact Analysis

Current Scenario

In this standard situation where the only variation is the closure of the Panama Canal, ADNOC is not affected because none of the Rio Grande supply goes to Asia—it all goes to Europe.

Price Volatility and Firm Demand Scenarios

ADNOC would be affected in price volatility scenarios where JKM (Japan Korea Marker) prices rise and spot opportunities in Asia become more profitable. Additionally, ADNOC could be impacted if they sign additional firm demand contracts in Asia requiring some Rio Grande supply to fulfill.

However, in most cases, additional firm demand in Asia might still be fulfilled by ADNOC’s own supply from UAE. The Panama Canal would be essential only when:

- The JKTC (Japan, Korea, Taiwan, China) area becomes significantly more profitable.

- ADNOC signs more US supply that exceeds EU demand/spot positions and must be shipped elsewhere.

In such cases, going through the Panama Canal to ship to Japan/Korea would be more convenient than going through Suez to serve some Middle East/India (MEI) contracts.

Conclusion

In the modeled Force Majeure scenario with the Panama Canal closure, ADNOC's portfolio with and without Rio Grande supply remains robust and unaffected in terms of P&L and cargo flows. The resilience of ADNOC’s portfolio is demonstrated, highlighting the strategic advantage of having diverse supply routes and the flexibility to adapt to potential disruptions. However, price volatility scenarios and additional firm demand contracts in Asia could necessitate the use of the Panama Canal for optimal cargo distribution.

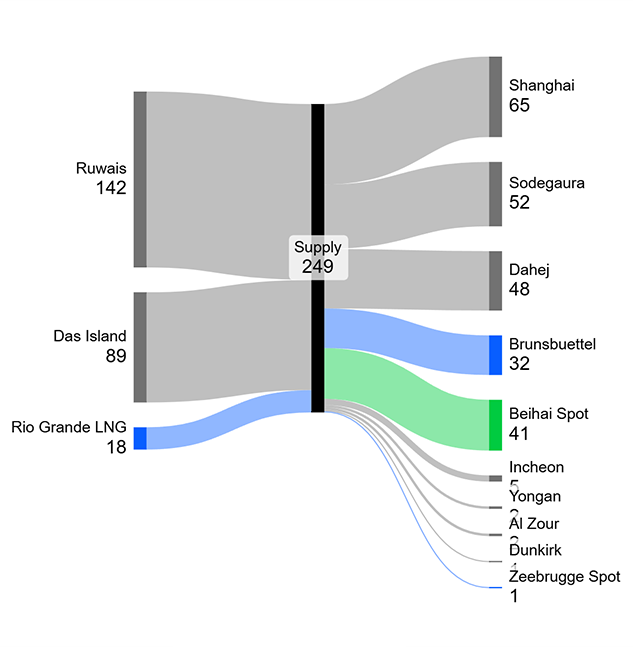

Scenario 3: Price volatility scenarios

We modeled price volatility scenarios by simulating variations in TTF (Title Transfer Facility) vs. JKM (Japan Korea Marker) prices, focusing on scenarios where TTF rises and JKM falls. These variations were applied to both portfolios with and without Rio Grande supply.

Key Findings

Impact on P&L

- Scenario with Rio Grande Supply:

- TTF at 1.05, JKM at 0.9: Total P&L decreased to around $650 million.

- Base Case (unmodified price curves): P&L was $1,105,073,371.

This trend of decreased P&L was consistent across all price variation scenarios.

Spot Market Flows

- Shift in Spot Market:

- With TTF Increase:

- 38 cargos to Spot Zeebrugge.

- 4 cargos to Spot China.

- With TTF Increase:

As TTF-based contracts became more profitable than JKM-indexed ones, the market shifted towards the Atlantic basin, reflecting an inversion of the spot market trend and reduced portfolio profitability.

Cargo Distribution and Profitability

JKM-Indexed Cargos

- Total JKM-Indexed: 118 out of 205 cargos

- 52 to Japan.

- 65 to China.

- 5 to South Korea.

The negative volatility of the JKM index caused all JKM-indexed contracts to become far less profitable. This impacted a high number of cargos in the JKTC (Japan, Korea, Taiwan, China) area.

TTF-Indexed Cargos

- Total TTF-Indexed: 33 cargos

- 32 to Germany.

- 1 to France.

The increased profitability of European cargos was not enough to offset the negative trend from JKM-indexed cargos.

Strategic Insights

Dual High Price Benefits

- High TTF Prices: More profitable European firm demand and spot cargos.

- High JKM Prices: More profitable Eastern Asia firm demand cargos.

The P&L gaps between these price-driven scenario variations and the base case reflect the influence of JKM volatility on firm demand contracts and the rerouted spot cargos from China to Zeebrugge, which were less profitable due to higher shipping costs.

Recommendations for Strategic Moves

European Ports

- Shipping Costs: A European port in Southern Europe would be more convenient than Zeebrugge for this scenario due to lower shipping costs.

Expanding Global Reach

ADNOC’s strategic move to sign US supply and anticipate more supply from Rio Grande or other Atlantic supply hubs in the next few years is advantageous. This step expands ADNOC’s global reach in the LNG market and enhances the resilience of its portfolio to FM events and price volatility scenarios.

However, the current portfolio remains heavily exposed to JKM fluctuations. While Rio Grande cargos facilitate easier service of the EU market, they do not significantly mitigate the exposure to JKM negative trends since all JKM-indexed firm demand contracts in Eastern Asia still need to be fulfilled.

Future Considerations

Access to more Atlantic supply hubs like Rio Grande or Nigeria would allow ADNOC to fulfill new firm demand contracts in the Atlantic area. These contracts would not be JKM-indexed, helping balance the portfolio’s risk and exposure to JKM fluctuations.

Find the more detailed analysis here: ADNOC Case Study Calypso

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

ADNOC signs Rio Grande LNG supply: portfolio implications

On May 20th, ADNOC announced:

- The acquisition of an 11.7% equity stake in Trains 1-3 in the Rio Grande LNG (RGLNG) project managed by NextDecade.

- A 20-year LNG offtake agreement from RGLNG Train 4, which will provide 1.9 million tonnes per annum (mtpa).

Calypso analyzes the impact of the newly acquired supply on ADNOC’s 2027 portfolio and shipping capacities, using public information on ADNOC's portfolio and Calypso's own assumptions, which might differ from the real portfolio. This analysis explores the opportunities generated in terms of:

- Cargo flow rerouting

- Spot market positions

- Price volatility scenarios

- Resilience to Force Majeure (FM) events

Details of X-LNG:

Our team at Calypso Commodities utilized our advanced AI system, X-LNG, to model this case study. X-LNG is uniquely designed to handle comprehensive portfolio-level analyses and calculations.

Key Features of X-LNG:

- Matches Longs and Shorts with Physical Assets: Seamlessly matches long and short positions with physical assets like vessels, ensuring optimal portfolio, operation plan and schedule management.

- Holistic Contract Valuation: Captures and models the value of each contract on a portfolio level taking into account all logistic and market aspects.

- Precise Operation Plans: Provides a precise operation plan for each optimized portfolio that operators can actually use.

- Day-to-Day Usability: Delivers real and actionable day-to-day operation plans for each optimized portfolio in this case study.

- Unmatched Transparency: X-LNG is the most transparent way of valuating and optimizing global LNG portfolios on the market.

- Cloud-Based System: Features a world-class user interface that enhances user experience.

- Scalability: Capable of solving and optimising portfolios of different sizes fast.

- High-Volume Scenario Analysis: Runs hundreds of thousands of scenarios simultaneously, ensuring robust and comprehensive solutions.

Scenario 1: Optimizing ADNOC's Portfolio with Rio Grande Supply

Using our own assumptions and x-lng, we modeled a scenario incorporating ADNOC's 2027 portfolio with the addition of the Rio Grande supply. This supply accounts for 18 out of the total 269 cargos in ADNOC's portfolio. This analysis compares the case with Rio Grande supply against the case without it, after we calculated an optimal sequence of laden and ballast journeys with x-lng for both cases in order to have two real and executable schedules.

Key Findings

The P&L was significantly higher with Rio Grande supply:

- With Rio Grande: $1,105,073,371

- Without Rio Grande: $879,914,321

- Difference: Approximately $120 million higher with Rio Grande supply

Cargo Distribution

In the scenario with Rio Grande supply:

- 17 Rio Grande cargos were delivered to Brunsbuettel.

- 1 cargo was delivered to Spot Zeebrugge.

- The spot market saw an increase to 42 cargos shipped, up from 24 in the base case.

For German demand fulfillment:

- With Rio Grande: 15 cargos (9 from Das Island, 6 from Ruwais)

- Without Rio Grande: 32 cargos (21 from Das Island, 11 from Ruwais)

Utilization of Available Cargos

With the addition of Rio Grande, ADNOC had 12 more cargos from Das Island and 5 more from Ruwais. These additional cargos were used to fulfill spot market positions in China.

Strategic Benefits

1. Demand Hub Service Expansion

Adding Rio Grande LNG allows ADNOC to serve more demand hubs in the Atlantic area. This supply can be used to fulfill firm demand contracts or optional regas slots in Europe, and it opens the potential to start selling to South America, particularly Brazil.

2. Geographical Advantage

Geographically, incorporating Rio Grande supply enables ADNOC to serve the European market more easily with consistent cargo flows. In the base case scenario, all Rio Grande cargos are directed to Europe.

3. Resilience Enhancement

This portfolio configuration enhances ADNOC’s resilience to Force Majeure (FM) events. For instance, in the event of a Suez Canal closure, a significant portion of the supply to Europe would remain unaffected, unlike the current situation where all European demand contracts are fulfilled by cargos flowing through Suez.

4. Price Volatility Exploitation

Adding Rio Grande supply also allows ADNOC to better exploit price volatility scenarios. For example, if TTF prices increase, the Rio Grande supply can be used to fulfill EU spot positions, while the supply from Ruwais and Das Island can fulfill firm demand.

Conclusion

Incorporating Rio Grande supply into ADNOC's portfolio not only increases P&L significantly but also enhances strategic flexibility and resilience. This configuration allows ADNOC to serve a broader market efficiently, mitigate risks associated with geopolitical events, and capitalize on price volatility in the European market.

Scenario 2: Panama Canal closure

In the second case, we modeled a Force Majeure scenario where the Panama Canal was closed. We used our own assumptions and the x-lng software to provide an optimal schedule, comparing the effect of this situation on the portfolio with and without Rio Grande supply.

Key Findings

The P&L and cargo flows remained unaltered by the closure of the Panama Canal. There was no change in the cargo flows due to this restriction of the shipping routes.

Cargo Distribution

- Spot Contracts:

- 41 cargos to Spot China, leaving from UAE.

- 1 cargo to Zeebrugge, leaving from Rio Grande.

Given that the changes are limited to the spot contracts (with all firm demand and supply set to non-cancelable), the flow of spot cargos remained the same as before.

Impact Analysis

Current Scenario

In this standard situation where the only variation is the closure of the Panama Canal, ADNOC is not affected because none of the Rio Grande supply goes to Asia—it all goes to Europe.

Price Volatility and Firm Demand Scenarios

ADNOC would be affected in price volatility scenarios where JKM (Japan Korea Marker) prices rise and spot opportunities in Asia become more profitable. Additionally, ADNOC could be impacted if they sign additional firm demand contracts in Asia requiring some Rio Grande supply to fulfill.

However, in most cases, additional firm demand in Asia might still be fulfilled by ADNOC’s own supply from UAE. The Panama Canal would be essential only when:

- The JKTC (Japan, Korea, Taiwan, China) area becomes significantly more profitable.

- ADNOC signs more US supply that exceeds EU demand/spot positions and must be shipped elsewhere.

In such cases, going through the Panama Canal to ship to Japan/Korea would be more convenient than going through Suez to serve some Middle East/India (MEI) contracts.

Conclusion

In the modeled Force Majeure scenario with the Panama Canal closure, ADNOC's portfolio with and without Rio Grande supply remains robust and unaffected in terms of P&L and cargo flows. The resilience of ADNOC’s portfolio is demonstrated, highlighting the strategic advantage of having diverse supply routes and the flexibility to adapt to potential disruptions. However, price volatility scenarios and additional firm demand contracts in Asia could necessitate the use of the Panama Canal for optimal cargo distribution.

Scenario 3: Price volatility scenarios

We modeled price volatility scenarios by simulating variations in TTF (Title Transfer Facility) vs. JKM (Japan Korea Marker) prices, focusing on scenarios where TTF rises and JKM falls. These variations were applied to both portfolios with and without Rio Grande supply.

Key Findings

Impact on P&L

- Scenario with Rio Grande Supply:

- TTF at 1.05, JKM at 0.9: Total P&L decreased to around $650 million.

- Base Case (unmodified price curves): P&L was $1,105,073,371.

This trend of decreased P&L was consistent across all price variation scenarios.

Spot Market Flows

- Shift in Spot Market:

- With TTF Increase:

- 38 cargos to Spot Zeebrugge.

- 4 cargos to Spot China.

- With TTF Increase:

As TTF-based contracts became more profitable than JKM-indexed ones, the market shifted towards the Atlantic basin, reflecting an inversion of the spot market trend and reduced portfolio profitability.

Cargo Distribution and Profitability

JKM-Indexed Cargos

- Total JKM-Indexed: 118 out of 205 cargos

- 52 to Japan.

- 65 to China.

- 5 to South Korea.

The negative volatility of the JKM index caused all JKM-indexed contracts to become far less profitable. This impacted a high number of cargos in the JKTC (Japan, Korea, Taiwan, China) area.

TTF-Indexed Cargos

- Total TTF-Indexed: 33 cargos

- 32 to Germany.

- 1 to France.

The increased profitability of European cargos was not enough to offset the negative trend from JKM-indexed cargos.

Strategic Insights

Dual High Price Benefits

- High TTF Prices: More profitable European firm demand and spot cargos.

- High JKM Prices: More profitable Eastern Asia firm demand cargos.

The P&L gaps between these price-driven scenario variations and the base case reflect the influence of JKM volatility on firm demand contracts and the rerouted spot cargos from China to Zeebrugge, which were less profitable due to higher shipping costs.

Recommendations for Strategic Moves

European Ports

- Shipping Costs: A European port in Southern Europe would be more convenient than Zeebrugge for this scenario due to lower shipping costs.

Expanding Global Reach

ADNOC’s strategic move to sign US supply and anticipate more supply from Rio Grande or other Atlantic supply hubs in the next few years is advantageous. This step expands ADNOC’s global reach in the LNG market and enhances the resilience of its portfolio to FM events and price volatility scenarios.

However, the current portfolio remains heavily exposed to JKM fluctuations. While Rio Grande cargos facilitate easier service of the EU market, they do not significantly mitigate the exposure to JKM negative trends since all JKM-indexed firm demand contracts in Eastern Asia still need to be fulfilled.

Future Considerations

Access to more Atlantic supply hubs like Rio Grande or Nigeria would allow ADNOC to fulfill new firm demand contracts in the Atlantic area. These contracts would not be JKM-indexed, helping balance the portfolio’s risk and exposure to JKM fluctuations.

Find the more detailed analysis here: ADNOC Case Study Calypso

.svg)

Legal Notice

Impressum

Angaben gemäß § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Handelsregister: HRB 239736 B

Amtsgericht Charlottenburg

Umsatzsteuer: DE342781749

Vertreten durch:

Michael Schach

Kontakt

Telefon: +49 30 41734423

E-Mail: [email protected]

Nutzungsvereinbarungen

Imprint

Disclosures according to German law § 5 TMG

Calypso Ventures GmbH

Bismarckstraße 10/12

10625 Berlin

Registered number: HRB 239736 B

Amtsgericht Charlottenburg (Germany)

VAT: DE342781749

Represented by:

Michael Schach

Contact

Phone: +49 30 41734423

E-Mail: [email protected]

User Agreements

.svg)